SunTrust 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

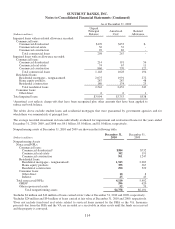

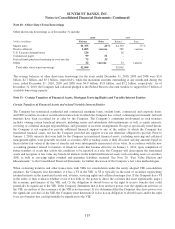

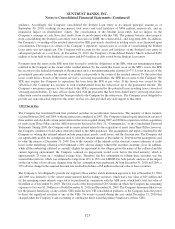

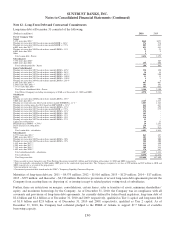

The following tables present certain information related to the Company’s asset transfers in which it has continuing

economic involvement for the years ended December 31, 2010, 2009 and 2008. Cash flows and fees received from

consolidated VIEs were excluded from the tables as of the date the VIE was consolidated.

Year Ended December 31, 2010

(Dollars in millions)

Residential

Mortgage

Loans

Commercial

and Corporate

Loans

Student

Loans

CDO

Securities Total

Cash flows on interests held $66$4$8$2$80

Servicing or management fees 412 1 - 17

Year Ended December 31, 2009

(Dollars in millions)

Residential

Mortgage

Loans

Commercial

and Corporate

Loans

Student

Loans

CDO

Securities Total

Cash flows on interests held $ 94 $ 2 $ 7 $ 3 $ 106

Servicing or management fees 5 11 1 - 17

Year Ended December 31, 2008

(Dollars in millions)

Residential

Mortgage

Loans

Commercial

and

Corporate

Loans

Student

Loans

CDO

Securities Total

Cash flows on interests held $ 86 $ 24 $ 8 $ 4 $ 122

Servicing or management fees 6 14 1 - 21

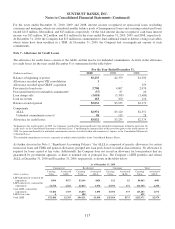

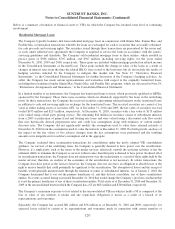

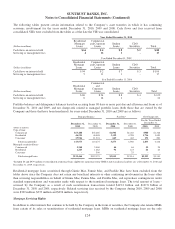

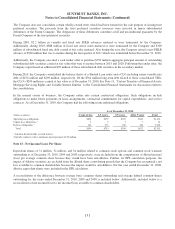

Portfolio balances and delinquency balances based on accruing loans 90 days or more past due and all nonaccrual loans as of

December 31, 2010 and 2009, and net charge-offs related to managed portfolio loans (both those that are owned by the

Company and those that have been transferred) for years ended December 31, 2010 and 2009 are as follows:

Principal Balance Past Due1Net Charge-offs

(Dollars in millions)

December 31,

2010

December 31,

2009

December 31,

2010

December 31,

2009

For the Years Ended

December 31,

2010 2009

Type of loan:

Commercial $53,488 $55,686 $1,904 $2,232 $988 $1,348

Residential 46,521 46,488 3,122 4,228 1,716 1,690

Consumer 15,966 11,501 649 442 151 200

Total loan portfolio 115,975 113,675 5,675 6,902 2,855 3,238

Managed securitized loans

Commercial 2,244 3,460 44 64 22 28

Residential 1,245 1,482 96 123 46 44

Consumer -506 -25 --

Total managed loans $119,464 $119,123 $5,815 $7,114 $2,923 $3,310

1Included $0 and $979 million of consolidated residential loans eligible for repurchase from GNMA and classified as held for sale at December 31, 2010 and

December 31, 2009, respectively.

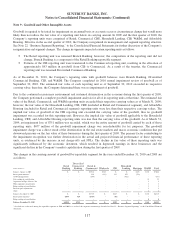

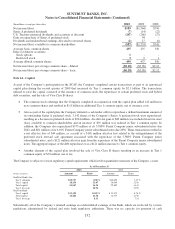

Residential mortgage loans securitized through Ginnie Mae, Fannie Mae, and Freddie Mac have been excluded from the

tables above since the Company does not retain any beneficial interests or other continuing involvement in the loans other

than servicing responsibilities on behalf of Ginnie Mae, Fannie Mae, and Freddie Mac, and repurchase contingencies under

standard representations and warranties made with respect to the transferred mortgage loans. The total amount of loans -

serviced by the Company as a result of such securitization transactions totaled $119.2 billion and $127.8 billion at

December 31, 2010 and 2009, respectively. Related servicing fees received by the Company during 2010, 2009 and 2008

were $369 million, $333 million and $294 million, respectively.

Mortgage Servicing Rights

In addition to other interests that continue to be held by the Company in the form of securities, the Company also retains MSRs

from certain of its sales or securitizations of residential mortgage loans. MSRs on residential mortgage loans are the only

124