SunTrust 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

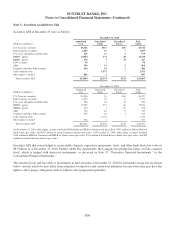

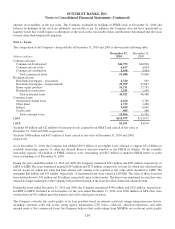

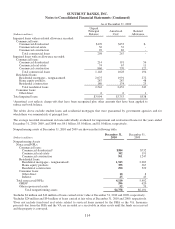

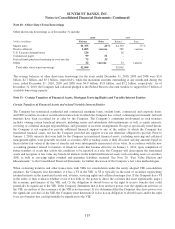

The Company tracks loan payment activity for the LHFI portfolio. The payment status for the LHFI portfolio at

December 31, 2010 and 2009 is shown in the tables below:

As of December 31, 2010

(Dollars in millions)

Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing3Total

Commercial loans:

Commercial & industrial1$44,046 $111 $12 $584 $44,753

Commercial real estate 5,794 27 4 342 6,167

Commercial construction 1,595 11 1 961 2,568

Total commercial loans 51,435 149 17 1,887 53,488

Residential loans:

Residential mortgages - guaranteed 3,469 167 884 - 4,520

Residential mortgages - nonguaranteed221,916 456 44 1,543 23,959

Home equity products 16,162 234 - 355 16,751

Residential construction 953 42 6 290 1,291

Total residential loans 42,500 899 934 2,188 46,521

Consumer loans:

Guaranteed student loans 3,281 383 596 - 4,260

Other direct 1,692 15 5 10 1,722

Indirect 9,400 74 - 25 9,499

Credit cards 460 12 13 - 485

Total consumer loans 14,833 484 614 35 15,966

Total LHFI $108,768 $1,532 $1,565 $4,110 $115,975

1Includes $4 million in loans carried at fair value at December 31, 2010.

2Includes $488 million in loans carried at fair value at December 31, 2010.

3Total nonaccruing loans past due 90 days or more totaled $3.3 billion at December 31, 2010. Nonaccruing loans past due fewer than 90

days include modified nonaccrual loans reported as TDRs.

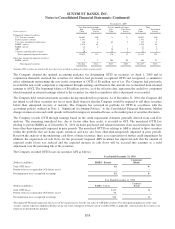

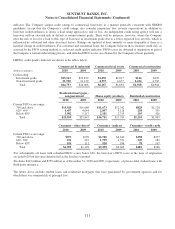

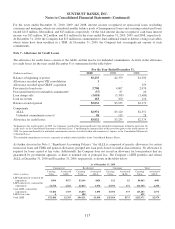

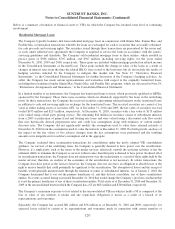

As of December 31, 2009

(Dollars in millions)

Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing3Total

Commercial loans:

Commercial & industrial1$43,092 $148 $36 $732 $44,008

Commercial real estate 6,423 71 9 191 6,694

Commercial construction 3,682 38 17 1,247 4,984

Total commercial loans 53,197 257 62 2,170 55,686

Residential loans:

Residential mortgages - guaranteed 949 - - - 949

Residential mortgages - nonguaranteed222,933 577 54 2,283 25,847

Home equity products 17,134 282 - 367 17,783

Residential construction 1,298 66 16 529 1,909

Total residential loans 42,314 925 70 3,179 46,488

Consumer loans:

Guaranteed student loans 2,185 236 365 - 2,786

Other direct 1,453 18 5 8 1,484

Indirect 6,522 98 - 45 6,665

Credit cards 528 19 19 - 566

Total consumer loans 10,688 371 389 53 11,501

Total LHFI $106,199 $1,553 $521 $5,402 $113,675

1Includes $12 million in loans carried at fair value at December 31, 2009.

2Includes $437 million in loans carried at fair value at December 31, 2009.

3Total nonaccruing loans past due 90 days or more totaled $4.3 billion at December 31, 2009. Nonaccruing loans past due fewer than 90

days include modified nonaccrual loans reported as TDRs.

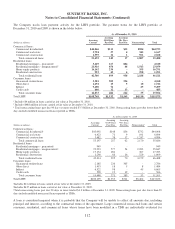

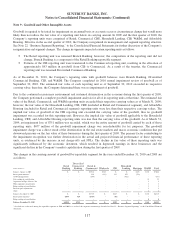

A loan is considered impaired when it is probable that the Company will be unable to collect all amounts due, including

principal and interest, according to the contractual terms of the agreement. Large commercial nonaccrual loans and certain

consumer, residential, and commercial loans whose terms have been modified in a TDR are individually evaluated for

112