SunTrust 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

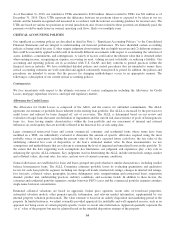

As of December 31, 2010, our cumulative UTBs amounted to $102 million. Interest related to UTBs was $21 million as of

December 31, 2010. These UTBs represent the difference between tax positions taken or expected to be taken in our tax

returns and the benefits recognized and measured in accordance with the relevant accounting guidance for income taxes. The

UTBs are based on various tax positions in several jurisdictions and, if taxes related to these positions are ultimately paid, the

payments would be made from our normal, operating cash flows, likely over multiple years.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in detail in Note 1, “Significant Accounting Policies,” to the Consolidated

Financial Statements and are integral to understanding our financial performance. We have identified certain accounting

policies as being critical because (1) they require judgment about matters that are highly uncertain and (2) different estimates

that could be reasonably applied would result in materially different assessments with respect to ascertaining the valuation of

assets, liabilities, commitments, and contingencies. A variety of factors could affect the ultimate value that is obtained either

when earning income, recognizing an expense, recovering an asset, valuing an asset or liability, or reducing a liability. Our

accounting and reporting policies are in accordance with U.S. GAAP, and they conform to general practices within the

financial services industry. We have established detailed policies and control procedures that are intended to ensure these

critical accounting estimates are well controlled and applied consistently from period to period. In addition, the policies and

procedures are intended to ensure that the process for changing methodologies occurs in an appropriate manner. The

following is a description of our current critical accounting policies.

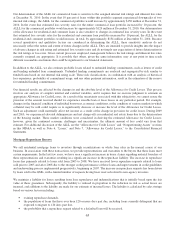

Contingencies

We face uncertainty with respect to the ultimate outcomes of various contingencies including the Allowance for Credit

Losses, mortgage repurchase reserves, and legal and regulatory matters.

Allowance for Credit Losses

The Allowance for Credit Losses is composed of the ALLL and the reserve for unfunded commitments. The ALLL

represents our estimate of probable losses inherent in the existing loan portfolio. The ALLL is increased by the provision for

credit losses and reduced by loans charged off, net of recoveries. The ALLL is determined based on our review and

evaluation of larger loans that meet our definition of impairment and the current risk characteristics of pools of homogeneous

loans (i.e., loans having similar characteristics) within the loan portfolio and our assessment of internal and external

influences on credit quality that are not fully reflected in the historical loss or risk-rating data.

Large commercial nonaccrual loans and certain commercial, consumer, and residential loans whose terms have been

modified in a TDR, are individually evaluated to determine the amount of specific allowance required using the most

probable source of repayment, including the present value of the loan’s expected future cash flows, the fair value of the

underlying collateral less costs of disposition, or the loan’s estimated market value. In these measurements, we use

assumptions and methodologies that are relevant to estimating the level of impaired and unrealized losses in the portfolio. To

the extent that the data supporting such assumptions has limitations, our judgment and experience play a key role in

enhancing the specific ALLL estimates. Key judgments used in determining the ALLL include internal risk ratings, market

and collateral values, discount rates, loss rates, and our view of current economic conditions.

General allowances are established for loans and leases grouped into pools that have similar characteristics, including smaller

balance homogeneous loans. The ALLL Committee estimates probable losses by evaluating quantitative and qualitative

factors for each loan portfolio segment, including net charge-off trends, internal risk ratings, changes in internal risk ratings,

loss forecasts, collateral values, geographic location, delinquency rates, nonperforming and restructured loans, origination

channel, product mix, underwriting practices, industry conditions, and economic trends. In addition to these factors, the

consumer and residential portfolio segments consider borrower FICO scores and the commercial portfolio segment considers

single name borrower concentration.

Estimated collateral valuations are based on appraisals, broker price opinions, recent sales of foreclosed properties,

automated valuation models, other property-specific information, and relevant market information, supplemented by our

internal property valuation professionals. The value estimate is based on an orderly disposition and marketing period of the

property. In limited instances, we adjust externally provided appraisals for justifiable and well supported reasons, such as an

appraiser not being aware of certain property-specific factors or recent sales information. Appraisals generally represent the

“as is” value of the property but may be adjusted based on the intended disposition strategy of the property.

64