SunTrust 2010 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

been considered level 3 securities due to the significant decrease in the volume and level of activity in these markets,

which has necessitated the use of significant unobservable inputs into the Company’s valuations. Valuation of these

shares is based on the level of issuer redemptions at par that have occurred as well as discussions with the dealer

community.

Level 3 equity securities classified as securities AFS include, as of December 31, 2010 and 2009, FHLB stock and

Federal Reserve Bank stock, which are redeemable with the issuer at par and cannot be traded in the market. As

such, no significant observable market data for these instruments is available. The Company accounts for the stock

based on the industry guidance that requires these investments be carried at cost and be evaluated for impairment

based on the ultimate recovery of the par value.

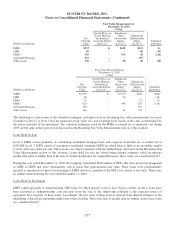

Derivative contracts (trading assets or trading liabilities)

With the exception of one derivative contract discussed herein and certain instruments discussed under ‘Other assets/

liabilities, net’ that qualify as derivative instruments, the Company’s derivative instruments are level 1 or level 2

instruments. Level 1 derivative contracts generally include exchange-traded futures or option contracts for which

pricing is readily available.

The Company’s level 2 instruments are predominantly standard OTC swaps, options and forwards, with underlying

market variables of interest rates, foreign exchange, equity and credit. Because fair values for OTC contracts are not

readily available, the Company estimates fair values using internal, but standard, valuation models that incorporate

market-observable inputs. The valuation model is driven by the type of contract: for option-based products, the

Company uses an appropriate option pricing model, such as Black-Scholes; for forward-based products, the

Company’s valuation methodology is generally a discounted cash flow approach. The primary drivers of the fair

values of derivative instruments are the underlying variables, such as interest rates, exchange rates, equity, or credit.

As such, the Company uses market-based assumptions for all significant inputs, such as interest rate yield curves,

quoted exchange rates and spot prices, market implied volatilities and credit curves.

The Agreements the Company entered into related to its Coke stock are level 3 instruments, due to the

unobservability of a significant assumption used to value these instruments. Because the value is primarily driven by

the embedded equity collars on the Coke shares, a Black-Scholes model is the appropriate valuation model. Most of

the assumptions are directly observable from the market, such as the per share market price of Coke common stock,

interest rates, and the dividend rate on the Coke common stock. Volatility is a significant assumption and is

impacted both by the unusually large size of the trade and the long tenor until settlement. Because the derivatives

carry scheduled terms of 6.5 and 7 years from the effective date and are on a significant number of Coke shares, the

observable and active options market on Coke does not provide for any identical or similar instruments. As such, the

Company receives estimated market values from a market participant who is knowledgeable about Coke equity

derivatives and is active in the market. Based on inquiries of the market participant as to their procedures, as well as

the Company’s own valuation assessment procedures, the Company has satisfied itself that the market participant is

using methodologies and assumptions that other market participants would use in estimating the fair value of The

Agreements. At December 31, 2010 and 2009, The Agreements’ combined fair value was a liability of $145 million

and $46 million, respectively.

Derivative instruments are primarily transacted in the institutional dealer market and priced with observable market

assumptions at a mid-market valuation point, with appropriate valuation adjustments for liquidity and credit risk. For

purposes of valuation adjustments to its derivative positions, the Company has evaluated liquidity premiums that

may be demanded by market participants, as well as the credit risk of its counterparties and its own credit. The

Company has considered factors such as the likelihood of default by itself and its counterparties, its net exposures,

and remaining maturities in determining the appropriate fair value adjustments to record. Generally, the expected

loss of each counterparty is estimated using the Company’s proprietary internal risk rating system. The risk rating

system utilizes counterparty-specific probabilities of default and loss given default estimates to derive the expected

loss. For counterparties that are rated by national rating agencies, those ratings are also considered in estimating the

credit risk. In addition, counterparty exposure is evaluated by netting positions that are subject to master netting

arrangements, as well as considering the amount of marketable collateral securing the position. Specifically

170