SunTrust 2010 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

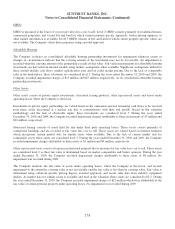

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

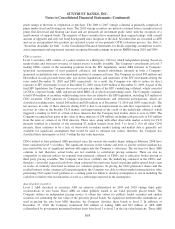

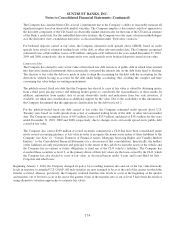

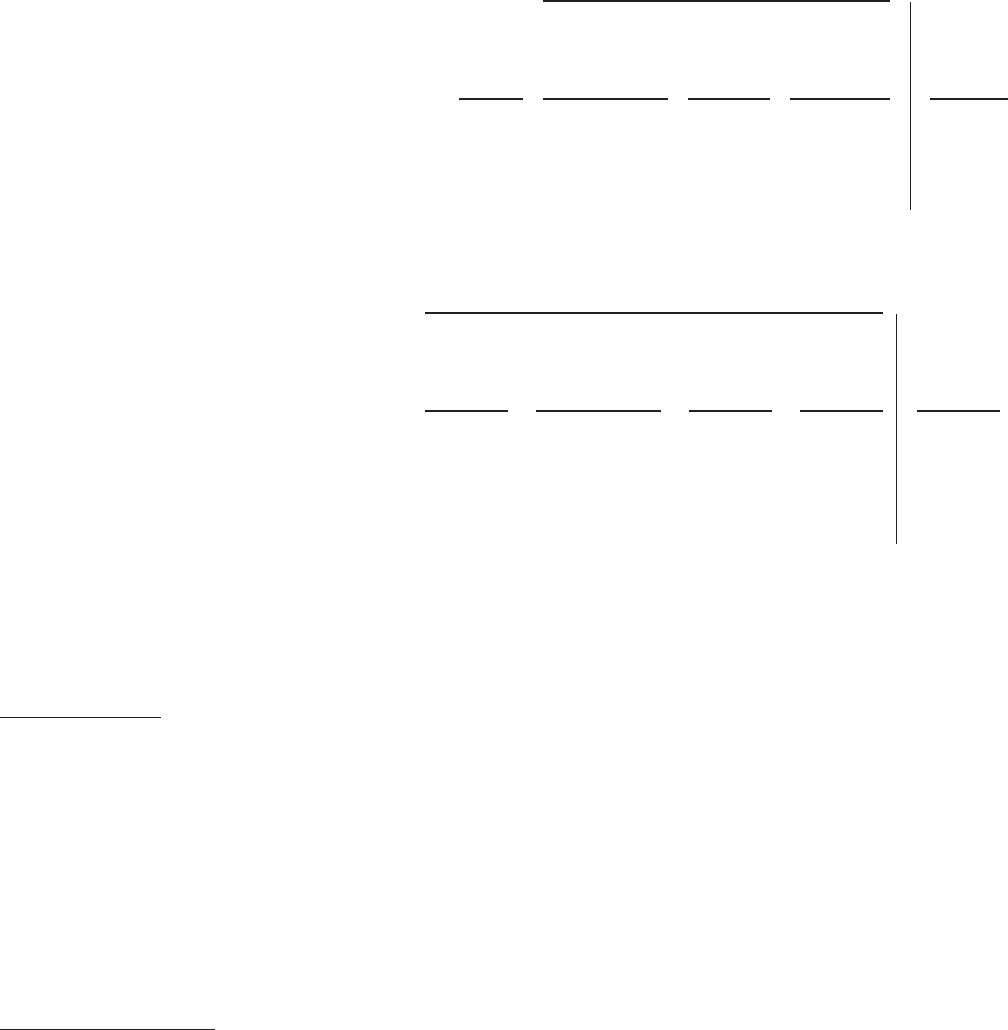

Fair Value Measurement at

December 31, 2010

Using

(Dollars in millions)

Net

Carrying

Value

Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Valuation

Allowance

LHFS $333 $- $142 $191 $-

LHFI 85 - - 85 (15)

OREO 596 - 553 43 (116)

Affordable Housing 357 - - 357 -

Other Assets 130 - 90 40 (20)

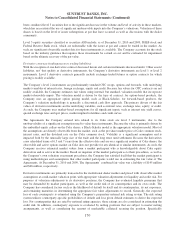

Fair Value Measurement at

December 31, 2009,

Using

(Dollars in millions)

Net

Carrying

Value

Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Valuation

Allowance

LHFS $1,339 $- $1,173 $166 ($48)

LHFI 96 - 96 - (16)

MSRs 23 - - 23 (7)

OREO 620 - 496 124 (110)

Affordable Housing 395 - - 395 -

Other Assets 144 - 61 83 -

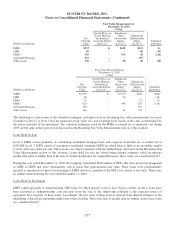

The following is a discussion of the valuation techniques and inputs used in developing fair value measurements for assets

classified as level 2 or level 3 that are measured at fair value on a non-recurring basis, based on the class as determined by

the nature and risks of the instrument. The valuation techniques used for the MSRs accounted for at amortized cost during

2009 are the same as those previously discussed in the Recurring Fair Value Measurement section of this footnote.

Loans Held for Sale

Level 2 LHFS consist primarily of conforming residential mortgage loans and corporate loans that are accounted for at

LOCOM. Level 3 LHFS consist of non-agency residential mortgage LHFS for which there is little or no secondary market

activity and leases held for sale. These loans are valued consistent with the methodology discussed in the Recurring Fair

Value Measurement section of this footnote. Leases held for sale are valued using internal estimates which incorporate

market data when available. Due to the lack of current market data for comparable leases, these assets are considered level 3.

During the year ended December 31, 2010, the Company transferred $160 million of NPLs that were previously designated

as LHFI to LHFS that were subsequently sold at prices that approximated fair value. These loans were predominantly

reported at amortized cost prior to transferring to LHFS; however, a portion of the NPLs was carried at fair value. There were

no similar transfers during the year ended December 31, 2009.

Loans Held for Investment

LHFI consist primarily of nonperforming CRE loans for which specific reserves have been recorded. As these loans have

been classified as nonperforming, cash proceeds from the sale of the underlying collateral is the expected source of

repayment for a majority of these loans. Accordingly, the fair value of these loans is derived from internal estimates of the

underlying collateral incorporating market data when available. Due to the lack of market data for similar assets, these loans

are considered level 3.

177