SunTrust 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ALLL may not be adequate to cover our eventual losses.

Like other financial institutions, we maintain an ALLL to provide for loan defaults and nonperformance. Our ALLL is based

on our historical loss experience, as well as an evaluation of the risks associated with our loan portfolio, including the size

and composition of the loan portfolio, current economic conditions and geographic concentrations within the portfolio. The

current stress on the U.S. economy and the local economies in which we do business may be greater or last longer than

expected, resulting in, among other things, greater than expected deterioration in credit quality of our loan portfolio, or in the

value of collateral securing these loans. Our ALLL may not be adequate to cover eventual loan losses, and future provisions

for loan losses could materially and adversely affect our financial condition and results of operations.

Additionally, in order to maximize the collection of loan balances, we sometimes modify loan terms when there is a

reasonable chance that an appropriate modification would allow our client to continue servicing the debt. If such

modifications ultimately are less effective at mitigating loan losses than we expect, we may incur losses in excess of the

specific amount of ALLL associated with a modified loan, and this would result in additional provision for loan loss expense.

We will realize future losses if the proceeds we receive upon liquidation of nonperforming assets are less than the

carrying value of such assets.

Nonperforming assets are recorded on our financial statements at the estimated net realizable value that we expect to receive

from ultimately dispensing of the assets. Deteriorating market conditions could result in a realization of future losses if the

proceeds we receive upon dispositions of nonperforming assets are less than the carrying value of such assets.

Weakness in the economy and in the real estate market, including specific weakness within our geographic footprint,

has adversely affected us and may continue to adversely affect us.

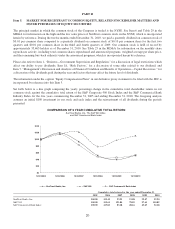

If the strength of the U.S. economy in general and the strength of the local economies in which we conduct operations remain

weak, this could result in, among other things, a deterioration of credit quality or a reduced demand for credit, including a

resultant effect on our loan portfolio and ALLL. A significant portion of our residential mortgages and commercial real estate

loan portfolios are composed of borrowers in the Southeastern and Mid-Atlantic regions of the U.S., in which certain markets

have been particularly adversely affected by declines in real estate value, declines in home sale volumes, and declines in new

home building. These factors could result in higher delinquencies and greater charge-offs in future periods, which would

materially adversely affect our financial condition and results of operations.

Weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely

affected us and may continue to adversely affect us.

Weakness in the non-agency secondary market for residential mortgage loans has limited the market for and liquidity of

many mortgage loans. The effects of ongoing mortgage market challenges, combined with the ongoing correction in

residential real estate market prices and reduced levels of home sales, could result in further price reductions in single family

home values, adversely affecting the value of collateral securing mortgage loans that we hold, and mortgage loan originations

and profits on sales of mortgage loans. Declining real estate prices have caused cyclically higher delinquencies and losses on

mortgage loans, particularly Alt-A mortgages, home equity lines of credit, and mortgage loans sourced from brokers that are

outside our branch bank network. These conditions have resulted in losses, write downs and impairment charges in our

mortgage and other lines of business. Continued declines in real estate values, low home sales volumes, financial stress on

borrowers as a result of unemployment, interest rate resets on ARMs or other factors could have further adverse effects on

borrowers that could result in higher delinquencies and greater charge-offs in future periods, which would adversely affect

our financial condition or results of operations. Additionally, counterparties to insurance arrangements used to mitigate risk

associated with increased defaults in the real estate market are stressed by weaknesses in the real estate market and a

commensurate increase in the number of claims. Additionally, decreases in real estate values might adversely affect the

creditworthiness of state and local governments, and this might result in decreased profitability or credit losses from loans

made to such governments. A decline in home values or overall economic weakness could also have an adverse impact upon

the value of real estate or other assets which we own upon foreclosing a loan and our ability to realize value on such assets.

We are subject to certain risks related to originating and selling mortgages. We may be required to repurchase

mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties,

borrower fraud, or certain borrower defaults, which could harm our liquidity, results of operations, and financial

condition.

We originate and often sell mortgage loans. When we sell mortgage loans, whether as whole loans or pursuant to a

securitization, we are required to make customary representations and warranties to the purchaser about the mortgage loans

and the manner in which they were originated. Our whole loan sale agreements require us to repurchase or substitute

mortgage loans in the event we breach any of these representations or warranties. In addition, we may be required to

11