SunTrust 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

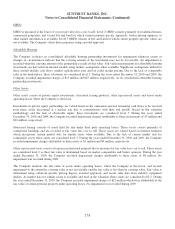

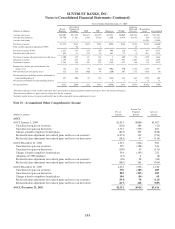

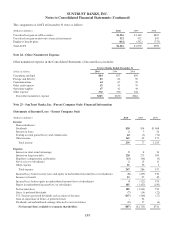

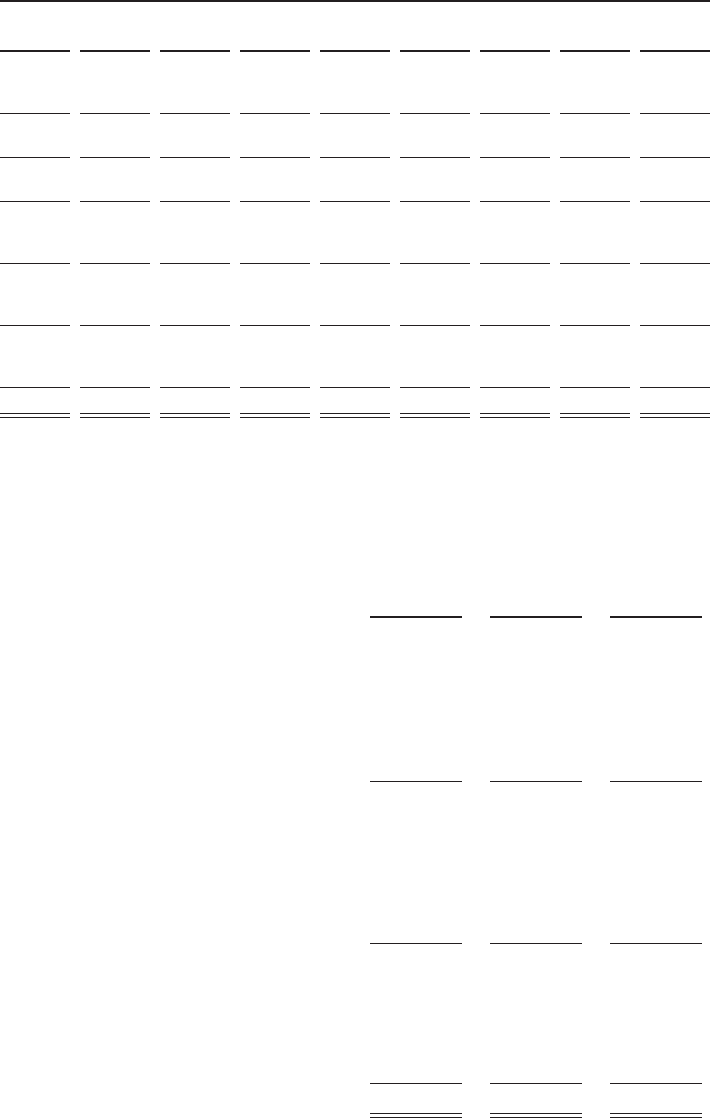

Twelve Months Ended December 31, 2008

(Dollars in millions)

Retail

Banking

Diversified

Commercial

Banking CRE CIB Mortgage W&IM

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $40,205 $27,289 $14,674 $22,755 $41,981 $9,009 $19,768 $167 $175,848

Average total liabilities 68,786 17,392 2,436 13,116 2,766 9,979 42,845 (68) 157,252

Average total equity -------18,596 18,596

Net interest income $2,251 $438 $244 $267 $496 $336 $154 $434 $4,620

Fully taxable-equivalent adjustment (FTE) - 96 - 3 - - 18 - 117

Net interest income (FTE)12,251 534 244 270 496 336 172 434 4,737

Provision for credit losses2851 55 112 28 491 27 (1) 911 2,474

Net interest income after provision for credit losses 1,400 479 132 242 5 309 173 (477) 2,263

Noninterest income 1,192 253 88 462 436 953 1,103 (14) 4,473

Noninterest expense 2,244 416 298 478 1,345 972 140 (14) 5,879

Income/(loss) before provision/(benefit) for

income taxes 348 316 (78) 226 (904) 290 1,136 (477) 857

Provision/(benefit) for income taxes3121 116 (106) 84 (360) 107 273 (185) 50

Net income/(loss) including income attributable to

noncontrolling interest 227 200 28 142 (544) 183 863 (292) 807

Net income attributable to noncontrolling interest ----219(1)11

Net income/(loss) $227 $200 $28 $142 ($546) $182 $854 ($291) $796

1Net interest income is fully taxable-equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

2Provision for credit losses represents net charge-offs for the segments.

3Includes regular income tax provision/(benefit) and taxable-equivalent income adjustment reversal.

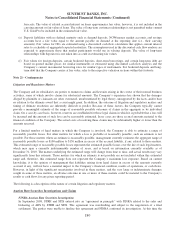

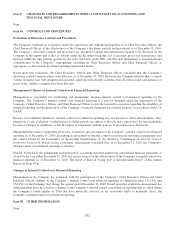

Note 23 - Accumulated Other Comprehensive Income

(Dollars in millions)

Pre-tax

Amount

Income Tax

(Expense)

Benefit

After-tax

Amount

AOCI

AOCI, January 1, 2008 $2,491 ($884) $1,607

Unrealized net gain on securities (238) 186 (52)

Unrealized net gain on derivatives 1,337 (535) 802

Change related to employee benefit plans (813) 305 (508)

Reclassification adjustment for realized gains and losses on securities (1,073) 319 (754)

Reclassification adjustment for realized gains and losses on derivatives (181) 67 (114)

AOCI, December 31, 2008 1,523 (542) 981

Unrealized net gain on securities 529 (188) 341

Unrealized net gain on derivatives (190) 59 (131)

Change related to employee benefit plans 394 (143) 251

Adoption of OTTI guidance (12) 4 (8)

Reclassification adjustment for realized gains and losses on securities (98) 38 (60)

Reclassification adjustment for realized gains and losses on derivatives (485) 181 (304)

AOCI, December 31, 2009 1,661 (591) 1,070

Unrealized net gain on securities 770 (283) 487

Unrealized net gain on derivatives 802 (293) 509

Change related to employee benefit plans 106 (46) 60

Reclassification adjustment for realized gains and losses on securities (191) 70 (121)

Reclassification adjustment for realized gains and losses on derivatives (617) 228 (389)

AOCI, December 31, 2010 $2,531 ($915) $1,616

188