SunTrust 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

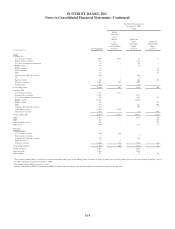

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

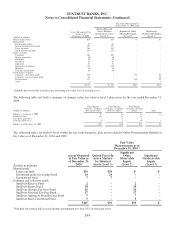

Credit Derivatives

As part of its trading businesses, the Company enters into contracts that are, in form or substance, written guarantees:

specifically, CDS, swap participations, and TRS. The Company accounts for these contracts as derivative instruments and,

accordingly, records these contracts at fair value, with changes in fair value recorded in trading account profits/(losses) and

commissions.

The Company writes CDS, which are agreements under which the Company receives premium payments from its

counterparty for protection against an event of default of a reference asset. In the event of default under the CDS, the

Company would either net cash settle or make a cash payment to its counterparty and take delivery of the defaulted reference

asset, from which the Company may recover all, a portion, or none of the credit loss, depending on the performance of the

reference asset. Events of default, as defined in the CDS agreements, are generally triggered upon the failure to pay and

similar events related to the issuer(s) of the reference asset. As of December 31, 2010 and 2009, all written CDS contracts

reference single name corporate credits or corporate credit indices. When the Company has written CDS, it has generally

entered into offsetting CDS for the underlying reference asset, under which the Company paid a premium to its counterparty

for protection against an event of default on the reference asset. The counterparties to these purchased CDS are generally of

high creditworthiness and typically have ISDA master agreements in place that subject the CDS to master netting provisions,

thereby mitigating the risk of non-payment to the Company. As such, at December 31, 2010 and 2009, the Company did not

have any significant risk of making a non-recoverable payment on any written CDS. During 2010 and 2009, the only

instances of default on written CDS were driven by credit indices with constituent credit default. In all cases where the

Company made resulting cash payments to settle, the Company collected like amounts from the counterparties to the

offsetting purchased CDS. At December 31, 2010 and 2009, the written CDS had remaining terms ranging from two months

to five years and three months to five years, respectively. The maximum guarantees outstanding at December 31, 2010 and

2009, as measured by the gross notional amounts of written CDS, were $99 million and $130 million, respectively. At

December 31, 2010 and 2009, the gross notional amounts of purchased CDS contracts, which represent benefits to, rather

than obligations of, the Company, were $87 million and $185 million, respectively. The fair values of the written and

purchased CDS were de minimis as of both December 31, 2010 and 2009.

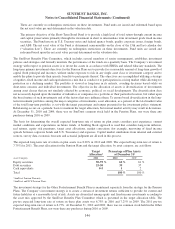

The Company writes risk participations, which are credit derivatives whereby the Company has guaranteed payment to a

dealer counterparty in the event that the counterparty experiences a loss on a derivative instrument, such as an interest rate

swap, due to a failure to pay by the counterparty’s customer (the “obligor”) on that derivative instrument. The Company

monitors its payment risk on its risk participations by monitoring the creditworthiness of the obligors, which is based on the

normal credit review process the Company would have performed had it entered into the derivative instruments directly with

the obligors. The obligors are all corporations or partnerships. However, the Company continues to monitor the

creditworthiness of its obligors and the likelihood of payment could change at any time due to unforeseen circumstances. To

date, no material losses have been incurred related to the Company’s written swap participations. At December 31, 2010 and

2009, the remaining terms on these risk participations generally ranged from one month to eight years and one month to nine

years, respectively, with a weighted average on the maximum estimated exposure of 3.1 years and 3.2 years, respectively.

The Company’s maximum estimated exposure to written swap participations, as measured by projecting a maximum value of

the guaranteed derivative instruments based on interest rate curve simulations and assuming 100% default by all obligors on

the maximum values, was $74 million and $83 million at December 31, 2010 and 2009, respectively. The fair values of the

written swap participations were de minimis at December 31, 2010 and 2009. As part of its trading activities, the Company

may enter into purchased swap participations, but such activity is not matched, as discussed herein related to CDS or TRS.

The Company has also entered into TRS contracts on loans. The Company’s TRS business consists of matched trades, such

that when the Company pays depreciation on one TRS, it receives the same depreciation on the matched TRS. As such, the

Company does not have any long or short exposure, other than credit risk of its counterparty, which is mitigated through

collateralization. The Company typically receives initial cash collateral from the counterparty upon entering into the TRS and

is entitled to additional collateral as the fair value of the underlying reference assets deteriorate. The Company temporarily

suspended this business and unwound its positions as of December 31, 2009 without incurring losses. Trading resumed

during 2010 and at December 31, 2010, there were $969 million of outstanding and offsetting TRS notional balances. The

fair values of the TRS derivative assets and liabilities were $34 million and $32 million at December 31, 2010, respectively,

and related collateral held at December 31, 2010 was $268 million.

154