SunTrust 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

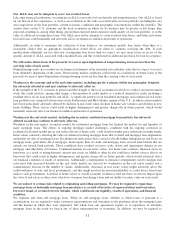

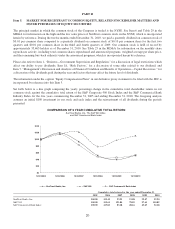

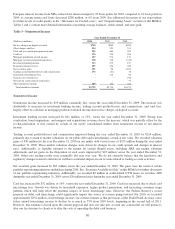

Item 6. SELECTED FINANCIAL DATA

Year Ended December 31

(Dollars in millions, except per share and other data) 2010 2009 2008 2007 2006

Summary of Operations

Interest income $6,343 $6,710 $8,328 $10,036 $9,792

Interest expense 1,489 2,244 3,708 5,316 5,132

Net interest income 4,854 4,466 4,620 4,720 4,660

Provision for credit losses32,651 4,064 2,474 665 262

Net interest income after provision for credit losses 2,203 402 2,146 4,055 4,398

Noninterest income 3,729 3,710 4,473 3,429 3,468

Noninterest expense 5,911 6,562 5,879 5,221 4,866

Income/(loss) before provision/(benefit) for income taxes 21 (2,450) 740 2,263 3,000

Net income attributable to noncontrolling interest 17 12 11 13 14

Provision/(benefit) for income taxes (185) (898) (67) 616 869

Net income/(loss) $189 ($1,564) $796 $1,634 $2,117

Net income/(loss) available to common shareholders ($87) ($1,733) $741 $1,593 $2,098

Net interest income-FTE1$4,970 $4,589 $4,737 $4,822 $4,748

Total revenue-FTE18,699 8,299 9,210 8,251 8,216

Total revenue-FTE excluding net securities (gains)/losses, net18,508 8,201 8,137 8,008 8,266

Net income/(loss) per average common share2

Diluted ($0.18) ($3.98) $2.12 $4.52 $5.78

Diluted excluding goodwill/intangible impairment charges, other than

MSRs1(0.18) (2.34) 2.19 4.39 5.77

Basic (0.18) (3.98) 2.12 4.56 5.84

Dividends paid per average common share 0.04 0.22 2.85 2.92 2.44

Book value per common share 36.34 35.29 48.74 50.72 49.12

Tangible book value per common share123.76 22.59 28.69 30.11 28.66

Market capitalization $14,768 $10,128 $10,472 $21,772 $29,972

Market price:

High 31.92 30.18 70.00 94.18 85.64

Low 20.16 6.00 19.75 60.02 69.68

Close 29.51 20.29 29.54 62.49 84.45

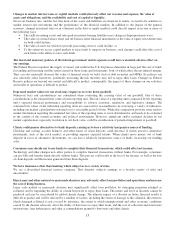

Selected Average Balances

Total assets $172,375 $175,442 $175,848 $177,796 $180,315

Earning assets 147,187 150,908 152,749 155,204 158,429

Loans 113,925 121,041 125,433 120,081 119,645

Consumer and commercial deposits 117,129 113,164 101,333 98,020 97,175

Brokered and foreign deposits 2,916 6,082 14,743 21,856 26,490

Total shareholders’ equity 22,834 22,286 18,596 17,928 17,698

Average common shares - diluted (thousands) 498,744 437,486 350,183 352,688 362,802

Average common shares - basic (thousands) 495,361 435,328 348,919 349,346 359,413

As of December 31

Total assets $172,874 $174,165 $189,138 $179,574 $182,162

Earning assets 148,473 147,896 156,017 154,397 159,064

Loans 115,975 113,675 126,998 122,319 121,454

Allowance for loan and lease losses 2,974 3,120 2,351 1,283 1,045

Consumer and commercial deposits 120,025 116,303 105,276 101,870 99,776

Brokered and foreign deposits 3,019 5,560 8,053 15,973 24,246

Long-term debt 13,648 17,490 26,812 22,957 18,993

Total shareholders’ equity 23,130 22,531 22,501 18,170 17,932

Financial Ratios and Other Data

Return on average total assets 0.11 % (0.89) % 0.45 % 0.92 % 1.17 %

Return on average total assets less net unrealized securities (gains)/

losses10.01 (0.96) 0.05 0.81 1.17

Return on average common shareholders’ equity (0.49) (10.07) 4.20 9.14 11.95

Return on average realized common shareholders’ equity 1(1.53) (11.12) 0.16 8.52 12.53

Net interest margin - FTE 3.38 3.04 3.10 3.11 3.00

Efficiency ratio - FTE 67.94 79.07 63.83 63.28 59.23

Tangible efficiency ratio167.36 69.35 62.51 62.11 57.97

Total average shareholders’ equity to total average assets 13.25 12.70 10.58 10.08 9.81

Tangible equity to tangible assets110.12 9.66 8.46 6.38 6.10

Effective tax rate (benefit)5NM (36.50) (9.23) 27.21 28.97

Allowance to year-end total loans 2.58 2.76 1.86 1.05 0.86

Total nonperforming assets to total loans plus

OREO and other repossessed assets 4.08 5.33 3.49 1.35 0.49

Common dividend payout ratio4N/A N/A 135.6 64.5 41.9

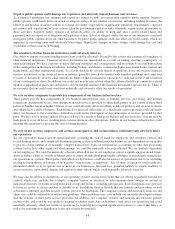

Capital Adequacy

Tier 1 common equity 8.08 % 7.67 % 5.83 % 5.27 % 5.66 %

Tier 1 capital 13.67 12.96 10.87 6.93 7.72

Total capital 16.54 16.43 14.04 10.30 11.11

Tier 1 leverage 10.94 10.90 10.45 6.90 7.23

1See Non-GAAP reconcilements in Tables 30 and 31 of the Management’s Discussion and Analysis of Financial Condition and Results of

Operations.

2Prior period amounts have been recalculated in accordance with updated accounting guidance related to earnings per share, that was effective

January 1, 2009 and required retrospective application.

3Beginning in the fourth quarter of 2009, SunTrust began recording the provision for unfunded commitments within the provision for credit

losses in the Consolidated Statements of Income/(Loss). Considering the immateriality of this provision, prior to the fourth quarter of 2009, the

provision for unfunded commitments remains classified within other noninterest expense in the Consolidated Statements of Income/(Loss).

4The common dividend payout ratio is not applicable in a period of net loss.

5The effective tax rate was not meaningful for the year ended December 31, 2010.

21