SunTrust 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

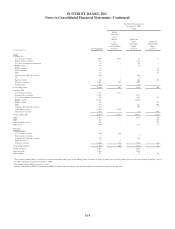

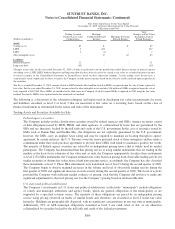

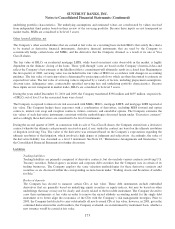

Fair Value Gain/(Loss) for the Year Ended

December 31, 2009, for Items Measured at Fair Value Pursuant

to Election of the FVO

(Dollars in millions)

Trading Account

Profits/(Losses) and

Commissions

Mortgage

Production Related

Income2

Mortgage Servicing

Related Income

Total

Changes in Fair Values

Included in Current

Period Earnings1

Assets

Trading assets $3 $- $- $3

LHFS 2 625 - 627

LHFI 3 (1) - 2

Other intangible assets - 17 66 83

Liabilities

Brokered deposits 11 - - 11

Long-term debt (65) - - (65)

1Changes in fair value for the year ended December 31, 2009, exclude accrued interest for the periods then ended. Interest income or interest expense

on trading assets, LHFI, LHFS, brokered deposits and long-term debt that have been elected to be carried at fair value are recorded in interest income

or interest expense in the Consolidated Statements of Income/(Loss) based on their contractual coupons. Certain trading assets do not have a

contractually stated coupon and, for these securities, the Company records interest income based on the effective yield calculated upon acquisitionof

the securities.

2For the year ended December 31, 2009, income related to LHFS includes $664 million related to MSRs recognized upon the sale of loans reported at

fair value. For the year ended December 31, 2009, income related to other intangible assets includes $18 million of MSRs recognized upon the sale of

loans reported at LOCOM. These MSRs are included in the table since the Company elected to report MSRs recognized in 2009 using the fair value

method. Previously, MSRs were reported under the amortized cost method.

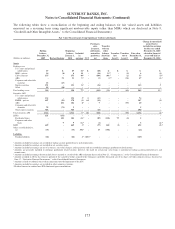

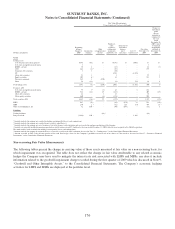

The following is a discussion of the valuation techniques and inputs used in developing fair value measurements for assets

and liabilities classified as level 2 or level 3 that are measured at fair value on a recurring basis, based on the class of

financial instrument as determined by the nature and risks of the instrument.

Trading Assets and Securities Available for Sale

Federal agency securities

The Company includes in this classification securities issued by federal agencies and GSEs. Agency securities consist

of debt obligations issued by HUD, FHLB, and other agencies, or collateralized by loans that are guaranteed by the

SBA and are, therefore, backed by the full faith and credit of the U.S. government. In the case of securities issued by

GSEs such as Fannie Mae and Freddie Mac, the obligations are not explicitly guaranteed by the U.S. government;

however, the GSEs carry an implied AAA rating and may be required to maintain such rating through its agency

agreement. In certain instances, the U.S. Treasury owns the senior preferred stock of these enterprises and has made a

commitment under that stock purchase agreement to provide these GSEs with funds to maintain a positive net worth.

The majority of Federal agency securities are valued by an independent pricing service that is widely used by market

participants. The Company has determined that this pricing service is using similar instruments that are trading in the

markets as the basis for its estimates of fair value and, as such, the Company appropriately classifies these instruments

as level 2. For SBA instruments, the Company estimates fair value based on pricing from observable trading activity for

similar securities or obtains fair values from a third party pricing service; accordingly, the Company has also classified

these instruments as level 2. These SBA instruments were transferred out of level 3 during the second quarter of 2009.

The Company began to observe marginal increases in the volume and level of observable trading activity during the

first quarter of 2009 and significant increases in such activity during the second quarter of 2009. This level of activity

provided the Company with sufficient market evidence of pricing, such that the Company did not have to make any

significant adjustments to observed pricing, nor was the Company’s pricing based on unobservable data.

U.S. states and political subdivisions

The Company’s investments in U.S. states and political subdivisions (collectively “municipals”) include obligations

of county and municipal authorities and agency bonds, which are general obligations of the municipality or are

supported by a specified revenue source. The majority of these obligations are priced by an independent pricing

service using pricing observed on trades of similar bonds and, therefore, are classified as level 2 in the fair value

hierarchy. Holdings are geographically dispersed, with no significant concentrations in any one state or municipality.

Additionally, 99% of AFS municipal obligations classified as level 2 are rated AAA or AA, or are otherwise

collateralized by securities backed by the full faith and credit of the federal government.

166