SunTrust 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. BUSINESS

General

The Company, one of the nation’s largest commercial banking organizations, is a diversified financial services holding

company whose businesses provide a broad range of financial services to consumer and corporate clients. SunTrust was

incorporated in 1984 under the laws of the State of Georgia. The principal executive offices of the Company are located in

the SunTrust Plaza, Atlanta, Georgia 30308.

Additional information relating to our businesses and our subsidiaries is included in the information set forth in Item 7,

Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Note 22, “Business Segment

Reporting,” to the Consolidated Financial Statements in Item 8 of this report.

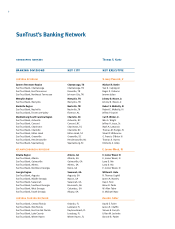

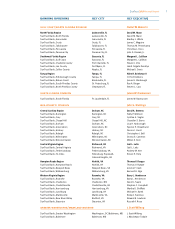

Primary Market Areas

Through its principal subsidiary, SunTrust Bank, the Company provides deposit, credit, and trust and investment services.

Additional subsidiaries provide mortgage banking, asset management, securities brokerage, capital market services, and

credit-related insurance. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina,

Tennessee, Virginia, and the District of Columbia and enjoys strong market positions in these markets. SunTrust operated

under the following business segments during 2009 and in the first quarter of 2010. These business segments were: Retail

and Commercial, CIB, Household Lending, W&IM, and Corporate Other and Treasury. The Company announced certain

organizational changes at the end of the first quarter of 2010, which became effective in the second quarter of 2010 and

resulted in the following business segments: Retail Banking, Diversified Commercial Banking, CRE, CIB, Mortgage,

W&IM, and Corporate Other and Treasury. In addition, SunTrust provides clients with a selection of technology-based

banking channels, including the internet, ATMs, and twenty-four hour telebanking. SunTrust’s client base encompasses a

broad range of individuals and families, businesses, institutions, and governmental agencies.

Acquisition and Disposition Activity

As part of its operations, the Company regularly evaluates the potential acquisition of, and holds discussions with, various

financial institutions and other businesses of a type eligible for financial holding company ownership or control. In addition,

the Company regularly analyzes the values of, and may submit bids for, the acquisition of customer-based funds and other

liabilities and assets of such financial institutions and other businesses. The Company may also consider the potential

disposition of certain of its assets, branches, subsidiaries or lines of businesses.

During 2010, the Company’s W&IM business transferred $14.1 billion in money market funds into funds managed by

Federated Investors, Inc. During 2009, W&IM completed three acquisitions of family office enterprises: Epic Advisors, Inc;

a division of CSI Capital Management; and Martin Kelly Capital Management LLC. We completed the sale of our minority

interest in Lighthouse Investment Partners on January 2, 2008, and effective May 1, 2008, we acquired GB&T. On May 30,

2008, we sold our interests in First Mercantile, a retirement plan services subsidiary. Moreover, on September 2, 2008, we

sold our fuel card business, TransPlatinum, to Fleet One Holdings LLC. Additional information on these and other

acquisitions and dispositions is included in Note 2, “Acquisitions/Dispositions,” to the Consolidated Financial Statements in

Item 8, which are incorporated herein by reference.

Government Supervision and Regulation

As a bank holding company and a financial holding company, the Company is subject to the regulation and supervision of

the Federal Reserve and, in limited circumstances described herein, the U.S. Treasury. The Company’s principal banking

subsidiary, SunTrust Bank, is a Georgia state chartered bank with branches in Georgia, Florida, the District of Columbia,

Maryland, Virginia, North Carolina, South Carolina, Tennessee, Alabama, West Virginia, Mississippi, and Arkansas.

SunTrust Bank is a member of the Federal Reserve System, and it is regulated by the Federal Reserve, the FDIC and the

Georgia Department of Banking and Finance.

1