SunTrust 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

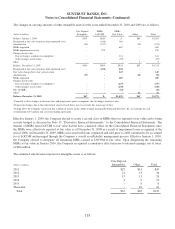

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

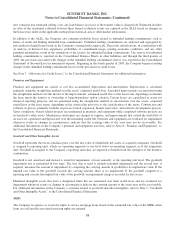

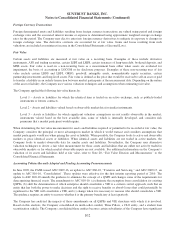

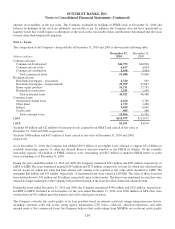

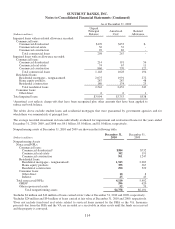

December 31, 2009

Less than twelve months Twelve months or longer Total

(Dollars in millions)

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Temporarily impaired securities

U.S. Treasury securities $5,083 $30 $- $- $5,083 $30

Federal agency securities 1,341 9 - - 1,341 9

U.S. states and political subdivisions 126 6 65 5 191 11

RMBS - agency 5,418 62 - - 5,418 62

RMBS - private 14 4 7 - 21 4

ABS 11 - 16 5 27 5

Corporate and other debt securities 20 - 31 3 51 3

Total temporarily impaired securities 12,013 111 119 13 12,132 124

Other-than-temporarily impaired securities 1

RMBS - private 1 1 304 90 305 91

Total impaired securities $12,014 $112 $423 $103 $12,437 $215

1Includes OTTI securities for which credit losses have been recorded in earnings in current or prior periods.

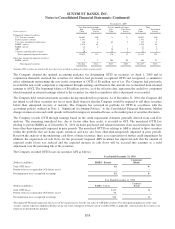

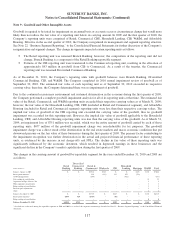

The Company adopted the updated accounting guidance for determining OTTI on securities on April 1, 2009 and in

conjunction therewith analyzed the securities for which it had previously recognized OTTI and recognized a cumulative

effect adjustment representing the non-credit component of OTTI of $8 million, net of tax. The Company had previously

recorded the non-credit component as impairment through earnings and therefore this amount was reclassified from retained

earnings to AOCI. The beginning balance of $8 million, pre-tax, as of the effective date, represents the credit loss component

which remained in retained earnings related to the securities for which a cumulative effect adjustment was recorded.

The Company held certain investment securities having unrealized loss positions. As of December 31, 2010, the Company did

not intend to sell these securities nor was it more likely than not that the Company would be required to sell these securities

before their anticipated recovery or maturity. The Company has reviewed its portfolio for OTTI in accordance with the

accounting policies outlined in Note 1, “Significant Accounting Policies,” to the Consolidated Financial Statements. Market

changes in interest rates and credit spreads will result in temporary unrealized losses as the market price of securities fluctuates.

The Company records OTTI through earnings based on the credit impairment estimates generally derived from cash flow

analyses. The remaining unrealized loss, due to factors other than credit, is recorded in OCI. The unrealized OTTI loss

relating to private RMBS as of December 31, 2010 includes purchased and retained interests from securitizations that have

been other-than-temporarily impaired in prior periods. The unrealized OTTI loss relating to ABS is related to three securities

within the portfolio that are home equity issuances and have also been other-than-temporarily impaired in prior periods.

Based on the analysis of the underlying cash flows of these securities, there is no expectation of further credit impairment. In

addition, the expectation of cash flows for the previously impaired ABS securities has improved such that the amount of

expected credit losses was reduced and the expected increase in cash flows will be accreted into earnings as a yield

adjustment over the remaining life of the securities.

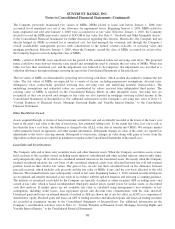

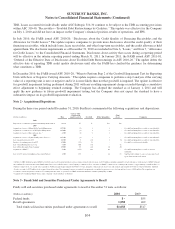

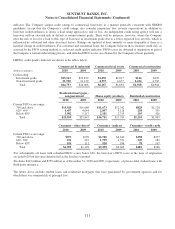

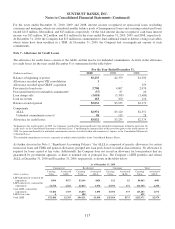

The Company recorded OTTI losses on securities AFS as follows:

Year Ended December 31, 2010

(Dollars in millions) RMBS - Private

Corporate

Bonds

Total OTTI losses $2 $-

Portion of losses recognized in OCI (before taxes)1--

Net impairment losses recognized in earnings $2 $-

Year Ended December 31, 2009

(Dollars in millions) RMBS - Private

Corporate

Bonds

Total OTTI losses $112 $1

Portion of losses recognized in OCI (before taxes)193 -

Net impairment losses recognized in earnings $19 $1

1The initial OTTI amount represents the excess of the amortized cost over the fair value of AFS debt securities. For subsequent impairments of the same

security, amount represents additional declines in the fair value subsequent to the previously recorded OTTI, if applicable, until such time the security is no

longer in an unrealized loss position.

108