SunTrust 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Market Risk

Other sources of market risk include the risk associated with holding residential and commercial mortgage loans prior to

selling them into the secondary market, commitments to clients to make mortgage loans that will be sold to the secondary

market, and our investment in MSRs. We manage the risks associated with the residential and commercial mortgage loans

classified as held for sale (i.e., the warehouse) and our IRLCs on residential loans intended for sale. The warehouses and

IRLCs consist primarily of fixed and adjustable rate single family residential and commercial real estate. The risk associated

with the warehouses and IRLCs is the potential change in interest rates between the time the customer locks in the rate on the

anticipated loan and the time the loan is sold on the secondary market, which is typically 60-150 days.

We manage interest rate risk predominantly with interest rate swaps, futures, and forward sale agreements, where the

changes in value of the instruments substantially offset the changes in value of the warehouse and the IRLCs. The IRLCs on

residential mortgage loans intended for sale are classified as free standing derivative financial instruments and are not

designated as hedge accounting relationships.

MSRs are the present value of future net cash flows that are expected to be received from the mortgage servicing portfolio. The

value of MSRs is highly dependent upon the assumed prepayment speed of the mortgage servicing portfolio which is driven by the

level of certain key interest rates, primarily the 30-year current coupon par mortgage rate known as the par mortgage rate. Future

expected net cash flows from servicing a loan in the mortgage servicing portfolio would not be realized if the loan pays off earlier

than anticipated. Prepayment speeds have generally been slowing down given the current economic environment; however, the

level of prepayments began to pick up towards the second half of 2010, but the impact from increasing prepayments was offset by

additions to the MSR portfolio from new origination activity.

We historically have not actively hedged MSRs, but have managed the market risk through our overall asset/liability

management process with consideration to the natural counter-cyclicality of servicing and production that occurs as interest

rates rise and fall over time with the economic cycle as well as with securities AFS. However, as of January 1, 2009, we

designated the 2008 MSRs vintage and all future MSRs production at fair value. In addition, as of January 1, 2010, we

designated at fair value the remaining MSR portfolio of $604 million being carried at LOCOM. Upon designating the

remaining MSRs at fair value, we increased the carrying value of these MSRs by $145 million and recorded an increase in

retained earnings, net of taxes, of $89 million. The decision to designate the MSR portfolio at fair value, key economic

assumptions, and the sensitivity of the current fair value of the MSRs as of December 31, 2010 and 2009 is discussed in

greater detail in Note 9, “Goodwill and Other Intangible Assets” and Note 11, “Certain Transfers of Financial Assets,

Mortgage Servicing Rights and Variable Interest Entities”, to the Consolidated Financial Statements.

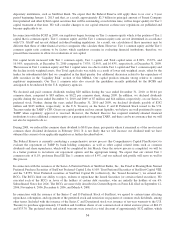

The MSRs being carried at fair value total $1.4 billion and $936 million as of December 31, 2010 and 2009, respectively, and

are managed within established risk limits and are monitored as part of various governance processes. We originated MSRs

with a fair value of $289 million and $682 million, at the time of origination, during the years ended December 31, 2010 and

2009, respectively. We recorded a decrease in fair value of $513 million for the year ended December 31, 2010, and an

increase in fair value of $66 million for the year ended December 31, 2009, including “decay” resulting from the realization

of expected monthly net servicing cash flows.

During the years ended December 31, 2010 and 2009, we recorded a loss in the Consolidated Statements of Income/(Loss)

related to fair value MSRs of $69 million (including decay of $240 million) and $22 million (including decay of $95

million), respectively, inclusive of the mark to market adjustments on the related hedges. We also recorded an impairment

recovery in the Consolidated Statements of Income/(Loss) of $199 million during the year ended December 31, 2009, related

to MSRs carried at LOCOM at the time.

We also have market risk from capital stock we hold in the FHLB of Atlanta and from capital stock we hold in the Federal

Reserve Bank. In order to be an FHLB member, we are required to purchase capital stock in the FHLB. In exchange,

members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost

loans for affordable housing and community-development projects, amongst other benefits. As of December 31, 2010, we

held a total of $298 million of capital stock in the FHLB. During 2010, we reduced our capital stock holdings in the FHLB

by $45 million. In order to become a member of the Federal Reserve System, regulations require that we hold a certain

amount of capital stock as a percentage of the Bank’s capital. During 2010, we held $391 million of Federal Reserve Bank

capital stock.

For a detailed overview regarding actions taken to address the risk from changes in equity prices associated with our

investment in Coke common stock, see “Investment in Common Shares of the Coca-Cola Company,” in this MD&A. We

62