SunTrust 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

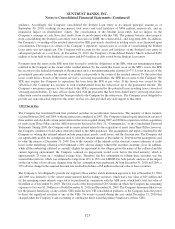

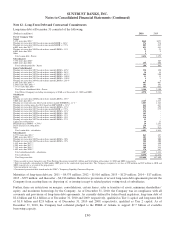

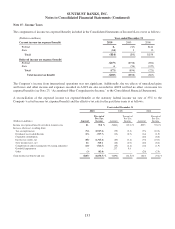

When the Company owns both the limited partner and general partner interests or acts as the indemnifying party, the

Company consolidates the partnerships and does not consider these partnerships VIEs because, as owner of the

partnerships, the Company has the ability to directly and indirectly make decisions that have a significant impact on the

business. As of December 31, 2010 and December 31, 2009, total assets, which consist primarily of fixed assets and

cash, attributable to the consolidated, non-VIE partnerships were $394 million and $425 million, respectively, and total

liabilities, excluding intercompany liabilities, primarily representing third-party borrowings, were $123 million and $209

million, respectively. See Note 20, “Fair Value Election and Measurement,” to the Consolidated Financial Statements

for further discussion on the impact of impairment charges on affordable housing partnership investments recorded

during the years ended December 31, 2010 and December 31, 2009.

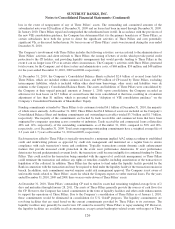

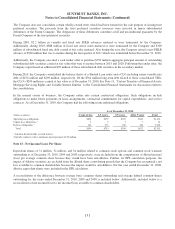

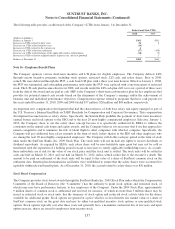

Registered and Unregistered Funds Advised by RidgeWorth

RidgeWorth, a registered investment advisor and majority owned subsidiary of the Company, serves as the investment

advisor for various private placement, common and collective funds, and registered mutual funds (collectively the

“Funds”). The Company evaluates these Funds to determine if the Funds are voting interest entities or VIEs, as well as

monitors the nature of its interests in each Fund to determine if the Company is required to consolidate any of the Funds.

In February 2010, the FASB issued guidance that defers the application of the new VIE consolidation guidance for

investment funds meeting certain criteria. All of the registered and unregistered Funds advised by RidgeWorth meet the

scope exception criteria and thus are not evaluated for consolidation under the new guidance. Accordingly, the Company

continues to apply the consolidation guidance in effect prior to the issuance of the new guidance to interests in funds that

qualify for the deferral. Further, funds that were determined to be VIEs under the previous accounting guidance and are

still considered VIEs under the new accounting guidance are required to comply with the new disclosure requirements.

The Company has concluded that some of the Funds are VIEs because the equity investors lack decision making rights.

However, the Company has concluded that it is not the primary beneficiary of these funds as the Company does not

absorb a majority of the expected losses nor expected returns of the funds. The Company’s exposure to loss is limited to

the investment advisor and other administrative fees it earns and if applicable, any equity investments. The total

unconsolidated assets of these funds as of December 31, 2010 and December 31, 2009 were $1.9 billion and $3.3 billion,

respectively.

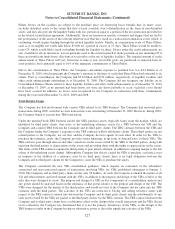

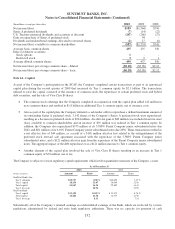

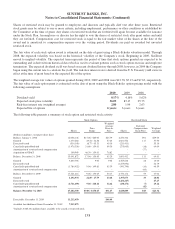

The Company does not have any contractual obligation to provide monetary support to any of the Funds. The Company

did elect to provide support to three funds during 2008. For additional information, see the Company’s 2009 Annual

Report on Form 10-K. The Company did not provide any significant support, contractual or otherwise, to the Funds

during the years ended December 31, 2010 and December 31, 2009.

129