SunTrust 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

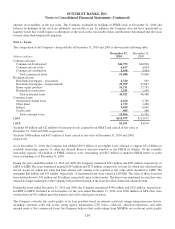

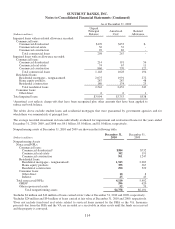

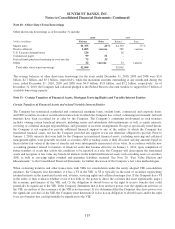

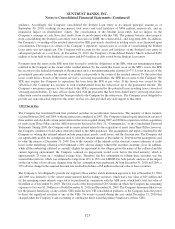

Note 10 - Other Short-Term Borrowings

Other short-term borrowings as of December 31 include:

2010 2009

(Dollars in millions) Balance Rates Balance Rates

Master notes $1,355 .40 % $1,363 .75 %

Dealer collateral 1,005 various 585 various

U.S. Treasury demand notes 124 - 62 -

Commercial paper 99 .51 --

Federal funds purchased maturing in over one day 75 .35 --

Other 32 various 52 various

Total other short-term borrowings $2,690 $2,062

The average balances of other short-term borrowings for the years ended December 31, 2010, 2009 and 2008 were $3.0

billion, $2.7 billion, and $3.1 billion, respectively, while the maximum amounts outstanding at any month-end during the

years ended December 31, 2010, 2009 and 2008 were $4.9 billion, $5.8 billion, and $5.2 billion, respectively. As of

December 31, 2010, the Company had collateral pledged to the Federal Reserve discount window to support $12.5 billion of

available borrowing capacity.

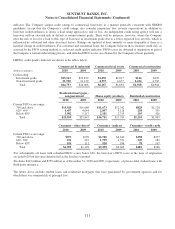

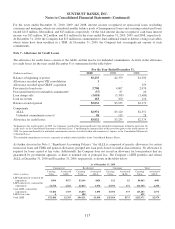

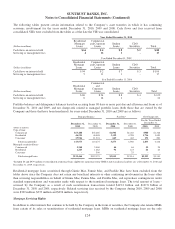

Note 11 - Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities

Certain Transfers of Financial Assets and related Variable Interest Entities

The Company has transferred residential and commercial mortgage loans, student loans, commercial and corporate loans,

and CDO securities in sale or securitization transactions in which the Company has, or had, continuing involvement. All such

transfers have been accounted for as sales by the Company. The Company’s continuing involvement in such transfers

includes owning certain beneficial interests, including senior and subordinate debt instruments as well as equity interests,

servicing or collateral manager responsibilities, and guarantee or recourse arrangements. Except as specifically noted herein,

the Company is not required to provide additional financial support to any of the entities to which the Company has

transferred financial assets, nor has the Company provided any support it was not otherwise obligated to provide. Prior to

January 1, 2010, interests that were held by the Company in transferred financial assets, excluding servicing and collateral

management rights, were generally recorded as securities AFS or trading assets at their allocated carrying amounts based on

their relative fair values at the time of transfer and were subsequently remeasured at fair value. In accordance with the new

accounting guidance related to transfers of financial assets that became effective on January 1, 2010, upon completion of

future transfers of assets that satisfy the conditions to be reported as a sale, the Company will derecognize the transferred

assets and recognize at fair value any beneficial interests in the transferred financial assets such as trading assets or securities

AFS, as well as servicing rights retained and guarantee liabilities incurred. See Note 20, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements, for further discussion of the Company’s fair value methodologies.

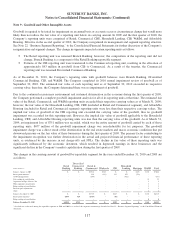

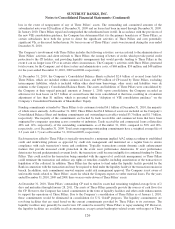

When evaluating transfers and other transactions with VIEs for consolidation under the newly adopted VIE consolidation

guidance, the Company first determines if it has a VI in the VIE. A VI is typically in the form of securities representing

retained interests in the transferred assets and, at times, servicing rights and collateral manager fees. If the Company has a VI

in the entity, it then evaluates whether or not it has both (1) the power to direct the activities that most significantly impact

the economic performance of the VIE, and (2) the obligation to absorb losses or the right to receive benefits that could

potentially be significant to the VIE. If the Company determines that it does not have power over the significant activities of

the VIE, an analysis of the economics of the VIE is not necessary. If it is determined that the Company does have power over

the significant activities of the VIE, the Company must determine if it also has an obligation to absorb losses and/or the right

to receive benefits that could potentially be significant to the VIE.

119