SunTrust 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

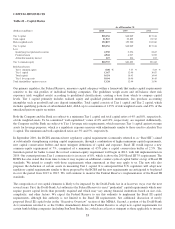

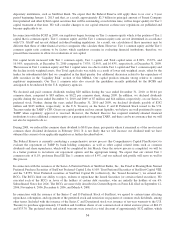

accounts which increased $10.3 billion, or 12%. The increase was partially offset by declines in consumer time and other

time deposit account balances which decreased by $6.3 billion, or 21%. These positive trends resulted from our continued

marketing efforts, pricing discipline in the context of a low and declining rate environment, improving operational execution,

as well as an industry-wide preference for greater liquidity.

Consumer and commercial deposit growth remains one of our key initiatives. During 2010, we focused on growing our client

base, number of households, and deposit share while managing the rates we pay on our deposits. Overall growth was

accomplished through a judicious use of competitive rates in select products and select geographies. We experienced mixed

results across our 16 regions due to competitive forces, unusual deposit flows resulting from the FDIC’s TAGP, and

concentrations of time deposit clients. Other initiatives to attract deposits included innovative product and features offerings,

enhanced programs and initiatives, customer-targeted offers, and advanced analytics that leverage product offerings with

customer segmentation. We continued to leverage the “Live Solid. Bank Solid.” brand to improve our visibility in the

marketplace. It is designed to speak to what is important to clients in the current environment and to inspire customer loyalty

and capitalize on some of the opportunities presented by the new banking landscape. We continue to manage judiciously

through the implications of impending or executed regulatory change and evaluate the impacts to our deposit products and

clients. Average brokered and foreign deposits decreased by $3.2 billion, or 52%, during 2010 compared to 2009. This

decrease was due to our ability to grow deposits and, in turn, reduce our reliance upon wholesale funding sources. As of

December 31, 2010 securities pledged as collateral for deposits totaled $3.9 billion.

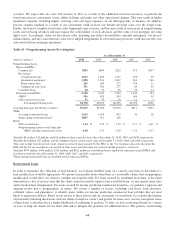

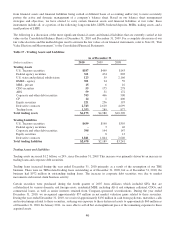

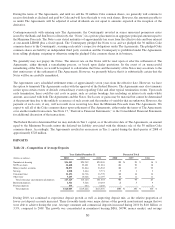

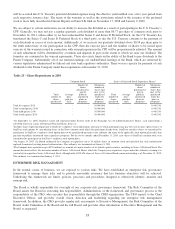

Table 21 – Maturity of Consumer Time and Other Time Deposits in Amounts of $100,000 or More

At December 31, 2010

(Dollars in millions)

Consumer

Time

Brokered

Time

Foreign

Time Total

Months to maturity:

3 or less $1,558 $140 $654 $2,352

Over 3 through 6 953 29 - 982

Over 6 through 12 2,016 52 - 2,068

Over 12 3,115 2,144 - 5,259

Total $7,642 $2,365 $654 $10,661

SHORT-TERM BORROWINGS

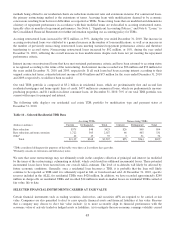

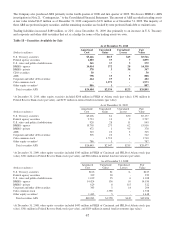

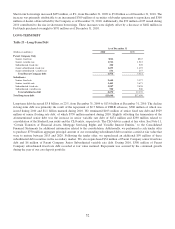

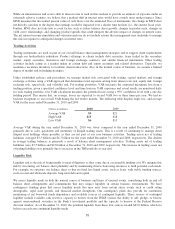

Table 22 – Short-Term Borrowings

As of December 31 Daily Average

Maximum

Outstanding

at any

Month-End(Dollars in millions) Balance Rate Balance Rate

2010

Federal funds purchased ¹ $951 0.18 % $1,226 0.19 % $3,163

Securities sold under agreement to repurchase ¹ 2,180 0.17 2,416 0.15 2,830

CP issued 99 0.62 458 0.48 1,009

Other short-term borrowings 2,591 0.71 2,556 0.42 4,608

2009

Federal funds purchased ¹ $1,433 0.15 % $1,670 0.19 % $3,920

Securities sold under agreement to repurchase ¹ 1,871 0.11 2,483 0.18 3,333

CP issued - N/A 15 0.40 150

Other short-term borrowings 2,062 1.08 2,689 0.54 5,676

2008

Federal funds purchased ¹ $1,120 0.32 % $2,622 1.96 % $5,693

Securities sold under agreement to repurchase ¹ 3,193 0.19 4,961 1.59 6,318

CP issued - N/A 52 2.40 148

Other short-term borrowings 5,166 0.48 3,005 1.79 5,166

1Federal funds purchased and securities sold under agreements to repurchase mature overnight or at a fixed maturity generally not exceeding three

months. Rates on overnight funds reflect current market rates. Rates on fixed maturity borrowings are set at the time of borrowings.

51