SunTrust 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

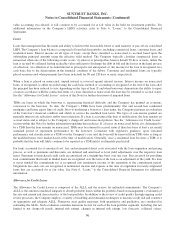

part of the Company’s operations. In addition, the Company evaluates contracts, such as brokered deposits and short-term

debt, to determine whether any embedded derivatives are required to be bifurcated and separately accounted for as

freestanding derivatives. For certain contracts containing embedded derivatives, the Company has elected not to bifurcate the

embedded derivative and instead carry the entire contract at fair value.

Certain derivatives are also used as risk management tools and designated as accounting hedges of the Company’s exposure

to changes in interest rates or other identified market risks. The Company prepares written hedge documentation for all

derivatives which are designated as hedges of (1) changes in the fair value of a recognized asset or liability (fair value hedge)

attributable to a specified risk or (2) a forecasted transaction, such as the variability of cash flows to be received or paid

related to a recognized asset or liability (cash flow hedge). The written hedge documentation includes identification of,

among other items, the risk management objective, hedging instrument, hedged item and methodologies for assessing and

measuring hedge effectiveness and ineffectiveness, along with support for management’s assertion that the hedge will be

highly effective. Methodologies related to hedge effectiveness and ineffectiveness are consistent between similar types of

hedge transactions and have included (i) statistical regression analysis of changes in the cash flows of the actual derivative

and a perfectly effective hypothetical derivative, (ii) statistical regression analysis of changes in the fair values of the actual

derivative and the hedged item and (iii) comparison of the critical terms of the hedged item and the hedging derivative.

For designated hedging relationships, the Company performs retrospective and prospective effectiveness testing using

quantitative methods and does not assume perfect effectiveness through the matching of critical terms. Assessments of hedge

effectiveness and measurements of hedge ineffectiveness are performed at least quarterly for ongoing effectiveness. Changes

in the fair value of a derivative that is highly effective and that has been designated and qualifies as a fair value hedge are

recorded in current period earnings, along with the changes in the fair value of the hedged item that are attributable to the

hedged risk. The effective portion of the changes in the fair value of a derivative that is highly effective and that has been

designated and qualifies as a cash flow hedge are initially recorded in AOCI and reclassified to earnings in the same period

that the hedged item impacts earnings; any ineffective portion is recorded in current period earnings.

Hedge accounting ceases on transactions that are no longer deemed effective, or for which the derivative has been terminated

or de-designated. For discontinued fair value hedges where the hedged item remains outstanding, the hedged item would

cease to be remeasured at fair value attributable to changes in the hedged risk and any existing basis adjustment would be

recognized as an adjustment to earnings over the remaining life of the hedged item. For discontinued cash flow hedges, the

unrealized gains and losses recorded in AOCI would be reclassified to earnings in the period when the previously designated

hedged cash flows occur unless it was determined that transaction was probable to not occur, whereby any unrealized gains

and losses in AOCI would be immediately reclassified to earnings.

The Company has elected not to offset fair value amounts related to collateral arrangements recognized for derivative

instruments under master netting arrangements. For additional information on the Company’s derivative activities, refer to

Note 17, “Derivative Financial Instruments,” to the Consolidated Financial Statements.

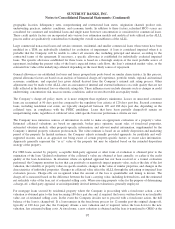

Stock-Based Compensation

The Company sponsors stock plans under which incentive and nonqualified stock options and restricted stock may be granted

periodically to certain employees. The Company accounts for stock-based compensation under the fair value recognition

provisions whereby the fair value of the award at grant date is expensed over the award’s vesting period. Additionally, the

Company estimates the number of awards for which it is probable that service will be rendered and adjusts compensation

cost accordingly. Estimated forfeitures are subsequently adjusted to reflect actual forfeitures. The required disclosures related

to the Company’s stock-based employee compensation plan are included in Note 16, “Employee Benefit Plans,” to the

Consolidated Financial Statements.

Employee Benefits

Employee benefits expense includes the net periodic benefit costs associated with the pension, supplemental retirement, and

other postretirement benefit plans, as well as contributions under the defined contribution plan, the amortization of restricted

stock, stock option awards, and costs of other employee benefits. See Note 16, “Employee Benefit Plans,” to the

Consolidated Financial Statements for additional information.

101