SunTrust 2010 Annual Report Download - page 77

Download and view the complete annual report

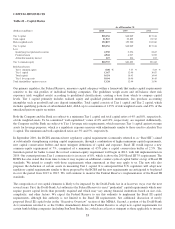

Please find page 77 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The primary uses of Parent Company liquidity include debt service, dividends on capital instruments, the periodic purchase

of investment securities, and loans to our subsidiaries. We fund corporate dividends primarily with dividends from our

banking subsidiary. We are subject to both state and federal banking regulations that limit our ability to pay common stock

dividends in certain circumstances. In September 2009 amidst the economic recession and credit market turmoil, we reduced

our quarterly common stock dividend to its current level of $0.01 per share. An increase in our quarterly dividend will be

dependent upon, among other factors, a sustained return to profitability and the consent of our applicable bank regulators.

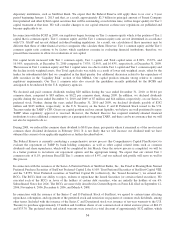

Recent Developments. Additional regulatory standards for bank liquidity were proposed during 2010. In December of 2010,

the BCBS reached final agreement on these proposals to strengthen and standardize global liquidity standards. The proposed

standards would require banks to comply with two new liquidity ratios—the LCR and the NSFR. The LCR is the ratio of a

bank’s stock of high-quality liquid assets to estimated net cash outflows during an acute 30-day stress scenario. The NSFR

measures the amount of a bank’s long-term stable funding relative to the liquidity profile of its funded assets and the

potential for contingent liquidity needs arising from off-balance sheet commitments. The intent of the LCR and NSFR is to

promote the retention of significant liquidity reserves and the increased use of stable funding sources such as core deposits

and long-term debt.

Our regulators have not yet adopted these new standards, although we expect the Federal Reserve will issue a Notice of

Proposed Rulemaking later in 2011 that will define how U.S. banks will be required to implement them. The BCBS’s

recommended adoption dates for these new standards are January 1, 2015 for the LCR and January 1, 2018 for the NSFR. In

the meantime, we continue to refine our methodologies for calculating these new liquidity ratios and develop plans for

compliance with the new standards. We believe the goals of these standards are consistent with our existing liquidity

management framework, policies and practices.

It is possible that these liquidity requirements will continue to evolve in the coming months, making it difficult to quantify

precisely the costs and other business impacts of these proposed measures at this time. In general, however, these standards

may lead to changes in the cost and maturity profile of our funding and/or the size and composition of our investment

portfolio. We believe the Company will be well positioned to comply with the new standards given our strong core banking

franchise and conservative liquidity management practices.

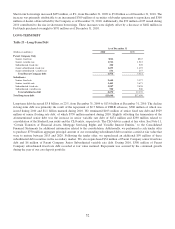

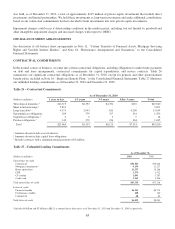

Other Liquidity Considerations. As detailed in Table 27, we had an aggregate potential obligation of $63.3 billion to our

clients in unused lines of credit at December 31, 2010. Commitments to extend credit are arrangements to lend to clients who

have complied with predetermined contractual obligations. As of December 31, 2009, the Bank had unused lines of credit

issued in support of Three Pillars as shown in the CP conduit line in Table 27. As of January 1, 2010 we consolidated Three

Pillars. Therefore, as of December 31, 2010, the amount of the CP conduit line depicted in Table 27 represents the unused

lines of credit that Three Pillars has extended to its clients, as opposed to the lines of credit that the Bank has extended to

Three Pillars, which are still legally outstanding. For more information about Three Pillars, see Note 11, “Certain Transfers

of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities,” to the Consolidated Financial Statements.

We also had $6.4 billion in letters of credit as of December 31, 2010, most of which are standby letters of credit, which

require that we provide funding if certain future events occur. Approximately $4.0 billion of these letters as of December 31,

2010 supported VRDOs. Our lines and letters of credit have declined since December 31, 2009 due to our decision to reduce

exposure to certain higher risk areas, as well as our clients’ decision not to renew their lines and letters of credit as a result of

their decreased need for these facilities as they pay down their debt and reduce their need for working capital.

Certain provisions of long-term debt agreements and the lines of credit prevent us from creating liens on, disposing of, or

issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations,

certain leases, sales or transfers of assets, and minimum shareholders’ equity ratios. As of December 31, 2010, we were and

expect to remain in compliance with all covenants and provisions of these debt agreements.

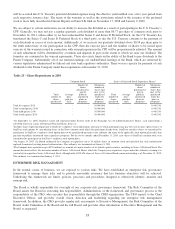

As of December 31, 2010, our cumulative UTBs amounted to $102 million. Interest related to UTBs was $21 million as of

December 31, 2010. These UTBs represent the difference between tax positions taken or expected to be taken in our tax

returns and the benefits recognized and measured in accordance with the relevant accounting guidance for income taxes. The

UTBs are based on various tax positions in several jurisdictions and, if taxes related to these positions are ultimately paid, the

payments would be made from our normal, operating cash flows, likely over multiple years.

61