SunTrust 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

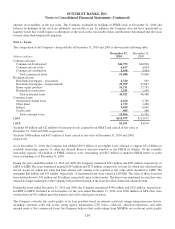

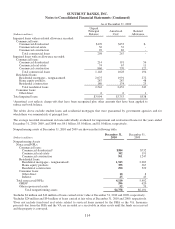

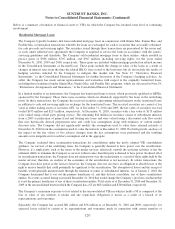

For the years ended December 31, 2010, 2009, and 2008, interest income recognized on nonaccrual loans (excluding

consumer and mortgage, which are considered smaller balance pools of homogeneous loans) and accruing restructured loans

totaled $113 million, $64 million, and $23 million, respectively. Of the total interest income recognized, cash basis interest

income was $13 million, $12 million, and $11 million for the years ended December 31, 2010, 2009, and 2008, respectively.

At December 31, 2010, the Company had $15 million in commitments to lend additional funds to debtors owing receivables

whose terms have been modified in a TDR. At December 31, 2009, the Company had an insignificant amount of such

commitments.

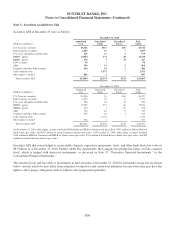

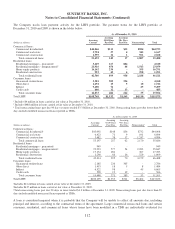

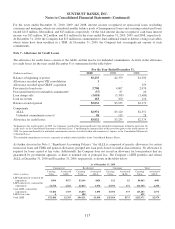

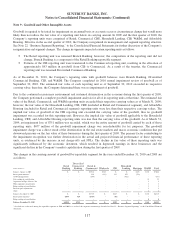

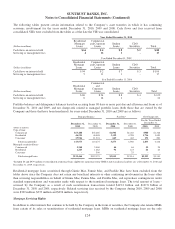

Note 7 - Allowance for Credit Losses

The allowance for credit losses consists of the ALLL and the reserve for unfunded commitments. Activity in the allowance

for credit losses for the years ended December 31 is summarized in the table below:

For the Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Balance at beginning of period $3,235 $2,379 $1,290

Allowance recorded upon VIE consolidation 1--

Allowance recorded upon GB&T acquisition -- 159

Provision for loan losses 2,708 4,007 2,474

Provision/(benefit) for unfunded commitments1(57) 87 20

Loan charge-offs (3,018) (3,398) (1,680)

Loan recoveries 163 160 116

Balance at end of period $3,032 $3,235 $2,379

Components:

ALLL $2,974 $3,120 $2,351

Unfunded commitments reserve258 115 28

Allowance for credit losses $3,032 $3,235 $2,379

1Beginning in the fourth quarter of 2009, the Company recorded the provision/(benefit) for unfunded commitments within the provision for

credit losses in the Consolidated Statements of Income/(Loss). Considering the immateriality of this provision prior to the fourth quarter of

2009, the provision/(benefit) for unfunded commitments remains classified within other noninterest expense in the Consolidated Statements

of Income/(Loss).

2The unfunded commitments reserve is separately recorded in other liabilities in the Consolidated Balance Sheets.

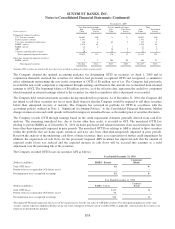

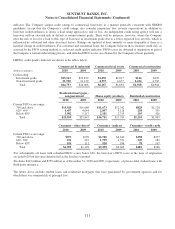

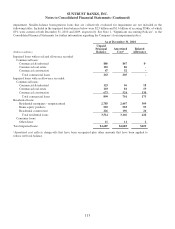

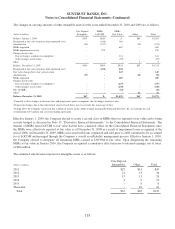

As further discussed in Note 1, “Significant Accounting Policies,” the ALLL is composed of specific allowances for certain

nonaccrual loans and TDRs and general allowances grouped into loan pools based on similar characteristics. No allowance is

required for loans carried at fair value. Additionally, the Company does not record an allowance for loan products that are

guaranteed by government agencies, as there is nominal risk of principal loss. The Company’s LHFI portfolio and related

ALLL at December 31, 2010 and December 31, 2009, respectively, is shown in the tables below:

As of December 31, 2010

Commercial Residential Consumer Total

(Dollars in millions)

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

LHFI individually evaluated for

impairment $906 $175 $3,166 $428 $11 $2 $4,083 $605

LHFI collectively evaluated for

impairment 52,578 1,128 42,867 1,070 15,955 171 111,400 2,369

Total LHFI evaluated for

impairment 53,484 1,303 46,033 1,498 15,966 173 115,483 2,974

LHFI at fair value 4 - 488 - - - 492 -

Total LHFI $53,488 $1,303 $46,521 $1,498 $15,966 $173 $115,975 $2,974

115