SunTrust 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

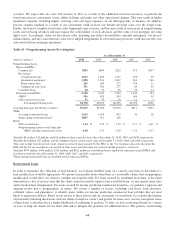

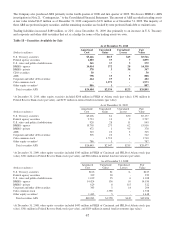

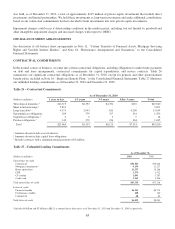

CAPITAL RESOURCES

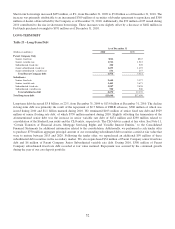

Table 24 – Capital Ratios

As of December 31

(Dollars in millions) 2010 2009 2008

Tier 1 capital $18,156 $18,069 $17,614

Total capital 21,967 22,895 22,743

Risk-weighted assets 132,819 139,380 162,046

Tier 1 capital $18,156 $18,069 $17,614

Less:

Qualifying trust preferred securities 2,350 2,356 2,847

Preferred stock 4,942 4,917 5,222

Allowable minority interest 127 104 102

Tier 1 common equity $10,737 $10,692 $9,443

Risk-based ratios:

Tier 1 common equity 8.08 % 7.67 % 5.83 %

Tier 1 capital 13.67 12.96 10.87

Total capital 16.54 16.43 14.04

Tier 1 leverage ratio 10.94 10.90 10.45

Total shareholders’ equity to assets 13.38 12.94 11.90

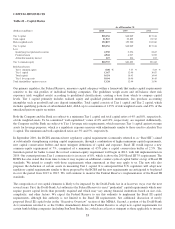

Our primary regulator, the Federal Reserve, measures capital adequacy within a framework that makes capital requirements

sensitive to the risk profiles of individual banking companies. The guidelines weigh assets and off-balance sheet risk

exposures (risk weighted assets) according to predefined classifications, creating a base from which to compare capital

levels. Tier 1 capital primarily includes realized equity and qualified preferred instruments, less purchase accounting

intangibles such as goodwill and core deposit intangibles. Total capital consists of Tier 1 capital and Tier 2 capital, which

includes qualifying portions of subordinated debt, ALLL up to a maximum of 1.25% of risk weighted assets, and 45% of the

unrealized gain on equity securities.

Both the Company and the Bank are subject to a minimum Tier 1 capital and total capital ratios of 4% and 8%, respectively,

of risk weighted assets. To be considered “well-capitalized,” ratios of 6% and 10%, respectively, are required. Additionally,

the Company and the Bank are subject to Tier 1 leverage ratio requirements, which measures Tier 1 capital against average

assets for leverage purposes, which is a regulatory exposure measure with adjustments similar to those used to calculate Tier

1 capital. The minimum and well-capitalized ratios are 3% and 5%, respectively.

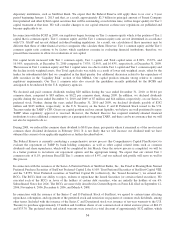

In September 2010, the BCBS announced new regulatory capital requirements (commonly referred to as “Basel III”) aimed

at substantially strengthening existing capital requirements, through a combination of higher minimum capital requirements,

new capital conservation buffers and more stringent definitions of capital and exposure. Basel III would impose a new

common equity requirement of 7%, comprised of a minimum of 4.5% plus a capital conservation buffer of 2.5%. The

transition period for banks to meet the revised common equity requirement will begin in 2013, with full implementation in

2019. Our current proforma Tier 1 common ratio is in excess of 8%, which is above the 2019 Basel III 7% requirement. The

BCBS has also stated that from time to time it may require an additional, counter-cyclical capital buffer on top of Basel III

standards. We intend to comply with those requirements when announced as they may apply to us. The new rule also

proposes the deduction of certain assets in measuring Tier 1 capital. It is anticipated that U.S. regulators will adopt new

regulatory capital requirements similar to those proposed by the BCBS and the new requirements are anticipated to be phased

in over the period from 2013 to 2015. We will continue to monitor the Federal Reserve’s implementation of the Basel III

standards.

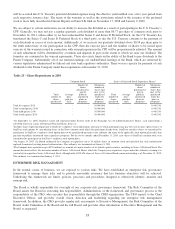

The composition of our capital elements is likely to be impacted by the Dodd-Frank Act in at least two ways over the next

several years. First, the Dodd-Frank Act authorizes the Federal Reserve to enact “prudential” capital requirements which may

require greater capital levels than presently required and which may vary among financial institutions based on size, risk,

complexity, and other factors. We expect the Federal Reserve to use this authority to implement the Basel III capital

requirements, although this authority is not limited to the Basel III requirements. See additional discussion of newly

proposed Basel III capital rules in the “Executive Overview” section of this MD&A. Second, a portion of the Dodd-Frank

Act (sometimes referred to as the Collins Amendment) directs the Federal Reserve to adopt new capital requirements for

certain bank holding companies (including SunTrust Banks, Inc.) which are at least as stringent as those applicable to insured

53