SunTrust 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

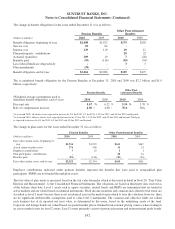

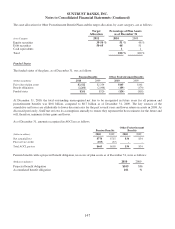

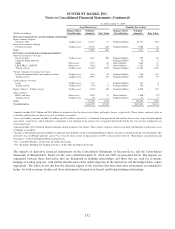

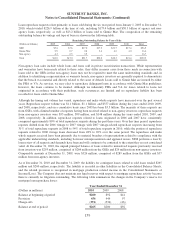

As of December 31, 2009

Asset Derivatives Liability Derivatives

(Dollars in millions)

Balance Sheet

Classification

Notional

Amounts Fair Value

Balance Sheet

Classification

Notional

Amounts Fair Value

Derivatives designated in cash flow hedging relationships 5

Equity contracts hedging:

Securities AFS Trading assets $1,547 $- Trading liabilities $1,547 $46

Interest rate contracts hedging:

Floating rate loans Trading assets 15,550 865 Trading liabilities 3,000 22

Total 17,097 865 4,547 68

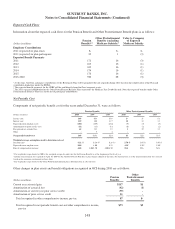

Derivatives not designated as hedging instruments 6

Interest rate contracts covering:

Fixed rate debt Trading assets 3,223 200 Trading liabilities 295 10

Corporate bonds and loans - - Trading liabilities 48 4

MSRs Other assets 3,715 62 Other liabilities 3,810 57

LHFS, IRLCs, LHFI-FV Other assets 7,462 375 Other liabilities 1,426 20

Trading activity Trading assets 94,140 13,290 Trading liabilities 83,483 3,243

Foreign exchange rate contracts covering:

Foreign-denominated debt and commercial loans Trading assets 1,164 96 Trading liabilities 656 144

Trading activity Trading assets 2,059 107 Trading liabilities 2,020 96

Credit contracts covering:

Loans Trading assets 115 1 Trading liabilities 241 4

Trading activity Trading assets 170 26 Trading liabilities 156 24

Equity contracts - Trading activity Trading assets 3,345 1446 Trading liabilities 6,908 672

Other contracts:

IRLCs and other Other assets 1,870 14 Other liabilities 1,560 449 4

Trading activity Trading assets 39 7 Trading liabilities 51 7

Total 117,302 4,304 100,654 4,310

Total derivatives $134,399 $5,169 $105,201 $4,378

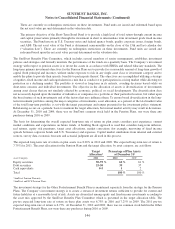

1Amounts include $18.2 billion and $0.5 billion of notional related to interest rate futures and equity futures, respectively. These futures contracts settle in

cash daily and therefore no derivative asset or liability is recorded.

2Asset and liability amounts include $4 million and $9 million, respectively, of notional from purchased and written interest rate swap risk participation

agreements, respectively, which notional is calculated as the notional of the interest rate swap participated adjusted by the relevant risk weighted assets

conversion factor.

3Amount includes $2.0 billion of notional amounts related to interest rate futures. These futures contracts settle in cash daily and therefore no derivative asset

or liability is recorded.

4Includes a $40 million derivative liability recorded in other liabilities in the Consolidated Balance Sheets, related to a notional amount of $134 million. This

derivative was established upon the sale of Visa Class B shares in the second quarter of 2009 as discussed in Note 18, “Reinsurance Arrangements and

Guarantees,” to the Consolidated Financial Statements.

5See “Cash Flow Hedges” in this Note for further discussion.

6See “Economic Hedging and Trading Activities” in this Note for further discussion.

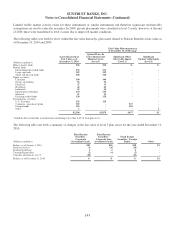

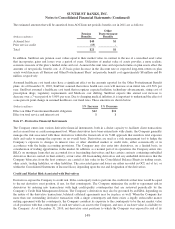

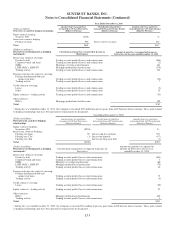

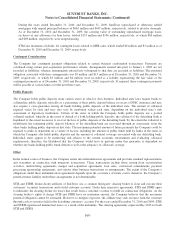

The impacts of derivative financial instruments on the Consolidated Statements of Income/(Loss) and the Consolidated

Statements of Shareholders’ Equity for the years ended December 31, 2010 and 2009 are presented below. The impacts are

segregated between those derivatives that are designated in hedging relationships and those that are used for economic

hedging or trading purposes, with further identification of the underlying risks in the derivatives and the hedged items, where

appropriate. The tables do not disclose the financial impact of the activities that these derivative instruments are intended to

hedge, for both economic hedges and those instruments designated in formal, qualifying hedging relationships.

152