SunTrust 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

will be accreted into U.S. Treasury preferred dividend expense using the effective yield method over a five year period from

each respective issuance date. The terms of the warrants as well as the restrictions related to the issuance of the preferred

stock is more fully described in Current Reports on Form 8-K filed on November 17, 2008 and January 2, 2009.

We are subject to certain restrictions on our ability to increase the dividend as a result of participating in the U.S. Treasury’s

CPP. Generally, we may not pay a regular quarterly cash dividend of more than $0.77 per share of common stock prior to

November 14, 2011, unless either (i) we have redeemed the Series C and Series D Preferred Stock, (ii) the U.S. Treasury has

transferred the Series C and Series D Preferred Stock to a third party, or (iii) the U.S. Treasury consents to the payment of

such dividends in excess of such amount. Additionally, if we increase our quarterly dividend above $0.54 per share prior to

the tenth anniversary of our participation in the CPP, then the exercise price and the number of shares to be issued upon

exercise of the warrants issued in connection with our participation in the CPP will be proportionately adjusted. The amount

of such adjustment will be determined by a formula and depends in part on the extent to which we raise our dividend. The

formulas are contained in the warrant agreements. There also exists limits on the ability of the Bank to pay dividends to the

Parent Company. Substantially all of our retained earnings are undistributed earnings of the Bank, which are restricted by

various regulations administered by federal and state bank regulatory authorities. There was no capacity for payment of cash

dividends to the Parent Company under these regulations at December 31, 2010.

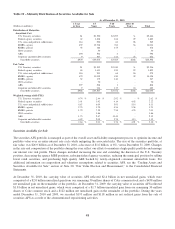

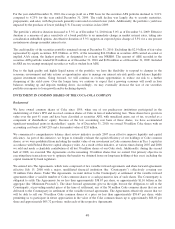

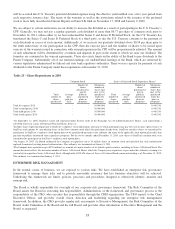

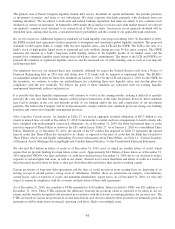

Table 25 – Share Repurchases in 2010

Common Stock Series A Preferred Stock Depositary Shares1

Total

number of

shares

purchased2

Average

price

paid per

share

Number of

shares

purchased as

part of

publicly

announced

plans or

programs

Maximum

number of

shares that

may yet be

purchased

under the

plans or

programs3

Total

number of

shares

purchased

Average

price

paid per

share

Number of

shares

purchased as

part of

publicly

announced

plans or

programs

Maximum

number of

shares that

may yet be

purchased

under the

plans or

programs4

Total first quarter 2010 - - - 30,000,000 - - - 9,469,530

Total second quarter 2010 - - - 30,000,000 - - - 9,469,530

Total third quarter 2010 - - - 30,000,000 - - - 9,469,530

Total fourth quarter 2010 - - - 30,000,000 - - - 9,469,530

1On September 12, 2006, SunTrust issued and registered under Section 12(b) of the Exchange Act 20 million Depositary Shares, each representing a

1/4,000th interest in a share of Perpetual Preferred Stock, Series A.

2Includes shares repurchased pursuant to SunTrust’s employee stock option plans, pursuant to which participants may pay the exercise price upon exercise of

SunTrust stock options by surrendering shares of SunTrust common stock which the participant already owns. SunTrust considers shares so surrenderedby

participants in SunTrust’s employee stock option plans to be repurchased pursuant to the authority and terms of the applicable stock option plan rather than

pursuant to publicly announced share repurchase programs. For the twelve months ended December 31, 2010, zero shares of SunTrust common stock were

surrendered by participants in SunTrust’s employee stock option plans.

3On August 14, 2007, the Board authorized the Company to repurchase up to 30 million shares of common stock and specified that such authorization

replaced (terminated) existing unused authorizations. This authority was terminated on January 5, 2011.

4The Company may repurchase up to $250 million face amount of various tranches of its hybrid capital securities, including its Series A Preferred Stock. The

amount disclosed reflects the maximum number of Series A Preferred Shares which the Company may repurchase at par under this authority assuming it is

used solely to repurchase Series A Preferred Stock, although only 6,900,426 shares of Series A Preferred Stock remain outstanding as of December 31, 2010.

This authority was terminated on January 5, 2011.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, we are exposed to various risks. We have established an enterprise risk governance

framework to manage these risks and to provide reasonable assurance that key business objectives will be achieved.

Underlying this framework are limits, policies, processes and procedures designed to effectively identify, monitor and

manage risk.

The Board is wholly responsible for oversight of our corporate risk governance framework. The Risk Committee of the

Board assists the Board in executing this responsibility. Administration of the framework and governance process is the

responsibility of the CRO, who executes this responsibility through the CRM organization. The CRO reports to the Chief

Executive Officer, and provides overall vision, direction and leadership regarding our enterprise risk management

framework. In addition, the CRO provides regular risk assessments to Executive Management, the Risk Committee of the

Board, Audit Committee of the Board and the full Board, and provides other information to Executive Management and the

Board, as requested.

55