SunTrust 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foregone interest income from NPLs reduced net interest margin by 20 basis points for 2010, compared to 21 basis points in

2009, as average nonaccrual loans decreased $280 million, or 6% from 2009. See additional discussion of our expectations

for future levels of credit quality in the “Allowance for Credit Losses”, and “Nonperforming Assets” sections of this MD&A.

Tables 1 and 2 contain more detailed information concerning average balances, yields earned, and rates paid.

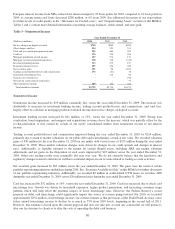

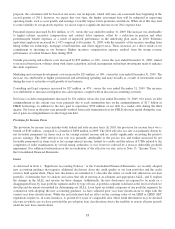

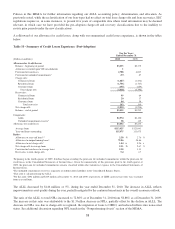

Table 3 - Noninterest Income

Year Ended December 31

(Dollars in millions) 2010 2009 2008

Service charges on deposit accounts $760 $848 $904

Other charges and fees 534 523 511

Trust and investment management income 503 486 592

Card fees 376 324 308

Mortgage production related income 127 376 171

Mortgage servicing related income/(loss) 358 330 (212)

Investment banking income 313 272 237

Retail investment services 205 218 289

Net securities gains 191 98 1,073

Trading account profits/(losses) and commissions 173 (41) 38

Gain from ownership in Visa -112 86

Gain on sale of businesses -- 198

Net gain on sale/leaseback of premises --37

Other noninterest income 189 164 241

Total noninterest income $3,729 $3,710 $4,473

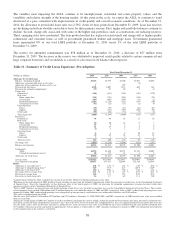

Noninterest Income

Noninterest income increased by $19 million, essentially flat, versus the year ended December 31, 2009. The increase was

attributable to increases in investment banking income, trading account profits/(losses) and commissions, and card fees,

largely offset by a decline in mortgage production related income and service charges on deposit accounts.

Investment banking income increased by $41 million, or 15%, versus the year ended December 31, 2009. Strong loan

syndication, bond originations, and mergers and acquisitions revenues drove the increase, which was partially offset by the

re-characterization of fees earned by certain of our newly consolidated entities from noninterest income to net interest

income.

Trading account profits/(losses) and commissions improved during the year ended December 31, 2010 by $214 million,

primarily due to mark to market valuations on our public debt and related hedges carried at fair value. We recorded valuation

gains of $36 million for the year December 31, 2010 on our public debt versus losses of $153 million during the year ended

December 31, 2009. These market valuation changes were driven by changes in our credit spreads and changes in interest

rates. Additionally, as liquidity returned to the market for certain illiquid assets, including ARS, net market valuation

adjustments and net gains on the disposition of such assets improved by $47 million versus the year ended December 31,

2009. Other core trading results were essentially flat year over year. We do not currently believe that the legislative and

regulatory changes related to derivatives will have a material impact on our revenue related to trading account activities.

Net securities gains increased by $93 million versus the year ended December 31, 2009. The gains were the result of certain

portfolio repositioning initiatives undertaken during 2010. See “Securities Available for Sale” in this MD&A for further discussion

of our portfolio repositioning initiatives. Additionally, we recorded $2 million in credit-related OTTI losses on securities AFS

during the year ended December 31, 2010 versus $20 million in losses during the year ended December 31, 2009.

Card fees increased by $52 million, or 16%, versus the year ended December 31, 2009. Card fees increased due to check card

interchange fees. Growth was driven by household expansion, higher product penetration, and increasing consumer usage

patterns which will help offset the potential impact of lower interchange rates. However, the Federal Reserve’s recent

proposal on debit card interchange could significantly impact this source of revenue going forward. For 2010, we recorded

approximately $332 million of interchange income; our current estimate is that provisions of the Dodd-Frank Act may cause

future annual interchange income to decline by as much as 75% from 2010 levels, beginning in the second half of 2011.

However, this estimate is based upon the current proposal and does not take into account any actions that we will pursue to

alter our fee structure to clients or to alter the costs of operating the debit card business.

30