SunTrust 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

As previously noted, while the reclassification of our loan types had no effect on total loans or total ALLL, SEC regulations

require us, in some instances, to present five years of comparable data where trend information may be deemed relevant, in

which case we have provided the pre-adoption ALLL by loan type classifications due to the inability to restate prior periods

under the new classifications.

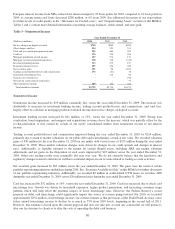

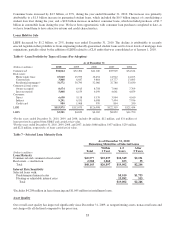

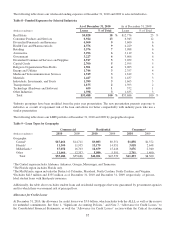

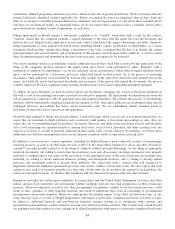

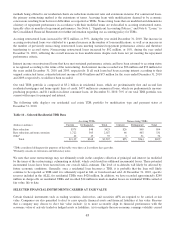

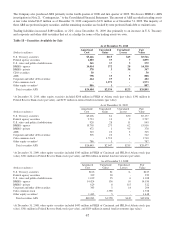

The allocation of our ALLL by loan type is shown in the tables below:

Table 12 - Allowance for Loan Losses by Loan Type (Post-Adoption)

December 31, 2010 December 31, 2009

ALLL

Loan types

asa%of

total loans ALLL

Loan types

as a % of

total loans

(Dollars in millions)

Commercial loans $1,303 46 % $1,353 49 %

Residential loans 1,498 40 1,592 41

Consumer loans 173 14 175 10

Total $2,974 100 % $3,120 100 %

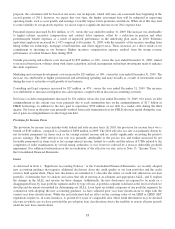

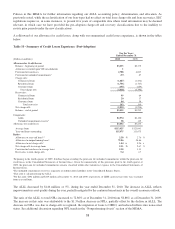

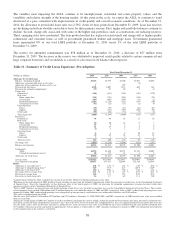

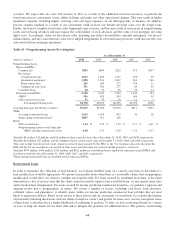

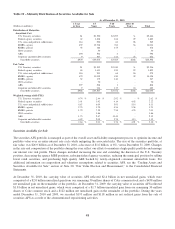

Table 13 - Allowance for Loan Losses by Loan Type (Pre-Adoption)

(Dollars in millions) As of December 31

Allocation by Loan Type 2010 2009 2008 2007 2006

Commercial loans $477 $650 $631 $423 $416

Real estate loans 2,238 2,268 1,523 664 443

Consumer loans 259 202 197 110 96

Unallocated 1-- - 85 90

Total $2,974 $3,120 $2,351 $1,282 $1,045

Year-end Loan Types as a Percent of As of December 31

Total Loans 2010 2009 2008 2007 2006

Commercial loans 29 % 29 % 32 % 29 % 29 %

Real estate loans 56 60 58 61 61

Consumer loans 15 11 10 10 10

Total 100 % 100 % 100 % 100 % 100 %

1Beginning in 2008, the unallocated reserve is reflected in our homogeneous pool estimates.

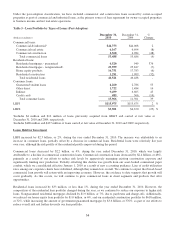

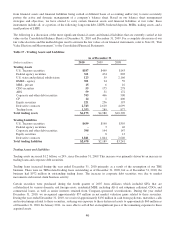

Charge-offs

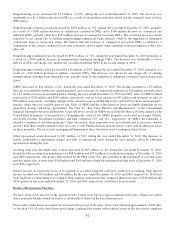

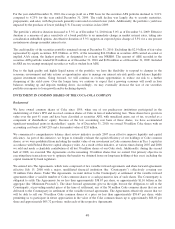

Net charge-offs for the years ended December 31, 2010 and 2009 were $2.9 billion and $3.2 billion, respectively. As a

percentage of average annualized loans, net charge-offs were 2.51% and 2.67% during the years ended December 31, 2010

and 2009, respectively. Factors which could affect general asset quality and charge-off levels include macro or regional

economic volatility, specific borrower performance, and trends within specific sectors, such as construction and commercial

real estate.

Total charge-offs for the year ended December 31, 2010 declined for the majority of our loan portfolios compared to the

same period in 2009. However, commercial real estate charge-offs increased during the latter half of 2010 as specific loans

were resolved. Given continuing stress in this segment, the timing and amount of future commercial real estate charge-offs

will remain variable. For the first quarter of 2011, a stable to a modest decline in net charge-offs from fourth quarter levels is

expected.

40