SunTrust 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

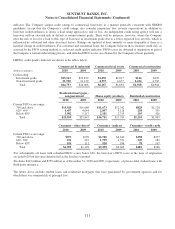

decision-making rights and own VIs that could potentially be significant to these VIEs. The primary balance sheet impacts

from consolidating Three Pillars, the CLO, and the student loan securitization vehicle, were increases in loans and leases, the

related ALLL, LHFS, long-term debt, and other short-term borrowings. The consolidations of these entities had no impact on

the Company’s earnings or cash flows that result from its involvement with these VIEs, but the Company’s Consolidated

Statements of Income/(Loss) reflect a reduction in noninterest income and increases in net interest income and noninterest

expense due to the consolidations. For additional information on the Company’s VIE structures, refer to Note 11, “Certain

Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities,” to the Consolidated Financial

Statements.

The combined impacts of consolidating these entities were incremental total assets and total liabilities, at the date of

consolidation, of $2.5 billion, respectively, and an immaterial impact on shareholders’ equity. No additional funding

requirements with respect to these entities are expected to significantly impact the liquidity position of the Company. The

Company consolidated the assets and liabilities of Three Pillars and the student loan securitization vehicle at their unpaid

principal amounts and subsequently accounted for these assets and liabilities on an accrual basis. The Company consolidated

the assets and liabilities of the CLO based on their estimated fair values and made an irrevocable election to carry all of the

financial assets and financial liabilities of the CLO at fair value. The impact on certain of the Company’s regulatory capital

ratios as a result of consolidating these entities was not significant.

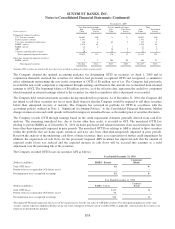

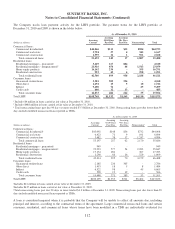

In January 2010, the FASB issued ASU 2010-06, an update to ASC 820-10, “Fair Value Measurements.” This update adds a

new requirement to disclose transfers in and out of level 1 and level 2, along with the reasons for the transfers, and requires a

gross presentation of purchases and sales of level 3 activities. Additionally, the update clarifies that entities provide fair value

measurement disclosures for each class of assets and liabilities and that entities provide enhanced disclosures around level 2

valuation techniques and inputs. The Company adopted the disclosure requirements for level 1 and level 2 transfers and the

expanded fair value measurement and valuation disclosures effective January 1, 2010. The disclosure requirements for

level 3 activities will be effective in the interim reporting period ending March 31, 2011. The adoption of the disclosure

requirements for level 1 and level 2 transfers and the expanded qualitative disclosures, had no impact on the Company’s

financial position, results of operations, and EPS. The adoption of the level 3 disclosure requirements will not have an impact

on the Company’s financial position, results of operations, and EPS.

In February 2010, the FASB issued ASU 2010-09, an update to ASC 855-10, “Subsequent Events.” This update amends the

guidance to remove the requirement for SEC filers to disclose the date through which subsequent events have been evaluated.

SEC filers must continue to evaluate subsequent events through the date the financial statements are issued. The amendment

was effective and has been adopted by the Company upon issuance.

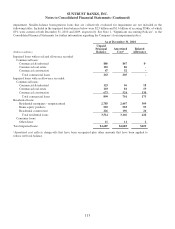

In February 2010, the FASB issued ASU 2010-10, an update to ASC 810-10, “Consolidation.” This update defers the

amendments to the consolidation requirements of ASC 810-10 for a reporting entity’s interest in entities that have the

attributes of investment companies or for which it is acceptable based on industry practice to apply measurement principles

that are consistent with those followed by investment companies and was effective January 1, 2010. The deferral also applies

to a reporting entity’s interest in an entity that is required to comply with or operate in accordance with requirements that are

similar to those included in Rule 2a-7 of the Investment Company Act of 1940 for registered MMMFs. Certain of the

Company’s wholly-owned subsidiaries provide investment advisor services for various private placement and publicly

registered investment funds. The deferral applies to all of these funds.

In March 2010, the FASB issued ASU 2010-11, an update to ASC 815-15, “Derivatives and Hedging–Embedded

Derivatives.” This update clarifies that the scope exception for considering certain credit-related features for potential

bifurcation and separate accounting in ASC 815-15 applies to contracts containing an embedded credit derivative that is only

in the form of subordination of one financial instrument to another. Other contracts containing embedded credit derivatives

do not qualify for the scope exception. The adoption of this standard, effective July 1, 2010, did not have an impact on the

Company’s financial position, results of operations, and EPS.

In April 2010, the FASB issued ASU 2010-18, an update to ASC 310-30, “Loans and Debt Securities Acquired with

Deteriorated Credit Quality.” This update clarifies that modifications of loans that are accounted for within a pool do not

result in the removal of those loans from the pool even if the modification of those loans would otherwise be considered a

103