SunTrust 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

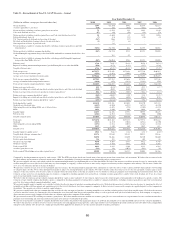

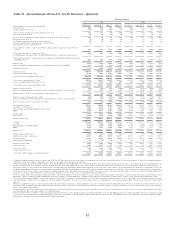

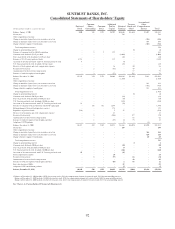

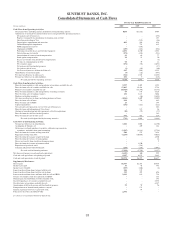

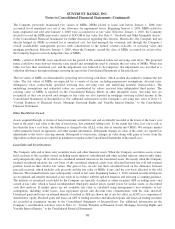

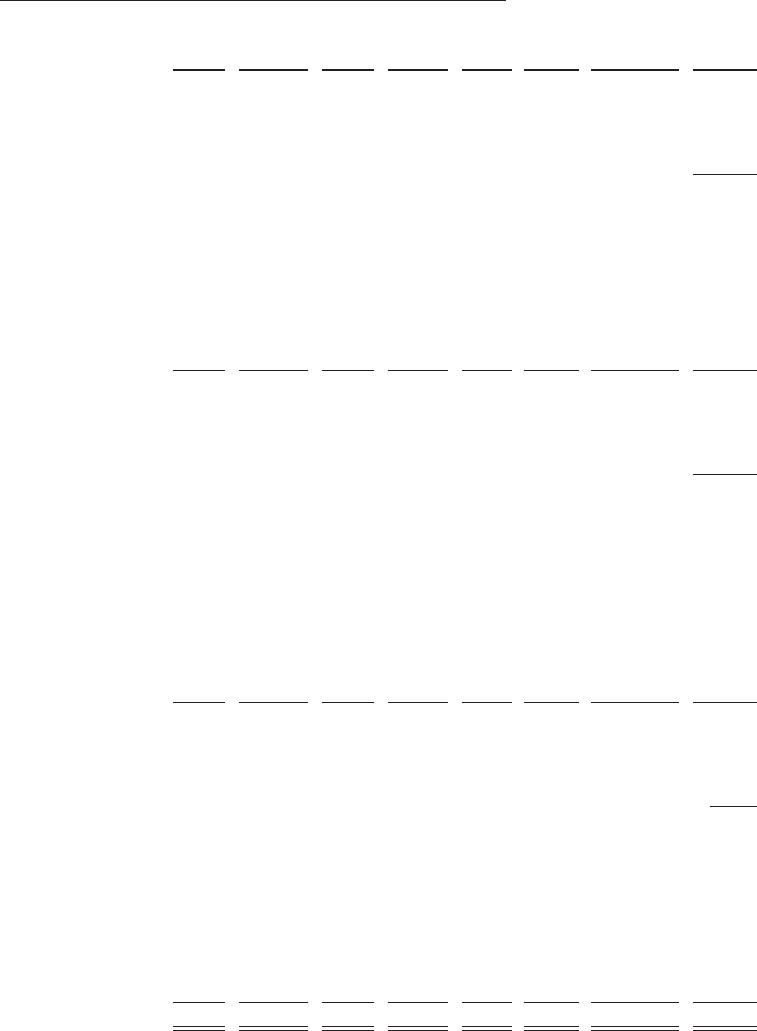

SUNTRUST BANKS, INC.

Consolidated Statements of Shareholders’ Equity

(Dollars and shares in millions, except per share data)

Preferred

Stock

Common

Shares

Outstanding

Common

Stock

Additional

Paid in

Capital

Retained

Earnings

Treasury

Stock and

Other1

Accumulated

Other

Comprehensive

Income Total

Balance, January 1, 2008 $500 348 $371 $6,707 $10,646 ($1,662) $1,607 $18,169

Net income - - - - 796 - - 796

Other comprehensive income:

Change in unrealized gains (losses) on securities, net of tax - - - - - - (806) (806)

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - 688 688

Change related to employee benefit plans - - - - - - (508) (508)

Total comprehensive income 170

Change in noncontrolling interest - - - - - (5) - (5)

Issuance of common stock for GB&T acquisition - 2 2 152 - - - 154

Common stock dividends, $2.85 per share - - - - (1,004) - - (1,004)

Series A preferred stock dividends, $4,451 per share - - - - (22) - - (22)

Issuance of U.S. Treasury preferred stock 4,718 - - 132 - - - 4,850

Accretion of discount associated with U.S. Treasury preferred stock 4 - - - (4) - - -

U.S. Treasury preferred stock dividends, $471 per share - - - - (23) - - (23)

Exercise of stock options and stock compensation expense - - - 16 - 40 - 56

Restricted stock activity - 2 - (46) - 47 - 1

Amortization of restricted stock compensation - - - - - 77 - 77

Issuance of stock for employee benefit plans - 2 - (57) - 135 - 78

Balance, December 31, 2008 $5,222 354 $373 $6,904 $10,389 ($1,368) $981 $22,501

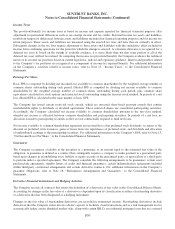

Net loss - - - - (1,564) - - (1,564)

Other comprehensive income:

Change in unrealized gains (losses) on securities, net of tax - - - - - - 281 281

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - (435) (435)

Change related to employee benefit plans - - - - - - 251 251

Total comprehensive loss (1,467)

Change in noncontrolling interest - - - - - (5) - (5)

Common stock dividends, $0.22 per share - - - - (83) - - (83)

Series A preferred stock dividends, $4,056 per share - - - - (14) - - (14)

U.S. Treasury preferred stock dividends, $5,004 per share - - - - (243) - - (243)

Accretion of discount associated with U.S. Treasury preferred stock 23 - - - (23) - - -

Issuance of common stock in connection with SCAP capital plan - 142 142 1,688 - - - 1,830

Extinguishment of forward stock purchase contract - - - 174 - - - 174

Repurchase of preferred stock (328) - - 5 95 - - (228)

Exercise of stock options and stock compensation expense - - - 11 - - - 11

Restricted stock activity - 2 - (206) - 177 - (29)

Amortization of restricted stock compensation - - - - - 66 - 66

Issuance of stock for employee benefit plans and other - 1 - (55) (2) 75 - 18

Adoption of OTTI guidance - - - - 8 - (8) -

Balance, December 31, 2009 $4,917 499 $515 $8,521 $8,563 ($1,055) $1,070 $22,531

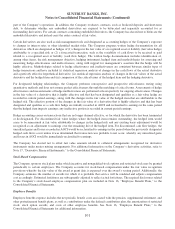

Net income - - - - 189 - - 189

Other comprehensive income:

Change in unrealized gains (losses) on securities, net of tax - - - - - - 366 366

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - 120 120

Change related to employee benefit plans - - - - - - 60 60

Total comprehensive income 735

Change in noncontrolling interest -----4 -4

Common stock dividends, $0.04 per share - - - - (20) - - (20)

Series A preferred stock dividends, $4,056 per share - - - - (7) - - (7)

U.S. Treasury preferred stock dividends, $5,000 per share - - - - (242) - - (242)

Accretion of discount associated with U.S. Treasury preferred stock 25 - - - (25) - - -

Stock compensation expense ---24-- -24

Restricted stock activity - 1 - (97) - 66 - (31)

Amortization of restricted stock compensation -----42 -42

Issuance of stock for employee benefit plans and other - - - (45) 2 55 - 12

Fair value election of MSRs - - - - 89 - - 89

Adoption of VIE consolidation guidance -- - - (7) - - (7)

Balance, December 31, 2010 $4,942 500 $515 $8,403 $8,542 ($888) $1,616 $23,130

1 Balance at December 31, 2010 includes ($974) for treasury stock, ($43) for compensation element of restricted stock, $129 for noncontrolling interest.

Balance at December 31, 2009 includes ($1,104) for treasury stock, ($59) for compensation element of restricted stock, $108 for noncontrolling interest.

Balance at December 31, 2008 includes ($1,368) for treasury stock, ($113) for compensation element of restricted stock, $113 for noncontrolling interest.

See Notes to Consolidated Financial Statements.

92