SunTrust 2010 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

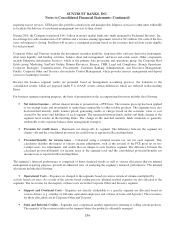

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

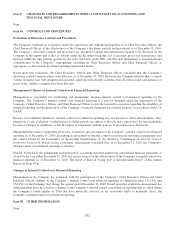

The application and development of management reporting methodologies is a dynamic process and is subject to periodic

enhancements. The implementation of these enhancements to the internal management reporting methodology may

materially affect the results disclosed for each segment with no impact on consolidated results. Whenever significant changes

to management reporting methodologies take place, the impact of these changes is quantified and prior period information is

reclassified wherever practicable.

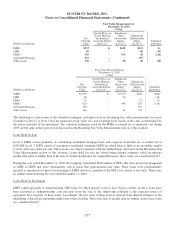

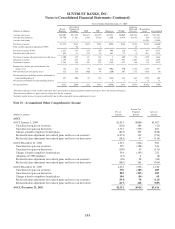

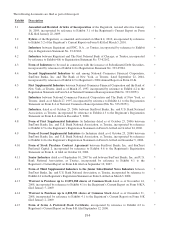

Twelve Months Ended December 31, 2010

(Dollars in millions)

Retail

Banking

Diversified

Commercial

Banking CRE CIB Mortgage W&IM

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $38,911 $24,662 $10,796 $20,387 $34,793 $9,177 $32,827 $822 $172,375

Average total liabilities 75,152 20,770 1,676 16,040 4,031 12,496 19,479 (103) 149,541

Average total equity -------22,834 22,834

Net interest income $2,540 $542 $162 $379 $427 $447 $473 ($116) $4,854

Fully taxable-equivalent adjustment (FTE) - 105 - 1 - - 10 - 116

Net interest income (FTE)12,540 647 162 380 427 447 483 (116) 4,970

Provision for credit losses2992 127 442 50 1,183 61 - (204) 2,651

Net interest income after provision for credit losses 1,548 520 (280) 330 (756) 386 483 88 2,319

Noninterest income 1,127 226 88 670 521 822 307 (32) 3,729

Noninterest expense 2,433 439 471 490 1,089 916 102 (29) 5,911

Income/(loss) before provision/(benefit) for

income taxes 242 307 (663) 510 (1,324) 292 688 85 137

Provision/(benefit) for income taxes386 110 (333) 188 (504) 105 235 44 (69)

Net income/(loss) including income attributable to

noncontrolling interest 156 197 (330) 322 (820) 187 453 41 206

Net income attributable to noncontrolling interest ----179-17

Net income/(loss) $156 $197 ($330) $322 ($821) $180 $444 $41 $189

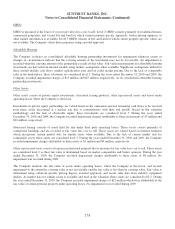

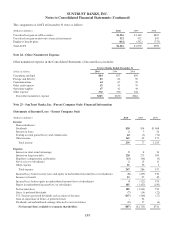

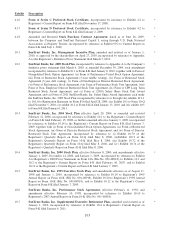

Twelve Months Ended December 31, 2009

(Dollars in millions)

Retail

Banking

Diversified

Commercial

Banking CRE CIB Mortgage W&IM

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $39,245 $26,769 $13,630 $21,414 $37,296 $9,136 $26,713 $1,239 $175,442

Average total liabilities 73,130 19,937 2,389 12,400 3,863 11,511 29,779 147 153,156

Average total equity -------22,286 22,286

Net interest income $2,351 $465 $179 $302 $499 $399 $428 ($157) $4,466

Fully taxable-equivalent adjustment (FTE) - 107 - 2 - - 14 - 123

Net interest income (FTE)12,351 572 179 304 499 399 442 (157) 4,589

Provision for credit losses21,236 112 435 248 1,125 79 2 827 4,064

Net interest income after provision for credit losses 1,115 460 (256) 56 (626) 320 440 (984) 525

Noninterest income 1,152 242 94 611 686 753 203 (31) 3,710

Noninterest expense 2,531 468 721 481 1,418 861 112 (30) 6,562

Income/(loss) before provision/(benefit) for

income taxes (264) 234 (883) 186 (1,358) 212 531 (985) (2,327)

Provision/(benefit) for income taxes3(99) 85 (299) 70 (366) 80 125 (371) (775)

Net income/(loss) including income attributable to

noncontrolling interest (165) 149 (584) 116 (992) 132 406 (614) (1,552)

Net income attributable to noncontrolling interest ----3-9-12

Net income/(loss) ($165) $149 ($584) $116 ($995) $132 $397 ($614) ($1,564)

187