SunTrust 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

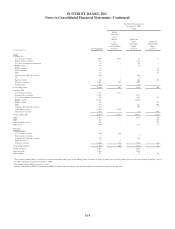

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

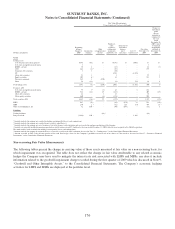

underlying portfolio characteristics. The underlying assumptions and estimated values are corroborated by values received

from independent third parties based on their review of the servicing portfolio. Because these inputs are not transparent in

market trades, MSRs are considered to be level 3 assets.

Other Assets/Liabilities, net

The Company’s other assets/liabilities that are carried at fair value on a recurring basis include IRLCs that satisfy the criteria

to be treated as derivative financial instruments, derivative financial instruments that are used by the Company to

economically hedge certain loans and MSRs, and the derivative that the Company obtained as a result of its sale of Visa

Class B shares.

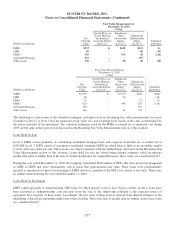

The fair value of IRLCs on residential mortgage LHFS, while based on interest rates observable in the market, is highly

dependent on the ultimate closing of the loans. These “pull-through” rates are based on the Company’s historical data and

reflect the Company’s best estimate of the likelihood that a commitment will ultimately result in a closed loan. Beginning in

the first quarter of 2008, servicing value was included in the fair value of IRLCs in accordance with changes in accounting

guidance. The fair value of servicing value is determined by projecting cash flows which are then discounted to estimate an

expected fair value. The fair value of servicing value is impacted by a variety of factors, including prepayment assumptions,

discount rates, delinquency rates, contractually specified servicing fees and underlying portfolio characteristics. Because

these inputs are not transparent in market trades, IRLCs are considered to be level 3 assets.

During the years ended December 31, 2010 and 2009, the Company transferred $398 million and $697 million, respectively,

of IRLCs out of level 3 as the associated loans were closed.

The Company is exposed to interest rate risk associated with MSRs, IRLCs, mortgage LHFS, and mortgage LHFI reported at

fair value. The Company hedges these exposures with a combination of derivatives, including MBS forward and option

contracts, interest rate swap and swaption contracts, futures contracts, and eurodollar options. The Company estimates the

fair values of such derivative instruments consistent with the methodologies discussed herein under “Derivative contracts”

and accordingly these derivatives are considered to be level 2 instruments.

During the second quarter of 2009, in connection with its sale of Visa Class B shares, the Company entered into a derivative

contract whereby the ultimate cash payments received or paid, if any, under the contract are based on the ultimate resolution

of litigation involving Visa. The value of the derivative was estimated based on the Company’s expectations regarding the

ultimate resolution of that litigation, which involved a high degree of judgment and subjectivity. Accordingly, the value of

the derivative liability was classified as a level 3 instrument. See Note 18, “Reinsurance Arrangements and Guarantees,” to

the Consolidated Financial Statements for further discussion.

Liabilities

Trading liabilities

Trading liabilities are primarily comprised of derivative contracts, but also include various contracts involving U.S.

Treasury securities, Federal agency securities and corporate debt securities that the Company uses in certain of its

trading businesses. The Company employs the same valuation methodologies for these derivative contracts and

securities as are discussed within the corresponding sections herein under “Trading Assets and Securities Available

for Sale.”

Brokered deposits

The Company has elected to measure certain CDs at fair value. These debt instruments include embedded

derivatives that are generally based on underlying equity securities or equity indices, but may be based on other

underlyings that may or may not be clearly and closely related to the host debt instrument. The Company elected to

carry these instruments at fair value in order to remove the mixed attribute accounting model for the single debt

instrument or to better align the economics of the CDs with the Company’s risk management strategies. Prior to

2009, the Company had elected to carry substantially all newly-issued CDs at fair value; however, in 2009, given the

continued dislocation in the credit markets, the Company evaluated, on an instrument by instrument basis, whether a

new issuance would be carried at fair value.

173