SunTrust 2010 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

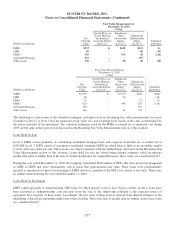

Level 3 municipal securities consist of ARS purchased since the auction rate market began failing in February 2008

and have been considered level 3 securities due to the significant decrease in the volume and level of activity in

these markets, which has necessitated the use of significant unobservable inputs in the Company’s valuations.

Municipal ARS are classified as securities AFS or trading securities. These securities were valued using

comparisons to similar ARS for which auctions are currently successful and/or to longer term, non-ARS issued by

similar municipalities. The Company also looks at the relative strength of the municipality and makes appropriate

downward adjustments in price based on the credit rating of the municipality as well as the relative financial strength

of the insurer on those bonds. Although auctions for several municipal ARS continue to operate successfully, ARS

owned by the Company at December 31, 2010 continue to be classified as level 3 as they are those ARS for which

the auctions continue to fail and, therefore, due to the uncertainty around the success rates for auctions and the

absence of any successful auctions for these identical securities, the Company continues to price the ARS below par.

Level 3 AFS municipal bond securities also include bonds that are only redeemable with the issuer at par and cannot

be traded in the market. As such, no significant observable market data for these instruments is available. In order to

estimate pricing on these securities, the Company utilizes a third party municipal bond yield curve for the lowest

investment grade bonds (BBB rated) and prices each bond based on the yield associated with that maturity.

RMBS – agency

RMBS – agency includes pass-through securities and collateralized mortgage obligations issued by GSEs and U.S.

government agencies, such as Fannie Mae, Freddie Mac and Ginnie Mae. Each security contains a guarantee by the

issuing GSE or agency. These securities are valued by an independent pricing service that is widely used by market

participants. The Company has determined that this pricing service is using similar instruments that are trading in the

market as the basis for its estimates of fair value and, as such, the Company appropriately classifies these

instruments as level 2.

MBS – private

MBS – private includes purchased interests in third party securitizations as well as retained interests in Company-

sponsored securitizations of residential mortgages. In addition, the Company also has approximately $9 million of

private-label CMBS in trading assets that were received as part of a SIV liquidation in 2010 (see CDO discussion

below). Generally, the Company attempts to obtain pricing for its securities from an independent pricing service or

third party brokers who have experience in valuing certain investments. This pricing may be used as either direct

support for the Company’s valuations or used to validate outputs from its own proprietary models. The Company

evaluates third party pricing to determine the reasonableness of the information relative to changes in market data,

such as any recent trades the Company executed, market information received from outside market participants and

analysts, and/or changes in the underlying collateral performance. When actual trades are not available to

corroborate pricing information received, the Company uses industry-standard or proprietary models to estimate fair

value and considers assumptions that are generally not observable in the current markets or that are not specific to

the securities that the Company owns, such as relevant market indices that correlate to the underlying collateral,

prepayment speeds, default rates, loss severity rates and discount rates. During the year ended December 31, 2010,

the Company began to observe a return of liquidity to the markets, resulting in the availability of more pricing

information from third parties and a reduction in the need to use internal pricing models to estimate fair value. Even

though limited third party pricing has been available, the Company continues to classify private RMBS as level 3, as

the Company believes that this third party pricing relies on a significant amount of unobservable assumptions as

evidenced by a persistently wide bid-ask price range, particularly for the vintage and exposures held by the

Company. For the private-label CMBS, the Company was able to obtain pricing information as part of the

foreclosure sale at liquidation and was also able to obtain at least two different pricing sources that were within

narrow price range. As such, the Company classified these securities as level 2.

Certain vintages of private RMBS have suffered from deterioration in credit quality leading to downgrades. At

December 31, 2010, the majority of the Company’s private RMBS contained 2006 to 2007 vintage securities AFS

and trading securities, along with a portion of 2003 vintage securities classified as AFS. All but a de minimis amount

of the 2006 to 2007 vintage securities AFS and trading securities had been downgraded to non-investment grade

levels by at least one nationally recognized rating agency. The vast majority of these securities had high investment

167