SunTrust 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

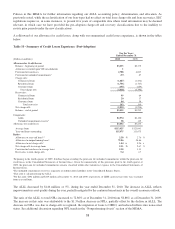

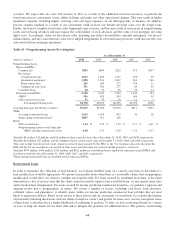

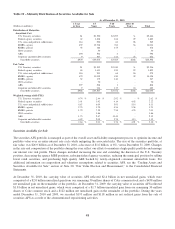

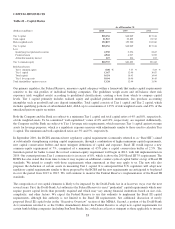

Table 19 – Maturity Distribution of Securities Available for Sale

As of December 31, 2010

(Dollars in millions)

1 Year

or Less

1-5

Years

5-10

Years

After 10

Years Total

Distribution of Maturities:

Amortized Cost

U.S. Treasury securities $1 $3,390 $2,055 $- $5,446

Federal agency securities 62 1,608 184 29 1,883

U.S. states and political subdivisions 114 290 63 98 565

RMBS - agency 459 12,738 781 36 14,014

RMBS - private 35 188 155 - 378

CDO securities - 50 - - 50

ABS 290 504 4 - 798

Corporate and other debt securities 9 307 123 25 464

Total debt securities $970 $19,075 $3,365 $188 $23,598

Fair Value

U.S. Treasury securities $1 $3,505 $2,010 $- $5,516

Federal agency securities 63 1,613 190 29 1,895

U.S. states and political subdivisions 116 303 64 96 579

RMBS - agency 470 13,039 810 39 14,358

RMBS - private 32 175 140 - 347

CDO securities - 50 - - 50

ABS 297 508 3 - 808

Corporate and other debt securities 9 314 135 24 482

Total debt securities $988 $19,507 $3,352 $188 $24,035

Weighted average yield (FTE):

U.S. Treasury securities 0.74 % 2.44 % 2.92 % - % 2.62 %

Federal agency securities 3.41 1.92 4.14 4.02 2.22

U.S. states and political subdivisions 6.87 6.09 5.93 5.14 6.11

RMBS - agency 2.23 3.20 4.56 5.38 3.23

RMBS - private 1.70 7.59 7.54 4.35 7.03

CDO securities - 3.86 - - 3.86

ABS 1.73 2.47 13.43 - 2.15

Corporate and other debt securities 4.82 2.09 5.74 1.13 3.15

Total debt securities 2.84 % 3.01 % 3.76 % 4.91 % 3.10 %

Securities Available for Sale

The securities AFS portfolio is managed as part of the overall asset and liability management process to optimize income and

portfolio value over an entire interest rate cycle while mitigating the associated risks. The size of the securities portfolio, at

fair value, was $26.9 billion as of December 31, 2010, a decrease of $1.6 billion, or 6%, versus December 31, 2009. Changes

in the size and composition of the portfolio during the year reflect our efforts to maintain a high quality portfolio and manage

our interest rate risk profile. These changes included increasing the size and extending the duration of the U.S. Treasury

position, decreasing the agency MBS positions, reducing federal agency securities, reducing the municipal position by selling

lower rated securities, and purchasing high quality ABS backed by newly-originated consumer automobile loans. For

additional information on composition and valuation assumptions related to securities AFS, see the “Trading Assets and

Securities Available for Sale” section of Note 20, “Fair Value Election and Measurement,” to the Consolidated Financial

Statements.

At December 31, 2010, the carrying value of securities AFS reflected $2.4 billion in net unrealized gains, which were

comprised of a $2.0 billion unrealized gain from our remaining 30 million shares of Coke common stock and a $438 million

net unrealized gain on the remainder of the portfolio. At December 31, 2009, the carrying value of securities AFS reflected

$1.8 billion in net unrealized gains, which were comprised of a $1.7 billion unrealized gain from our remaining 30 million

shares of Coke common stock and a $122 million net unrealized gain on the remainder of the portfolio. During the years

ended December 31, 2010 and 2009, we recorded $193 million and $118 million in net realized gains from the sale of

securities AFS as a result of the aforementioned repositioning activities.

48