SunTrust 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

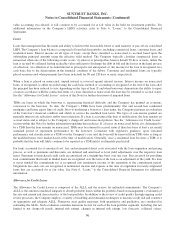

Notes to Consolidated Financial Statements (Continued)

Income Taxes

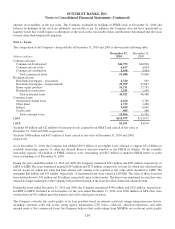

The provision/(benefit) for income taxes is based on income and expense reported for financial statement purposes after

adjustment for permanent differences such as tax-exempt income and tax credits. Deferred income tax assets and liabilities

result from temporary differences between assets and liabilities measured for financial reporting purposes and for income tax

return purposes. These assets and liabilities are measured using the enacted tax rates and laws that are currently in effect.

Subsequent changes in the tax laws require adjustment to these assets and liabilities with the cumulative effect included in

income from continuing operations for the period in which the change is enacted. A valuation allowance is recognized for a

deferred tax asset if, based on the weight of available evidence, it is more likely than not that some portion or all of the

deferred tax asset will not be realized. In computing the income tax provision/(benefit), the Company evaluates the technical

merits of its income tax positions based on current legislative, judicial and regulatory guidance. Interest and penalties related

to the Company’s tax positions are recognized as a component of income tax expense/(benefit). For additional information

on the Company’s activities related to income taxes, refer to Note 15, “Income Taxes,” to the Consolidated Financial

Statements.

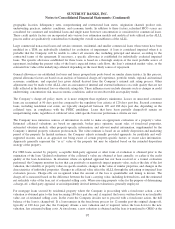

Earnings Per Share

Basic EPS is computed by dividing net income/(loss) available to common shareholders by the weighted average number of

common shares outstanding during each period. Diluted EPS is computed by dividing net income available to common

shareholders by the weighted average number of common shares outstanding during each period, plus common share

equivalents calculated for stock options and restricted stock outstanding using the treasury stock method. In periods of a net

loss, diluted EPS is calculated in the same manner as basic EPS.

The Company has issued certain restricted stock awards, which are unvested share-based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents. These restricted shares are considered participating securities.

Accordingly, the Company calculated net income available to common shareholders pursuant to the two-class method,

whereby net income is allocated between common shareholders and participating securities. In periods of a net loss, no

allocation is made to participating securities as they are not contractually required to fund net losses.

Net income available to common shareholders represents net income/(loss) after preferred stock dividends, accretion of the

discount on preferred stock issuances, gains or losses from any repurchases of preferred stock, and dividends and allocation

of undistributed earnings to the participating securities. For additional information on the Company’s EPS, refer to Note 13,

“Net Income/(Loss) Per Share,” to the Consolidated Financial Statements.

Guarantees

The Company recognizes a liability at the inception of a guarantee, at an amount equal to the estimated fair value of the

obligation. A guarantee is defined as a contract that contingently requires a company to make payment to a guaranteed party

based upon changes in an underlying asset, liability or equity security of the guaranteed party, or upon failure of a third-party

to perform under a specified agreement. The Company considers the following arrangements to be guarantees: certain asset

purchase/sale agreements, standby letters of credit and financial guarantees, certain indemnification agreements included

within third-party contractual arrangements and certain derivative contracts. For additional information on the Company’s

guarantor obligations, refer to Note 18, “Reinsurance Arrangements and Guarantees,” to the Consolidated Financial

Statements.

Derivative Financial Instruments and Hedging Activities

The Company records all contracts that satisfy the definition of a derivative at fair value in the Consolidated Balance Sheets.

Accounting for changes in the fair value of a derivative is dependent upon its classification as either a freestanding derivative

or a derivative that has been designated as a hedging instrument.

Changes in the fair value of freestanding derivatives are recorded in noninterest income. Freestanding derivatives include

derivatives that the Company enters into in a dealer capacity to facilitate client transactions and as a risk management tool to

economically hedge certain identified market risks, along with certain IRLCs on residential mortgage loans that are a normal

100