SunTrust 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

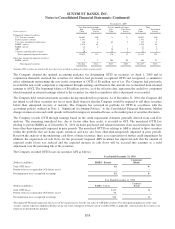

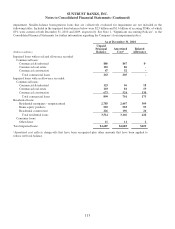

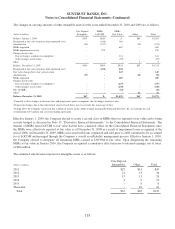

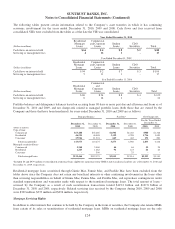

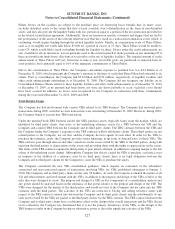

The changes in carrying amounts of other intangible assets for the years ended December 31, 2010 and 2009 are as follows:

(Dollars in millions)

Core Deposit

Intangibles

MSRs

LOCOM

MSRs

Fair Value Other Total

Balance, January 1, 2009 $145 $810 $- $80 $1,035

Designated at fair value (transfers from amortized cost) - (188) 188 - -

Amortization (41) (217) - (15) (273)

MSRs originated - - 682 - 682

MSRs impairment recovery - 199 - - 199

Changes in fair value

Due to changes in inputs or assumptions 1- - 161 - 161

Other changes in fair value 2- - (95) - (95)

Other - - - 2 2

Balance, December 31, 2009 $104 $604 $936 $67 $1,711

Designated at fair value (transfers from amortized cost) - (604) 604 - -

Fair value change due to fair value election - - 145 - 145

Amortization (37) - - (13) (50)

MSRs originated - - 289 - 289

Changes in fair value

Due to changes in inputs or assumptions 1- - (275) - (275)

Other changes in fair value 2- - (238) - (238)

Sale of MSRs - - (22) - (22)

Other 3- - - 11 11

Balance, December 31, 2010 $67 $- $1,439 $65 $1,571

1Primarily reflects changes in discount rates and prepayment speed assumptions, due to changes in interest rates.

2Represents changes due to the collection of expected cash flows, net of accretion, due to passage of time.

3During 2010, the Company transferred $14.1 billion in money market funds to funds managed by Federated Investors, Inc. in exchange for cash

consideration of $7 million and a revenue-sharing agreement.

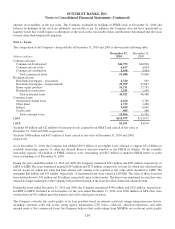

Effective January 1, 2009, the Company elected to create a second class of MSRs that was reported at fair value and is being

actively hedged as discussed in Note 17, “Derivative Financial Instruments,” to the Consolidated Financial Statements. The

transfer of MSRs from LOCOM to fair value did not have a material effect on the Consolidated Financial Statements since

the MSRs were effectively reported at fair value as of December 31, 2008 as a result of impairment losses recognized at the

end of 2008. At December 31, 2009, MSRs associated with loans originated and sold prior to 2008 continued to be accounted

for at LOCOM and managed through the Company’s overall asset/liability management process. Effective January 1, 2010,

the Company elected to designate all remaining MSRs carried at LOCOM at fair value. Upon designating the remaining

MSRs at fair value in January 2010, the Company recognized a cumulative effect increase to retained earnings, net of taxes,

of $89 million.

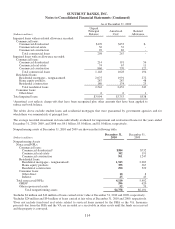

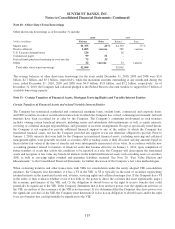

The estimated amortization expense for intangible assets is as follows:

(Dollars in millions)

Core Deposit

Intangibles Other Total

2011 $29 $14 $43

2012 21 13 34

2013 13 11 24

2014 4913

2015 -88

Thereafter -1010

Total $67 $65 $132

118