SunTrust 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Provision for credit losses was $442 million, a $7 million, or 2%, increase over the same period in 2009. The increase was

predominantly driven by an increase in construction and investor owned commercial real estate net charge-offs.

Total noninterest income was $88 million, down $6 million, or 6%. The decrease was primarily due to a $2 million decrease

in other income associated with affordable housing and a $2 million decrease in letters of credit fees due to lower borrower

demand.

Total noninterest expense was $471 million, a decrease of $250 million, or 35%, over the same period in 2009. The decline

was primarily due to the $299 million non-cash goodwill impairment charge recognized in the first quarter of 2009. Credit-

related expenses including collections and other real estate expense increased $75 million but were partially offset by a $28

million decline in other expenses largely related to affordable housing impairment recorded in the third quarter of 2009.

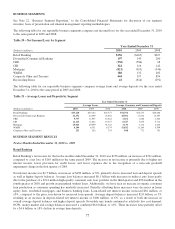

Corporate and Investment Banking

CIB’s net income for the twelve months ended December 31, 2010 was $322 million, an increase of $206 million, compared

with the same period in 2009. The increase in net income was primarily due to a decrease in provision for credit losses and

an increase in total revenue.

Net interest income-FTE was $380 million, an increase of $76 million, or 25%, from the prior year primarily driven by

higher loan and deposit spreads. Average loan balances declined $1.6 billion, or 13%, partly due to the continued reduction

in line of credit utilization by large corporate clients. Although revolver utilization was down from the prior year, utilization

rates have recently stabilized. The decrease in revolver utilization was partially offset by approximately $1.8 billion of

incremental loans as the result of the January 1, 2010 consolidation of Three Pillars, our CP conduit. Loan-related net interest

income increased $54 million, or 28%, including $33 million of the increase related to the Three Pillars consolidation while

higher loan spreads drove the remainder of the increase. Total average customer deposits increased $0.8 billion, or 13%, as

NOW and money market account balances increased a combined $1.0 billion, or 26%, while CD balances decreased $0.3

billion or 70%. Customer deposit-related net interest income increased $17 million, or 23%, as a result of improved deposit

mix and higher NOW and money market spreads.

Provision for credit losses was $50 million, as net charge-offs declined $198 million, or 80%. Lower net charge-offs related

to large corporate borrowers operating in economically sensitive industries drove the decline.

Total noninterest income was $670 million, an increase of $59 million, or 10%, over the prior year. The increase was driven

by higher loan commitment fees, loan syndications and bond originations fees, merger and acquisition fees, and lower

reserves on private equity investments. These increases were partially offset by the consolidation of Three Pillars and the

resulting shift of $33 million from noninterest income to net interest income. In addition, derivative revenue, treasury

management fees, fixed income sales and trading revenue, and equity offering fees also declined.

Total noninterest expense was $490 million, an increase of $9 million, or 2%. The increase is due to higher salaries and

incentive compensation expense related to increased performance which was partially offset by lower allocated operational,

support, and overhead costs.

Mortgage

Mortgage reported a net loss of $821 million for the year ended December 31, 2010 compared with a net loss of $995 million

in 2009, a $174 million improvement in earnings. The improvement was primarily due to a $279 million non-cash goodwill

impairment charge recognized in 2009. In addition, the change was driven by lower mortgage production income and net

interest income offset by higher servicing income and lower staff expense.

Net interest income was $427 million for the year ended December 31, 2010, down $72 million, or 14%, primarily due to

lower net interest income on LHFS. LHFS declined $2.1 billion, or 46%, while the related net interest income declined $93

million, or 49%. Consumer mortgages declined $0.8 billion, or 3%, while the resulting net interest income was up $6 million

due to improved spreads. Average nonaccrual loans decreased $0.3 billion, or 12%, while accruing restructured loans

increased $1.0 billion. The resulting nonaccrual and restructured net interest income increased $20 million, or 28%.

Provision for credit losses increased $58 million, or 5%. The increase was primarily due to specific actions taken in the first

quarter of 2010 which resulted in additional charge-offs recognized on severely delinquent residential mortgage NPLs,

primarily in Florida, as well as $51 million in additional charge-offs related to the $211 million loans that were reclassified to

LHFS and subsequently sold.

79