SunTrust 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company also purchased ARS primarily in the fourth quarter of 2008 and first quarter of 2009. We discuss FINRA’s ARS

investigation in Note 21, “Contingencies,” to the Consolidated Financial Statements. The amount of ARS recorded in trading assets

at fair value totaled $147 million as of December 31, 2010 compared to $176 million as of December 31, 2009. The majority of

these ARS are preferred equity securities, and the remaining securities are backed by trust preferred bank debt or student loans.

Trading liabilities increased $489 million, or 22%, since December 31, 2009 due primarily to an increase in U.S. Treasury

and corporate and other debt securities that act as a hedge for some of the trading assets we own.

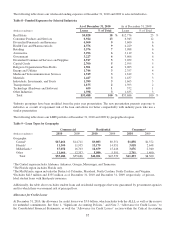

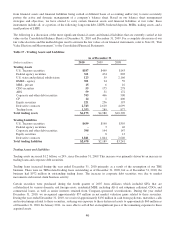

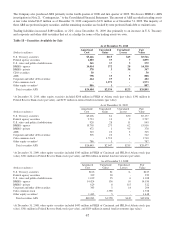

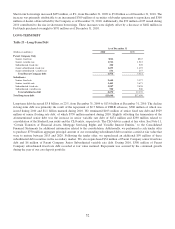

Table 18 – Securities Available for Sale

As of December 31, 2010

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $5,446 $115 $45 $5,516

Federal agency securities 1,883 19 7 1,895

U.S. states and political subdivisions 565 17 3 579

RMBS - agency 14,014 372 28 14,358

RMBS - private 378 3 34 347

CDO securities 50 - - 50

ABS 798 15 5 808

Corporate and other debt securities 464 19 1 482

Coke common stock - 1,973 - 1,973

Other equity securities1886 1 - 887

Total securities AFS $24,484 $2,534 $123 $26,895

1At December 31, 2010, other equity securities included $298 million in FHLB of Atlanta stock (par value), $391 million in

Federal Reserve Bank stock (par value), and $197 million in mutual fund investments (par value).

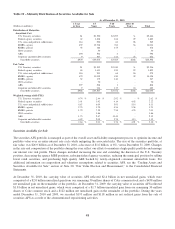

As of December 31, 2009

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $5,206 $1 $30 $5,177

Federal agency securities 2,733 13 9 2,737

U.S. states and political subdivisions 928 28 11 945

RMBS - agency 15,705 273 62 15,916

RMBS - private 472 1 95 378

ABS 310 10 5 315

Corporate and other debt securities 505 10 3 512

Coke common stock - 1,710 - 1,710

Other equity securities1786 1 - 787

Total securities AFS $26,645 $2,047 $215 $28,477

1At December 31, 2009, other equity securities included $343 million in FHLB of Cincinnati and FHLB of Atlanta stock (par

value), $361 million in Federal Reserve Bank stock (par value), and $82 million in mutual fund investments (par value).

As of December 31, 2008

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $126 $1 $- $127

Federal agency securities 339 20 - 359

U.S. states and political subdivisions 1,019 25 6 1,038

RMBS - agency 14,424 136 10 14,550

RMBS - private 629 8 115 522

Corporate and other debt securities 303 5 14 294

Coke common stock - 1,358 - 1,358

Other equity securities11,443 5 - 1,448

Total securities AFS $18,283 $1,558 $145 $19,696

1At December 31, 2008, other equity securities included $493 million in FHLB of Cincinnati and FHLB of Atlanta stock (par

value), $361 million in Federal Reserve Bank stock (par value), and $589 million in mutual fund investments (par value).

47