SunTrust 2010 Annual Report Download - page 19

Download and view the complete annual report

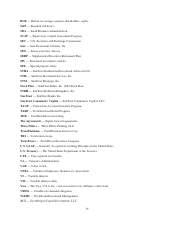

Please find page 19 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily on relative credit risk. In addition, the Company, and any bank with significant trading activity, must incorporate a

measure for market risk in their regulatory capital calculations. The leverage ratio is determined by dividing Tier 1 capital by

adjusted average total assets. Under the Dodd-Frank Act, trust preferred securities that formerly constituted Tier 1 capital

will no longer be included in Tier 1 capital after a three-year phase-in period which begins January 1, 2013. Moreover,

capital requirements for bank holding companies and banks change frequently and these changes are often linked to decisions

made by the BCBS of the Bank for International Settlements. Capital requirements applicable to bank holding companies and

banks may increase in the near-future as a result of the Dodd-Frank Act and initiatives of the BCBS.

FDICIA, among other things, identifies five capital categories for insured depository institutions (“well capitalized,”

“adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” and “critically undercapitalized”) and requires

the respective federal regulatory agencies to implement systems for “prompt corrective action” for insured depository

institutions that do not meet minimum capital requirements within such categories. FDICIA imposes progressively more

restrictive constraints on operations, management and capital distributions, depending on the category in which an institution

is classified. Failure to meet the capital guidelines could also subject a banking institution to capital raising requirements. An

“undercapitalized” bank must develop a capital restoration plan and its parent holding company must guarantee that bank’s

compliance with the plan. The liability of the parent holding company under any such guarantee is limited to the lesser of

five percent of the bank’s assets at the time it became “undercapitalized” or the amount needed to comply with the plan.

Furthermore, in the event of the bankruptcy of the parent holding company, such guarantee would take priority over the

parent’s general unsecured creditors. In addition, FDICIA requires the various regulatory agencies to prescribe certain

non-capital standards for safety and soundness relating generally to operations and management, asset quality, and executive

compensation and permits regulatory action against a financial institution that does not meet such standards.

The various regulatory agencies have adopted substantially similar regulations that define the five capital categories

identified by FDICIA, using the total risk-based capital, Tier 1 risk-based capital and leverage capital ratios as the relevant

capital measures. Such regulations establish various degrees of corrective action to be taken when an institution is considered

undercapitalized. Under the regulations, a “well capitalized” institution must have a Tier 1 risk-based capital ratio of at least

six percent, a total risk-based capital ratio of at least ten percent and a leverage ratio of at least five percent and not be subject

to a capital directive order.

Regulators also must take into consideration: (a) concentrations of credit risk; (b) interest rate risk (when the interest rate

sensitivity of an institution’s assets does not match the sensitivity of its liabilities or its off-balance sheet position); and

(c) risks from non-traditional activities, as well as an institution’s ability to manage those risks, when determining the

adequacy of an institution’s capital. This evaluation will be made as a part of the institution’s regular safety and soundness

examination. In addition, regulators may choose to examine other factors in order to evaluate the safety and soundness of

financial institutions. For instance, in connection with the SCAP, our regulators began focusing on “Tier 1 common equity,”

which is the proportion of Tier 1 capital that is common equity, and the Tier 1 common equity ratio continues to be a factor

which regulators examine in evaluating the safety and soundness of financial institutions.

Capital Framework and Basel III

In December 2009, the BCBS issued two consultative documents proposing reforms to bank capital and liquidity regulation.

The BCBS’s capital proposals would significantly revise the definitions of Tier 1 capital and Tier 2 capital.

The Basel III capital framework, among other things:

•introduces as a new capital measure Tier 1 Common Equity, specifies that Tier 1 capital consists of Tier 1

Common Equity and “Additional Tier 1 capital” instruments meeting specified requirements, defines Tier 1

Common Equity narrowly by requiring that most deductions or adjustments to regulatory capital measures be

made to Tier 1 Common Equity and not to the other components of capital, and expands the scope of the

deductions or adjustments as compared to existing regulations;

•when fully phased in on January 1, 2019, requires banks to maintain:

Oas a newly adopted international standard, a minimum ratio of Tier 1 Common Equity to risk-weighted

assets of at least 4.5%, plus a 2.5% “capital conservation buffer” (which is added to the 4.5% Tier 1

Common Equity ratio as that buffer is phased in, effectively resulting in a minimum ratio of Tier 1

Common Equity to risk-weighted assets of at least 7%);

3