SunTrust 2010 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

The Company does not consolidate certain wholly-owned trusts which had been formed for the sole purpose of issuing trust

preferred securities. The proceeds from the trust preferred securities issuances were invested in junior subordinated

debentures of the Parent Company. The obligations of these debentures constitute a full and unconditional guarantee by the

Parent Company of the trust preferred securities.

During 2010, $2.2 billion in variable and fixed rate FHLB advances matured or were terminated by the Company.

Additionally, during 2010, $888 million of fixed rate senior notes matured or were terminated by the Company and $300

million of subordinated fixed rate debt carried at fair value matured. Also during the year, the Company issued a new FHLB

advance of $500 million that was to mature during the first quarter of 2011 which was terminated before December 31, 2010.

Additionally, the Company executed a cash tender offer to purchase $750 million aggregate principal amount of outstanding

subordinated debt securities carried at fair value that were to mature between 2015 and 2020. Following the tender offer, the

Company repurchased an additional $99 million of these subordinated debt securities in the secondary market.

During 2010, the Company consolidated the balance sheets of a Student Loan entity and a CLO including senior variable rate

debt of $474 million and $290 million, respectively. Of the $764 million long-term debt related to these consolidated VIEs,

the CLO’s $290 million is carried at fair value as of December 31, 2010. See Note 11, “Certain Transfers of Financial Assets,

Mortgage Servicing Rights and Variable Interest Entities” to the Consolidated Financial Statements for discussion related to

the consolidation.

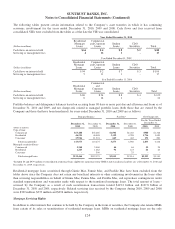

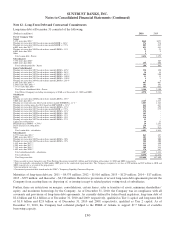

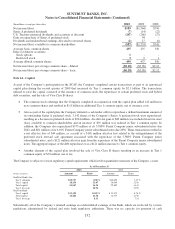

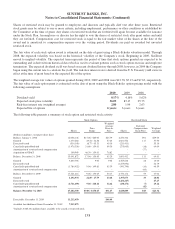

In the normal course of business, the Company enters into certain contractual obligations. Such obligations include

obligations to make future payments on lease arrangements, contractual commitments for capital expenditures, and service

contracts. As of December 31, 2010, the Company had the following in unconditional obligations:

As of December 31, 2010

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating lease obligations $209 $379 $327 $561 $1,476

Capital lease obligations 1223714

Purchase obligations 2143 372 226 304 1,045

Total $354 $753 $556 $872 $2,535

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

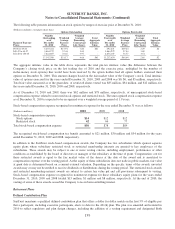

Note 13 - Net Income/(Loss) Per Share

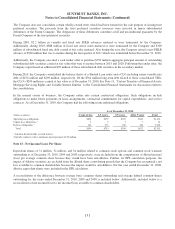

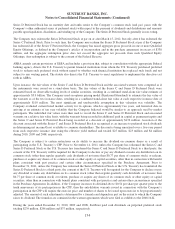

Equivalent shares of 31 million, 32 million, and 34 million related to common stock options and common stock warrants

outstanding as of December 31, 2010, 2009 and 2008, respectively, were excluded from the computations of diluted income/

(loss) per average common share because they would have been anti-dilutive. Further, for EPS calculation purposes, the

impact of dilutive securities are excluded from the diluted share count during periods that the Company has recognized a net

loss available to common shareholders because the impact would be anti-dilutive. For the year ended December 31, 2008,

dilutive equivalent shares were included in the EPS calculation.

A reconciliation of the difference between average basic common shares outstanding and average diluted common shares

outstanding for the years ended December 31, 2010, 2009 and 2008 is included below. Additionally, included below is a

reconciliation of net income/(loss) to net income/(loss) available to common shareholders.

131