SunTrust 2010 Annual Report Download - page 70

Download and view the complete annual report

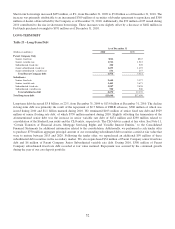

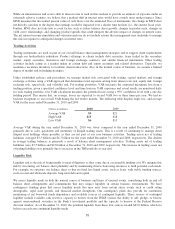

Please find page 70 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.depositary institutions, such as SunTrust Bank. We expect that the Federal Reserve will apply these to us over a 3-year

period beginning January 1, 2013 and that, as a result, approximately $2.3 billion in principal amount of Parent Company

trust preferred and other hybrid capital securities that will be outstanding at such future time, will no longer qualify for Tier 1

capital treatment at that time. We will consider changes to our capital structure as these new regulations are published and

become applicable to us.

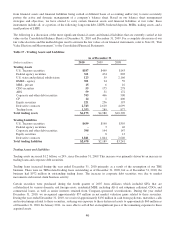

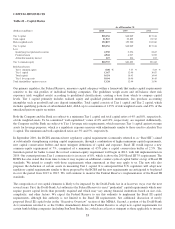

In connection with the SCAP in 2009, our regulators began focusing on Tier 1 common equity which is the portion of Tier 1

capital that is common equity. Tier 1 common equity and the Tier 1 common equity ratio are not determined in accordance

with U.S. GAAP and are not defined in federal banking regulations. As a result, our calculation of these measures may be

different than those of other financial service companies who calculate them. However, Tier 1 common equity and the Tier 1

common equity ratio continue to be factors which regulators examine in evaluating financial institutions; therefore, we

present these measures to allow for evaluations of our capital.

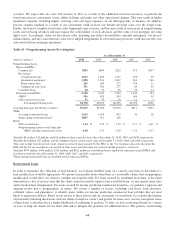

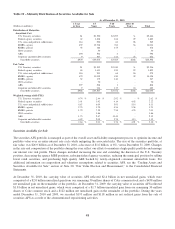

Our capital levels increased with Tier 1 common equity, Tier 1 capital, and Total capital ratios at 8.08%, 13.67%, and

16.54%, respectively, at December 31, 2010 compared to 7.67%, 12.96%, and 16.43%, respectively, at December 31, 2009.

The increase in Tier 1 common equity and Tier 1 capital ratios was due to stable Tier 1 capital and Tier 1 common equity and

the decline in risk weighted assets. Our Total capital ratio was stable as a result of lower risk weighted assets, offset by the

tender for subordinated debt that we completed in the third quarter. See additional discussion related to the repurchase of

debt securities in the “Liquidity Risk” section of this MD&A. Our capital position remains strong relative to current

regulatory requirements. Our Tier 1 common ratio also exceeds the guidelines recently published by the BCBS and

anticipated to be endorsed by the U.S. regulatory agencies.

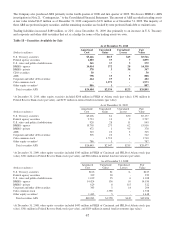

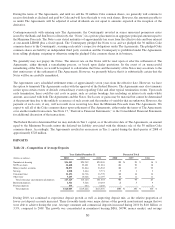

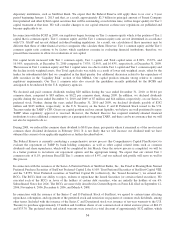

We declared and paid common dividends totaling $20 million during the year ended December 31, 2010, or $0.04 per

common share, compared to $83 million, or $0.22 per common share, during 2009. In addition, we declared dividends

payable during the years ended December 31, 2010 and 2009 of $7 million and $14 million, respectively, on our Series A

preferred stock. Further, during the years ended December 31, 2010 and 2009, we declared dividends payable of $242

million and $243 million, respectively, to the U.S. Treasury on the Series C and D Preferred Stock issued to the U.S.

Treasury under the TARP’s CPP. Given our capital position and our current liquidity, we believe are well positioned to repay

TARP when regulatory approval is received. However, the Federal Reserve has required similarly-situated financial

institutions to raise additional common equity as a prerequisite to repaying TARP, and there can be no assurance that we will

not also be required to do so.

During 2009, we reduced the common share dividend to $0.01 per share, per quarter where it remained as of the most recent

common share dividend declaration in February 2011. It is not likely that we will increase our dividend until we have

obtained the consent of our applicable regulators as further described below.

The Federal Reserve is currently conducting a comprehensive review process (the Comprehensive Capital Plan Review) to

evaluate the repayment of TARP by bank holding companies, as well as other capital related items such as common

dividends and share repurchases, which will be completed by late March. Once the review process is completed, we will be

in a better position to reevaluate our repayment options and the appropriate timing. We expect that our current Tier 1

common ratio of 8.1%, proforma Basel III Tier 1 common ratio of 8.4%, and our reduced risk profile will serve us well in

this process.

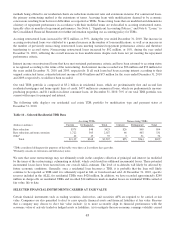

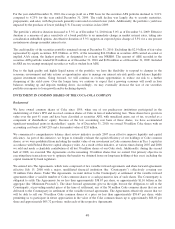

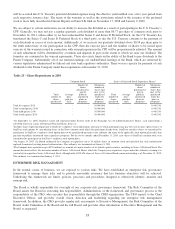

In connection with the issuances of the Series A Preferred Stock of SunTrust Banks, Inc., the Fixed to Floating Rate Normal

Preferred Purchase Securities of SunTrust Preferred Capital I, the 6.10% Trust Preferred Securities of SunTrust Capital VIII,

and the 7.875% Trust Preferred securities of SunTrust Capital IX (collectively, the “Issued Securities”), we entered into

RCCs. The RCCs limit our ability to repay, redeem or repurchase the Issued Securities (or certain related securities). We

executed each of the RCCs in favor of the holders of certain debt securities, who are initially the holders of our 6%

Subordinated Notes due 2026. The RCCs are more fully described in Current Reports on Form 8-K filed on September 12,

2006, November 6, 2006, December 6, 2006, and March 4, 2008.

In connection with the issuance of the Series C and D Preferred Stock of SunTrust, we agreed to certain terms affecting

repurchase, redemption, and repayment of the preferred stock and restriction on payment of common stock dividends, among

other terms. Included with the issuance of the Series C and D preferred stock was issuance of ten-year warrants to the U.S.

Treasury to purchase approximately 12 million and 6 million shares of our common stock at initial exercise prices of $44.15

and $33.70. The preferred stock and related warrants were issued at a total discount of approximately $132 million, which

54