SunTrust 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

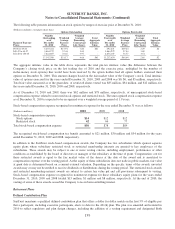

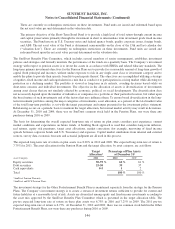

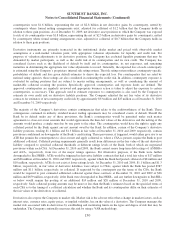

The estimated amounts that will be amortized from AOCI into net periodic benefit cost in 2011 are as follows:

(Dollars in millions)

Pension

Benefits

Other

Postretirement

Benefits

Actuarial loss $40 $1

Prior service credit (19) -

Total $21 $1

In addition, SunTrust sets pension asset values equal to their market value, in contrast to the use of a smoothed asset value

that incorporates gains and losses over a period of years. Utilization of market value of assets provides a more realistic

economic measure of the plan’s funded status and cost. Assumed discount rates and expected returns on plan assets affect the

amounts of net periodic benefit cost. A 25 basis point decrease in the discount rate or expected long-term return on plan

assets would increase all Pension and Other Postretirement Plans’ net periodic benefit cost approximately $8 million and $6

million, respectively.

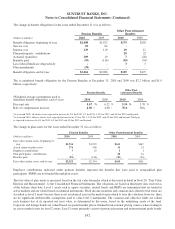

Assumed healthcare cost trend rates have a significant effect on the amounts reported for the Other Postretirement Benefit

plans. As of December 31, 2010, SunTrust assumed that retiree health care costs will increase at an initial rate of 8.50% per

year. SunTrust assumed a healthcare cost trend that recognizes expected inflation, technology advancements, rising cost of

prescription drugs, regulatory requirements and Medicare cost shifting. SunTrust expects this annual cost increase to

decrease over a 7-year period to 5.00% per year. Due to changing medical inflation, it is important to understand the effect of

a one-percent point change in assumed healthcare cost trend rates. These amounts are shown below:

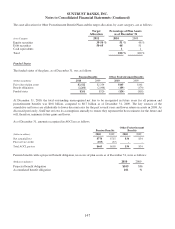

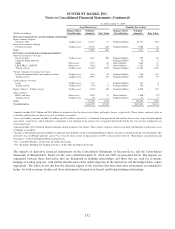

(Dollars in millions) 1% Increase 1% Decrease

Effect on Other Postretirement Benefit obligation $12 $11

Effect on total service and interest cost 11

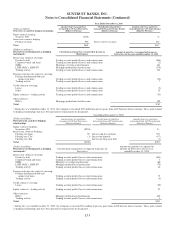

Note 17 - Derivative Financial Instruments

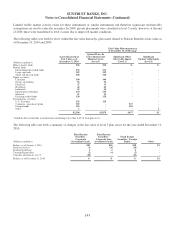

The Company enters into various derivative financial instruments, both in a dealer capacity to facilitate client transactions

and as an end user as a risk management tool. Where derivatives have been entered into with clients, the Company generally

manages the risk associated with these derivatives within the framework of its VAR approach that monitors total exposure

daily and seeks to manage the exposure on an overall basis. Derivatives are used as a risk management tool to hedge the

Company’s exposure to changes in interest rates or other identified market or credit risks, either economically or in

accordance with the hedge accounting provisions. The Company may also enter into derivatives, on a limited basis, in

consideration of trading opportunities in the market. In addition, as a normal part of its operations, the Company enters into

IRLCs on mortgage loans that are accounted for as freestanding derivatives and has certain contracts containing embedded

derivatives that are carried, in their entirety, at fair value. All freestanding derivatives and any embedded derivatives that the

Company bifurcates from the host contracts are carried at fair value in the Consolidated Balance Sheets in trading assets,

other assets, trading liabilities, or other liabilities. The associated gains and losses are either recorded in OCI, net of tax, or

within the Consolidated Statements of Income/(Loss) depending upon the use and designation of the derivatives.

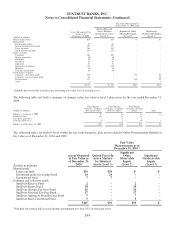

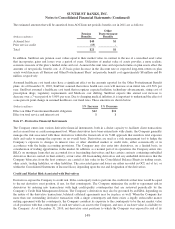

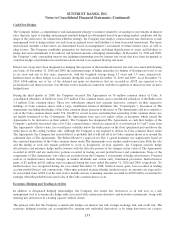

Credit and Market Risk Associated with Derivatives

Derivatives expose the Company to credit risk. If the counterparty fails to perform, the credit risk at that time would be equal

to the net derivative asset position, if any, for that counterparty. The Company minimizes the credit or repayment risk in

derivatives by entering into transactions with high credit-quality counterparties that are reviewed periodically by the

Company’s Credit Risk Management division. The Company’s derivatives may also be governed by an ISDA, depending on

the nature of the derivative transactions, bilateral collateral agreements may be in place as well. When the Company has

more than one outstanding derivative transaction with a single counterparty and there exists a legally enforceable master

netting agreement with the counterparty, the Company considers its exposure to the counterparty to be the net market value

of all positions with that counterparty, if such net value is an asset to the Company, and zero, if such net value is a liability to

the Company. As of December 31, 2010, net derivative asset positions to which the Company was exposed to risk of its

149