SunTrust 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

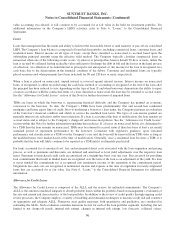

Notes to Consolidated Financial Statements (Continued)

The Company reviews securities AFS for impairment on a quarterly basis. A security is considered to be impaired if the fair

value of a debt security is less than its amortized cost basis at the measurement date and the decline in fair value is

determined to be other-than-temporary. Prior to April 1, 2009, debt securities that the Company had the intent and ability to

hold to recovery and for which it was probable that the Company would receive all cash flows were considered not to be

other-than-temporarily impaired. Debt securities AFS which had OTTI were written down to fair value as a realized loss in

the Consolidated Statements of Income/(Loss).

After April 1, 2009, the Company changed its policy based on an update to the guidance for determining OTTI. Based on the

updated guidance, the Company determines whether it has the intent to sell the debt security or whether it is more likely than

not it will be required to sell the debt security before the recovery of its amortized cost basis. If either condition is met, the

Company will recognize a full impairment and write the debt security down to fair value. For all other debt securities for

which the Company does not expect to recover the entire amortized cost basis of the security and do not meet either

condition, an OTTI loss is considered to have occurred, and the Company records the credit loss portion of impairment in

earnings and the temporary impairment related to all other factors in OCI.

Nonmarketable equity securities include venture capital equity and certain mezzanine securities that are not publicly traded

as well as equity investments acquired for various purposes. These securities are accounted for under the cost or equity

method and are included in other assets. The Company reviews nonmarketable securities accounted for under the cost

method on a quarterly basis and reduces the asset value when declines in value are considered to be other-than-temporary.

Equity method investments are recorded at cost, adjusted to reflect the Company’s portion of income, loss or dividends of the

investee. Realized income, realized losses and estimated other-than-temporary unrealized losses on cost and equity method

investments are recognized in noninterest income in the Consolidated Statements of Income/(Loss).

For additional information on the Company’s securities activities, refer to Note 5, “Securities Available for Sale,” to the

Consolidated Financial Statements.

Securities Sold Under Repurchase Agreements

Securities sold under agreements to repurchase are accounted for as collateralized financing transactions and are recorded at

the amounts at which the securities were sold, plus accrued interest. The fair value of collateral received is continually

monitored and additional collateral is obtained or requested to be returned to the Company as deemed appropriate.

Loans Held for Sale

The Company’s LHFS includes certain residential mortgage loans, commercial loans, and student loans. Loans are initially

classified as LHFS when they are identified as being available for immediate sale and a formal plan exists to sell them. LHFS

are recorded at either fair value, if elected, or the lower of cost or fair value on an individual loan basis. Origination fees and

costs for LHFS recorded at LOCOM are capitalized in the basis of the loan and are included in the calculation of realized

gains and losses upon sale. Origination fees and costs are recognized in earnings at the time of origination for LHFS that are

recorded at fair value. Fair value is derived from observable current market prices, when available, and includes loan

servicing value. When observable market prices are not available, the Company will use judgment and estimate fair value

using internal models, in which the Company uses its best estimates of assumptions it believes would be used by market

participants in estimating fair value. Adjustments to reflect unrealized gains and losses resulting from changes in fair value

and realized gains and losses upon ultimate sale of the loans are classified as noninterest income in the Consolidated

Statements of Income/(Loss).

The Company may transfer certain residential mortgage loans, commercial loans, and student loans to a held for sale

classification at LOCOM. At the time of transfer, any credit losses are recorded as a reduction in the ALLL. Subsequent

credit losses as well as incremental interest rate or liquidity related valuation adjustments are recorded as a component of

noninterest income in the Consolidated Statements of Income/(Loss). The Company may also transfer loans from held for

sale to held for investment. At the time of transfer, any difference between the carrying amount of the loan and its

outstanding principal balance is recognized as an adjustment to yield using the interest method, unless the loan was elected

upon origination to be accounted for at fair value. If a held for sale loan is transferred to held for investment for which fair

95