SunTrust 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

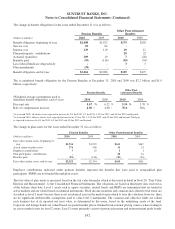

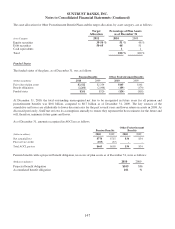

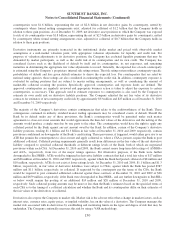

Effective January 1, 2011, a separate retirement plan was created exclusively for inactive and retired employees (“SunTrust

Banks, Inc. Retirement Plan for Inactive Participants”). Obligations and related plan assets were transferred from the

SunTrust Banks, Inc. Retirement Plan to the new plan. Establishing a separate plan and trust fund for the assets used to pay

benefits for retirees and inactive employees allows SunTrust to manage the assets for this plan more effectively.

The SunTrust Banks, Inc. Retirement Plan was also amended to include a lump sum option for any employee active on or

after October 1, 2010. Other minor changes include a change in the death benefit payable based on a joint and 100% survivor

annuity and a delay in accumulating benefits until date of participation for any employee hired on or after January 1, 2011.

On December 31, 2010, the Company adopted the SunTrust Banks, Inc. Restoration Plan (the “Restoration Plan”) effective

January 1, 2011. Like the ERISA Excess Plan, the Restoration Plan is a nonqualified defined benefit cash balance plan

designed to restore benefits to certain employees that are limited under provisions of the Internal Revenue Code which are

not otherwise provided for under the ERISA Excess Plan. The benefit formula under the Restoration Plan is the same as the

Personal Pension Account under the qualified retirement plan.

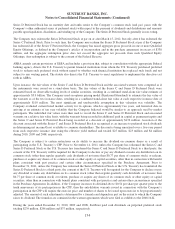

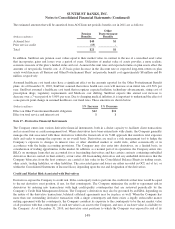

Other Postretirement Benefits

Although not under contractual obligation, SunTrust provides certain health care and life insurance benefits to retired

employees (“Other Postretirement Benefits” in the tables). At the option of SunTrust, retirees may continue certain health

and life insurance benefits if they meet age and service requirements for Other Postretirement Benefits while working for the

Company. The health care plans are contributory with participant contributions adjusted annually, and the life insurance

plans are noncontributory. Employees who have retired or will retire after December 31, 2003 are not eligible for retiree life

insurance or subsidized post-65 medical benefits. Effective January 1, 2008, the pre-65 employer subsidy for medical

benefits was discontinued for participants who will not be age 55 with at least 10 years of service before January 1, 2010.

Certain retiree health benefits are funded in a Retiree Health Trust. In addition, certain retiree life insurance benefits are

funded in a VEBA. SunTrust reserves the right to amend or terminate any of the benefits at any time.

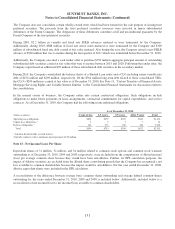

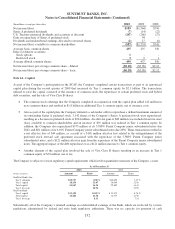

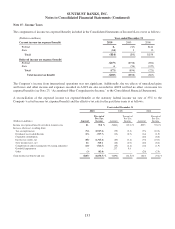

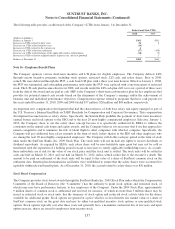

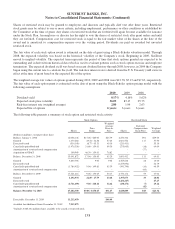

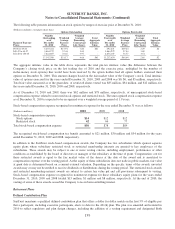

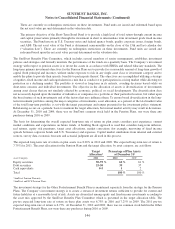

Assumptions

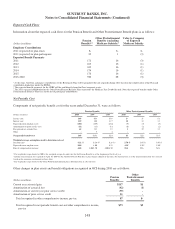

The SunTrust Benefits Plan Committee reviews and approves the assumptions for year-end measurement calculations. A

discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is

determined by matching the expected cash flows of each plan to a yield curve based on long-term, high quality fixed income

debt instruments available as of the measurement date. A series of benefit payments projected to be paid by the plan for the

next 100 years is developed based on the most recent census data, plan provisions and assumptions. The benefit payments at

each future maturity are discounted by the year-appropriate spot interest rates. The model then solves for the discount rate

that produces the same present value of the projected benefit payments as generated by discounting each year’s payments by

the spot rate. This assumption is reviewed by the SunTrust Benefits Plan Committee and updated every year for each plan. A

rate of compensation growth is used to determine future benefit obligations for those plans whose benefits vary by pay. Due

to current economic conditions and Company projections for wage growth, merit increases, and real inflation, base pay

compensation growth assumptions of 3% and 3.5% will be used for the next two years (2011 – 2012) with the ultimate

assumption returning to 4% in 2013. Total pay is assumed to increase 6% for 2011 and 2012 with the ultimate assumption

returning to 4% in 2013.

Actuarial gains and losses are created when actual experience deviates from assumptions. The actuarial losses on obligations

generated within the Pension Plans in 2010 resulted primarily from lower discount rates.

141