SunTrust 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

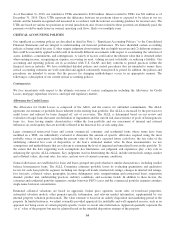

Other Liabilities

During the second quarter of 2009, in connection with our sale of Visa Class B shares, we entered into a derivative contract

whereby the ultimate cash payments received or paid, if any, under the contract are based on the ultimate resolution of

litigation involving Visa. The value of the derivative is estimated based on our expectations regarding the ultimate resolution

of that litigation, which involves a high degree of judgment and subjectivity. As a result, the value of the derivative liability

was classified as a level 3 instrument. At December 31, 2010, the Visa derivative liability was valued at $23 million and was

included within other liabilities. See Note 18, “Reinsurance Arrangements and Guarantees”, to the Consolidated Financial

Statements for further discussion.

The fair value methodology and assumptions related to our IRLCs is described in Note 20, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements.

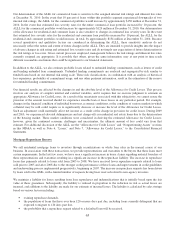

Goodwill

In 2009, our reporting units were comprised of Retail, Commercial, CRE, Household Lending, CIB, W&IM, and Affordable

Housing. In the first quarter of 2009, we wrote off all of the goodwill of the CRE, Household Lending, and Affordable

Housing reporting units in connection with our goodwill impairment analysis. In the second quarter of 2010, we changed our

business segments. Among other changes, portions of the CIB segment, such as Middle Market, Asset-Based Lending, and

Equipment Leasing were moved to the Diversified Commercial Banking segment, resulting in the allocation of

approximately $43 million in goodwill from the CIB reporting unit to the Commercial reporting unit, which was renamed the

Diversified Commercial Banking reporting unit. The Retail reporting unit was renamed Branch Banking; however, the

composition of the reporting unit did not change. Branch Banking is a component of the Retail Banking reportable segment.

As of December 31, 2010, the reporting units with goodwill balances are Branch Banking, Diversified Commercial Banking,

CIB, and W&IM. See Note 22, “Business Segment Reporting,” to the Consolidated Financial Statements for a further

discussion of the changes to our reportable segments.

We review the goodwill of each reporting unit for impairment on an annual basis, or more often, if events or circumstances

indicate that it is more likely than not that the fair value of the reporting unit is below the carrying value of its equity. The

goodwill impairment analysis estimates the fair value of equity using discounted cash flow analyses which require

assumptions, as well as guideline company and guideline transaction information, where available. The inputs and

assumptions specific to each reporting unit are incorporated in the valuations including projections of future cash flows,

discount rates, the fair value of tangible and intangible assets and liabilities, and applicable valuation multiples based on the

guideline information. We assess the reasonableness of the estimated fair value of the reporting units by giving consideration

to our market capitalization over a reasonable period of time; however, supplemental information is applied based on

observable multiples from guideline transactions, adjusting to reflect our specific factors, as well as current market

conditions. Based on our annual impairment analysis of goodwill as of September 30, 2010, we believe that the fair value for

all reporting units is substantially in excess of the respective reporting unit’s carrying value.

Valuation Techniques

In determining the fair value of our reporting units, we primarily use discounted cash flow analyses, which require

assumptions about short and long-term net cash flow growth rates for each reporting unit, as well as discount rates. In

addition, we consider guideline company and guideline transaction information, where available, to aid in the valuation of

certain reporting units.

Growth Assumptions

Multi-year financial forecasts are developed for each reporting unit by considering several key business drivers such as new

business initiatives, client service and retention standards, market share changes, anticipated loan and deposit growth,

forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term

growth rate used in determining the terminal value of each reporting unit was estimated at 4% in 2009 and 2010 based on

management’s assessment of the minimum expected terminal growth rate of each reporting unit, as well as broader economic

considerations such as gross domestic product and inflation.

71