SunTrust 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

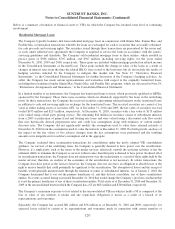

loss in the event of nonpayment of any of Three Pillars’ assets. The outstanding and committed amounts of the

subordinated note were $20 million at December 31, 2009 and no losses had been incurred through December 31, 2009.

In January 2010, Three Pillars repaid and extinguished the subordinated note in full. In accordance with the provisions of

the new VIE consolidation guidance, the Company has determined that it is the primary beneficiary of Three Pillars, as

certain subsidiaries have both the power to direct the significant activities of Three Pillars and own potentially

significant VIs, as discussed further herein. No losses on any of Three Pillars’ assets were incurred during the year ended

December 31, 2010.

The Company’s involvement with Three Pillars includes the following activities: services related to the administration of

Three Pillars’ activities and client referrals to Three Pillars; the issuing of letters of credit, which provide partial credit

protection to the CP holders; and providing liquidity arrangements that would provide funding to Three Pillars in the

event it can no longer issue CP or in certain other circumstances. The Company’s activities with Three Pillars generated

total revenue for the Company, net of direct salary and administrative costs, of $68 million, $59 million, and $48 million

for the years ended December 31, 2010, 2009 and 2008, respectively.

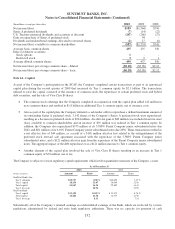

At December 31, 2010, the Company’s Consolidated Balance Sheets reflected $2.4 billion of secured loans held by

Three Pillars, which are included within commercial loans, and $99 million of CP issued by Three Pillars, excluding

intercompany liabilities, which is included within other short-term borrowings; other assets and liabilities were de

minimis to the Company’s Consolidated Balance Sheets. The assets and liabilities of Three Pillars were consolidated by

the Company at their unpaid principal amounts at January 1, 2010; upon consolidation, the Company recorded an

allowance for loan losses on $1.7 billion of secured loans that were consolidated at that time, resulting in a transition

adjustment of less than $1 million, which is presented within “Adoption of VIE consolidation guidance” on the

Company’s Consolidated Statements of Shareholders’ Equity.

Funding commitments extended by Three Pillars to its customers totaled $4.1 billion at December 31, 2010, the majority

of which renew annually. At December 31, 2009, Three Pillars had $1.8 billion of assets not included on the Company’s

Consolidated Balance Sheet and funding commitments and outstanding receivables totaled $3.7 billion and $1.7 billion,

respectively. The majority of the commitments are backed by trade receivables and commercial loans that have been

originated by companies operating across a number of industries. Trade receivables and commercial loans collateralize

48% and 14%, respectively, of the outstanding commitments, as of December 31, 2010, compared to 50% and 18%,

respectively, as of December 31, 2009. Total assets supporting outstanding commitments have a weighted average life of

2.3 years and 1.7 years at December 31, 2010 and 2009, respectively.

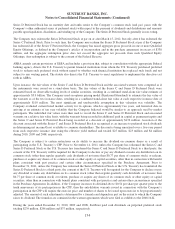

Each transaction added to Three Pillars is typically structured to a minimum implied A/A2 rating according to established

credit and underwriting policies as approved by credit risk management and monitored on a regular basis to ensure

compliance with each transaction’s terms and conditions. Typically, transactions contain dynamic credit enhancement

features that provide increased credit protection in the event asset performance deteriorates. If asset performance

deteriorates beyond predetermined covenant levels, the transaction could become ineligible for continued funding by Three

Pillars. This could result in the transaction being amended with the approval of credit risk management, or Three Pillars

could terminate the transaction and enforce any rights or remedies available, including amortization of the transaction or

liquidation of the collateral. In addition, Three Pillars has the option to fund under the liquidity facility provided by the

Bank in connection with the transaction and may be required to fund under the liquidity facility if the transaction remains in

breach. In addition, each commitment renewal requires credit risk management approval. The Company is not aware of

unfavorable trends related to Three Pillars’ assets for which the Company expects to suffer material losses. For the years

ended December 31, 2010, 2009 and 2008, there were no write-downs of Three Pillars’ assets.

At December 31, 2010, Three Pillars’ outstanding CP used to fund its assets had remaining weighted average lives of 2

days and maturities through January 28, 2011. The assets of Three Pillars generally provide the sources of cash flows for

the CP. However, the Company has issued commitments in the form of liquidity facilities and other credit enhancements

to support the operations of Three Pillars. Due to the Company’s consolidation of Three Pillars as of January 1, 2010,

these commitments would be eliminated in consolidation for U.S. GAAP purposes. The liquidity commitments are

revolving facilities that are sized based on the current commitments provided by Three Pillars to its customers. The

liquidity facilities may generally be used if new CP cannot be issued by Three Pillars to repay maturing CP. However,

the liquidity facilities are available in all circumstances, except certain bankruptcy-related events with respect to Three

126