SunTrust 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

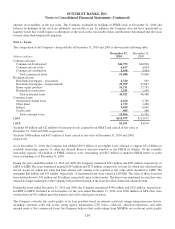

TDR. Loans accounted for individually under ASC Subtopic 310-30 continue to be subject to the TDR accounting provisions

within ASC 310-40, “Receivables—Troubled Debt Restructurings by Creditors.” This update was effective for the Company

on July 1, 2010 and did not have an impact on the Company’s financial position, results of operations, and EPS.

In July 2010, the FASB issued ASU 2010-20, “Disclosures about the Credit Quality of Financing Receivables and the

Allowance for Credit Losses.”The update requires companies to provide more disclosures about the credit quality of their

financing receivables, which include loans, lease receivables, and other long-term receivables, and the credit allowances held

against them. The disclosure requirements as of December 31, 2010 are included in Note 6, “Loans,” and Note 7, “Allowance

for Credit Losses,” to the Consolidated Financial Statements. Disclosures about activity that occurs during a reporting period

will be effective in the interim reporting period ending March 31, 2011. In January 2011, the FASB issued ASU 2011-01,

“Deferral of the Effective Date of Disclosures about Troubled Debt Restructurings in ASU 2010-20.” The update defers the

effective date of reporting TDR credit quality disclosures until after the FASB has clarified the guidance for determining

what constitutes a TDR.

In December 2010, the FASB issued ASU 2010-28, “When to Perform Step 2 of the Goodwill Impairment Test for Reporting

Units with Zero or Negative Carrying Amounts.” The update requires companies to perform a step 2 analysis if the carrying

value of a reporting unit is zero or negative and if it is more likely than not that goodwill is impaired. The update is effective

for goodwill impairment testing performed during 2011 with any resulting impairment charge recorded through a cumulative

effect adjustment to beginning retained earnings. The Company has adopted the standard as of January 1, 2011 and will

apply the new guidance to future goodwill impairment testing, but the Company does not expect the standard to have a

substantive impact on its goodwill impairment evaluation.

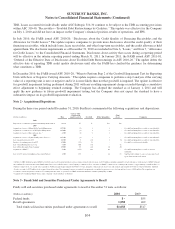

Note 2 - Acquisitions/Dispositions

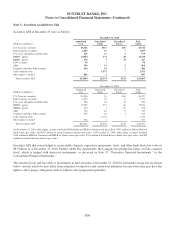

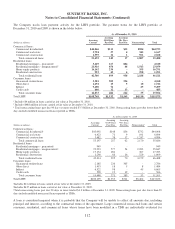

During the three year period ended December 31, 2010, SunTrust consummated the following acquisitions and dispositions:

(Dollars in millions) Date

Cash or other

consideration

(paid)/ received Goodwill Other Intangibles

Gain/

(Loss) Comments

2010

Disposition of certain money market fund management business various $7 $- $11 $18

2009

Acquisition of assets of Martin Kelly Capital Management 12/22/09 (2) 1 1 - Goodwill and intangibles recorded are tax-deductible.

Acquisition of certain assets of CSI Capital Management 11/30/09 (3) 1 2 - Goodwill and intangibles recorded are tax-deductible.

Acquisition of assets of Epic Advisors, Inc. 24/1/09 (2) 5 1 - Goodwill and intangibles recorded are tax-deductible.

2008

Acquisition of assets of Cymric Family Office Services 212/31/08 (3) 1 1 - Goodwill and intangibles recorded are tax-deductible.

Sale of majority interest in ZCI 10/1/08 8 (15) 1 (3) Goodwill and intangibles recorded are tax-deductible.

Purchase of remaining interest in ZCI 9/30/08 (23) 21 - - Goodwill recorded is tax-deductible.

Sale of TransPlatinum Service Corp. 9/2/08 100 (11) - 82

Sale of First Mercantile Trust Company 5/30/08 59 (12) (3) 30

Acquisition of GB&T 15/1/08 (155) 144 30 - Goodwill and intangibles recorded are non tax-

deductible.

Sale of 24.9% interest in Lighthouse Investment Partners 1/2/08 155 - (6) 89 SunTrust will continue to earn a revenue share based

upon client referrals to the funds.

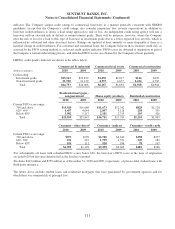

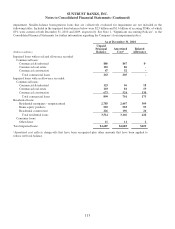

1On May 1, 2008, SunTrust acquired GB&T, a North Georgia-based financial institution serving commercial and retail customers, for $155 million, including cash paid for fractional shares, via the merger of GB&T with and

into SunTrust. In connection therewith, GB&T shareholders received 0.1562 shares of the Company’s common stock for each share of GB&T’s common stock, resulting in the issuance of approximately 2.2 million shares of

SunTrust common stock. As a result of the acquisition, SunTrust acquired approximately $1.4 billion of loans, primarily commercial real estate loans, and assumed approximately $1.4 billion of deposit liabilities. SunTrust

elected to account for $172 million of the acquired loans at fair value. The remaining loans are accounted for at amortized cost and had a carryover reserve for loan and lease losses of $159 million. The acquisition was

accounted for under the purchase method of accounting with the results of operations for GB&T included in SunTrust’s results beginning May 1, 2008.

2Acquisition by GenSpring Family Offices, LLC a majority owned subsidiary of SunTrust.

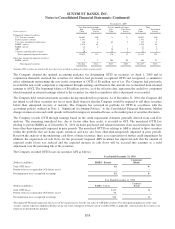

Note 3 - Funds Sold and Securities Purchased Under Agreements to Resell

Funds sold and securities purchased under agreements to resell at December 31 were as follows:

(Dollars in millions) 2010 2009

Federal funds $- $55

Resell agreements 1,058 462

Total funds sold and securities purchased under agreements to resell $1,058 $517

104