SunTrust 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

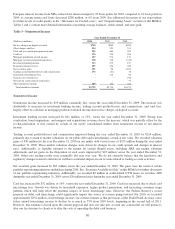

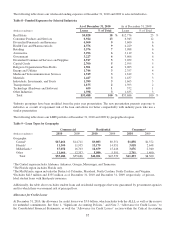

Table 2 - Analysis of Changes in Net Interest Income 1

2010 Compared to 2009

Increase (Decrease) Due to

2009 Compared to 2008 Increase

(Decrease) Due to

(Dollars in millions on a taxable-equivalent basis) Volume Rate Net Volume Rate Net

Interest Income

Loans:

Real estate 1-4 family ($31) ($138) ($169) ($138) ($144) ($282)

Real estate construction (93) 21 (72) (205) (173) (378)

Real estate home equity lines (25) 4 (21) 24 (298) (274)

Real estate commercial (40) (6) (46) 83 (233) (150)

Commercial - FTE2(193) 201 8 (89) (181) (270)

Credit card 691553439

Consumer - direct 30 14 44 29 (76) (47)

Consumer - indirect 56 (51) 5 (42) - (42)

Nonaccrual (2) 5 3 17 (6) 11

Securities available for sale:

Taxable 217 (222) (5) 324 (265) 59

Tax-exempt 2(12) (1) (13) (2) (6) (8)

Funds sold and securities purchased under

agreements to resell 1 (2) (1) (7) (16) (23)

Loans held for sale (81) (15) (96) 7 (64) (57)

Interest-bearing deposits ---- (1) (1)

Interest earning trading assets (19) (7) (26) (125) (64) (189)

Total interest income (186) (188) (374) (119) (1,493) (1,612)

Interest Expense

NOW accounts 4 (45) (41) 27 (181) (154)

Money market accounts 61 (148) (87) 89 (295) (206)

Savings 1 (2) (1) - (6) (6)

Consumer time (63) (149) (212) (2) (158) (160)

Other time (97) (97) (194) 32 (128) (96)

Brokered deposits (108) 64 (44) (150) (87) (237)

Foreign deposits ---(38) (40) (78)

Funds purchased (1) - (1) (14) (34) (48)

Securities sold under agreements to repurchase - (1) (1) (27) (48) (75)

Interest-bearing trading liabilities 13 (3) 10 (12) 5 (7)

Other short-term borrowings 1 (3) (2) (6) (35) (41)

Long-term debt (147) (35) (182) (124) (232) (356)

Total interest expense (336) (419) (755) (225) (1,239) (1,464)

Net change in net interest income $150 $231 $381 $106 ($254) ($148)

1Changes in net interest income are attributed to either changes in average balances (volume change) or changes in average rates (rate

change) for earning assets and sources of funds on which interest is received or paid. Volume change is calculated as change in volume times

the previous rate, while rate change is change in rate times the previous volume. The rate/volume change, change in rate times change in

volume, is allocated between volume change and rate change at the ratio each component bears to the absolute value of their total.

2Interest income includes the effects of the taxable-equivalent adjustments to increase tax-exempt interest income to a taxable-equivalent

basis.

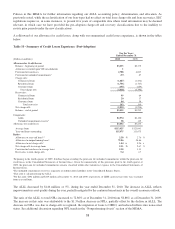

Net Interest Income/Margin

Net interest income, on an FTE basis, was $5.0 billion during 2010, an increase of $381 million, or 8%, from 2009. This

increase was driven mainly by a continued positive trend in net interest margin, which increased 34 basis points to 3.38% in

2010 from 3.04% in 2009. Earning asset yields declined 14 basis points compared to 2009 from 4.53% to 4.39%, but the cost

of interest-bearing liabilities decreased 56 basis points over the same period. The biggest contributors to the net interest

margin increase were growth in low cost deposits, lower rates paid on time deposits, and a reduction in higher-cost long-term

debt coupled with a strong focus on loan pricing and higher commercial loan yields due to our commercial loan swap

position. These favorable margin contributors were partially offset by a reduction in residential mortgage loan yields and an

increase in lower-yielding securities.

We currently expect margin to be relatively stable in the near-term. Risks to this expectation include the potential impacts of

a prolonged low rate environment, yield curve flattening, a shift in deposit mix and volume, and loan pricing, while

opportunities include continued deposit re-pricing, further steepening of the yield curve, and lower nonperforming assets. As

28