SunTrust 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

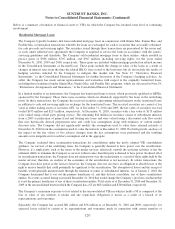

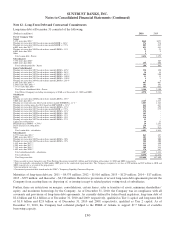

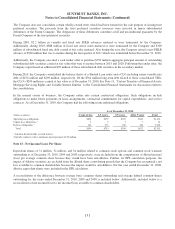

Note 12 - Long-Term Debt and Contractual Commitments

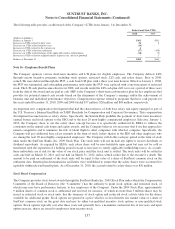

Long-term debt at December 31 consisted of the following:

(Dollars in millions) 2010 2009

Parent Company Only

Senior

5.25% notes due 2012 3$460 $453

Floating rate notes due 2012 based on one month LIBOR + .46% 4576 576

Floating rate notes due 2018 based on one month LIBOR + 1.75% 885 885

6.00% notes due 2017 2451 485

Floating rate notes due 2019 based on three month LIBOR + .15% 51 51

6.00% notes due 2028 99

Other 2-

Total senior debt - Parent 2,434 2,459

Subordinated

7.75% notes due 2010 3-305

6.00% notes due 2026 200 200

Total subordinated debt - Parent 200 505

Junior Subordinated

Floating rate notes due 2027 based on three month LIBOR + .67% 1350 350

Floating rate notes due 2027 based on three month LIBOR + .98% 134 34

Floating rate notes due 2028 based on three month LIBOR + .65% 1,2 244 250

Floating rate notes due 2032 based on three month LIBOR + 3.40% 113 13

Floating rate notes due 2033 based on three month LIBOR + 3.10% 122

Floating rate notes due 2034 based on three month LIBOR + 2.65% 188

6.10% notes due 2036 1,2 907 907

5.588% notes due 2042 1,2 101 101

7.7875% notes due 2068 1685 685

Total junior subordinated debt - Parent 2,344 2,350

Total Parent Company (excluding intercompany of $160 as of December 31, 2010 and 2009) 4,978 5,314

Subsidiaries

Senior

Floating rate notes due 2010 based on three month LIBOR + .65% 4-750

3.00% notes due 2011 2,4 2,145 2,245

Floating rate euro notes due 2011 based on three month EURIBOR + .11% 21,083 1,164

Floating rate sterling notes due 2012 based on GBP LIBOR + .12% 2462 623

Floating rate notes due 2012 based on three month LIBOR + .11% 2859 859

Floating rate notes due 2017 based on one month LIBOR + 1.75% 275 275

Floating rate notes due 2018 based on three month LIBOR + .14% 3290 -

Floating rate notes due 2020 based on three month LIBOR + .10% 105 -

Floating rate notes due 2023 based on three month LIBOR + .12% 116 -

Floating rate notes due 2037 based on three month LIBOR + .19% 230 -

Floating rate notes due 2037 based on three month LIBOR + .27% 23 -

Capital lease obligations 14 15

FHLB advances (0.00% - 8.79%) 234 2,243

Direct finance lease obligations 250 251

Other 197 423

Total senior debt - subsidiaries 6,083 8,848

Subordinated

6.375% notes due 2011 3863 887

5.00% notes due 2015 2,3 281 515

Floating rate notes due 2015 based on three month LIBOR + .30% 200 200

Floating rate notes due 2015 based on three month LIBOR + .29% 300 300

5.45% notes due 2017 2,3 231 450

5.20% notes due 2017 2,3 190 321

7.25% notes due 2018 2,3 348 388

5.40% notes due 2020 2,3 174 267

Total subordinated debt - subsidiaries 2,587 3,328

Total subsidiaries 8,670 12,176

Total long-term debt $13,648 $17,490

1Notes payable to trusts formed to issue Trust Preferred Securities totaled $2.4 billion and $2.4 billion at December 31, 2010 and 2009, respectively.

2Debt was partially extinguished in 2010 and/or 2009 prior to the contractual repayment date. The Company recognized a net loss of $70 million and $39 million in 2010 and

2009, respectively, as a result of the prepayment.

3Debt recorded at fair value.

4Government guaranteed debt issued under the FDIC’s Temporary Liquidity Guarantee Program.

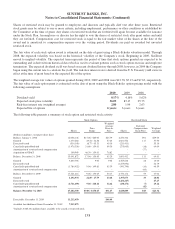

Maturities of long-term debt are: 2011 – $4,573 million; 2012 – $1,916 million; 2013 – $129 million; 2014 – $17 million;

2015 – $797 million; and thereafter – $6,216 million. Restrictive provisions of several long-term debt agreements prevent the

Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries.

Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders’

equity, and maximum borrowings by the Company. As of December 31, 2010, the Company was in compliance with all

covenants and provisions of long-term debt agreements. As currently defined by federal bank regulators, long-term debt of

$2.4 billion and $2.4 billion as of December 31, 2010 and 2009, respectively, qualified as Tier 1 capital, and long-term debt

of $1.8 billion and $2.8 billion as of December 31, 2010 and 2009, respectively, qualified as Tier 2 capital. As of

December 31, 2010, the Company had collateral pledged to the FHLB of Atlanta to support $7.7 billion of available

borrowing capacity.

130