SunTrust 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

analysis incorporates what management believes to be the most appropriate assumptions about client behavior in an interest

rate scenario. Specific strategies are also analyzed to determine their impact on net interest income levels and sensitivities.

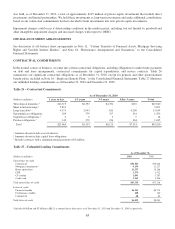

The sensitivity analysis included below is measured as a percentage change in net interest income due to an instantaneous

100 basis point move in benchmark interest rates. Estimated changes set forth below are dependent upon material

assumptions such as those previously discussed. The net interest income profile reflects a relatively neutral interest rate

sensitive position with respect to an instantaneous 100 basis point change in rates.

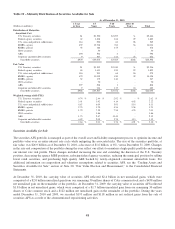

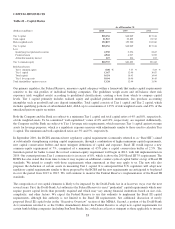

Economic Perspective

Rate Change

(Basis Points)

Estimated % Change in

Net Interest Income Over 12 Months

December 31, 2010 December 31, 2009

+100 0.2% 0.0%

-100 (0.9%) 0.1%

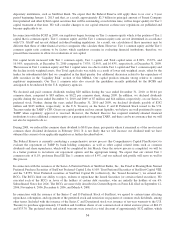

The recognition of interest rate sensitivity from an economic perspective (above) is different from a financial reporting

perspective (below) due to certain interest rate swaps that are used as economic hedges for fixed rate debt. The above profile

includes the recognition of the net interest payments from these swaps, while the profile below does not include the net

interest payments. The swaps are accounted for as trading assets and therefore, the benefit to income due to a decline in short

term interest rates will be recognized as a gain in the fair value of the swaps and will be recorded as an increase in trading

account profits/(losses) and commissions from a financial reporting perspective.

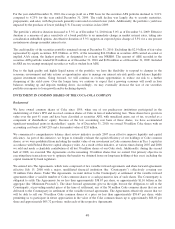

Financial Reporting Perspective

Rate Change

(Basis Points)

Estimated % Change in

Net Interest Income Over 12 Months

December 31, 2010 December 31, 2009

+100 0.5% 0.5%

-100 (1.0%) (0.3%)

The difference from December 31, 2009 to December 31, 2010 seen above in both the economic and financial reporting

perspectives related to a 100 basis point shock is primarily due to interest rates being at or near terminally low levels as well

as reaching floors of essentially zero percent in downward rate shocks.

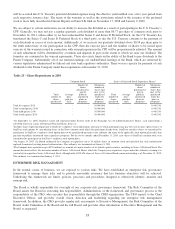

We also perform valuation analysis, which is used for discerning levels of risk present in the balance sheet and derivative

positions that might not be taken into account in the net interest income simulation analysis above. Whereas net interest

income simulation highlights exposures over a relatively short time horizon, valuation analysis incorporates all cash flows

over the estimated remaining life of all balance sheet and derivative positions. The valuation of the balance sheet, at a point

in time, is defined as the discounted present value of asset cash flows and derivative cash flows minus the discounted present

value of liability cash flows, the net of which is referred to as MVE. The sensitivity of MVE to changes in the level of

interest rates is a measure of the longer-term repricing risk and options risk embedded in the balance sheet. Similar to the net

interest income simulation, MVE uses instantaneous changes in rates. MVE values only the current balance sheet and does

not incorporate the growth assumptions that are used in the net interest income simulation model. As with the net interest

income simulation model, assumptions about the timing and variability of balance sheet cash flows are critical in the MVE

analysis. Particularly important are the assumptions driving prepayments and the expected changes in balances and pricing of

the indeterminate deposit portfolios.

As of December 31, 2010, the MVE profile indicates modest changes with respect to an instantaneous 100 basis point change in rates.

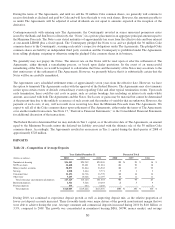

Rate Shock

(Basis Points) Estimated % Change in MVE

December 31, 2010 December 31, 2009

+100 (3.4%) (4.2%)

-100 1.1% 2.3%

58