SunTrust 2010 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

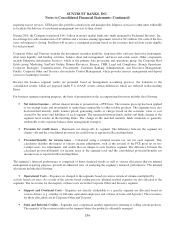

Notes to Consolidated Financial Statements (Continued)

requiring escrow services. STIIA provides portfolio construction and manager due diligence services to other units within IIS

to facilitate the delivery of investment management services to their clients.

During 2010, the Company transferred $14.1 billion in money market funds into funds managed by Federated Investors, Inc.

in exchange for cash consideration of $7 million and a revenue-sharing agreement valued at $11 million. For each of the five

years subsequent to closing, SunTrust will receive a contingent payment based on the revenues derived from assets eligible

for such payment.

Corporate Other and Treasury includes the investment securities portfolio, long-term debt, end user derivative instruments,

short-term liquidity and funding activities, balance sheet risk management, and most real estate assets. Other components

include Enterprise Information Services, which is the primary data processing and operations group; the Corporate Real

Estate group, Marketing, SunTrust Online, Human Resources, Finance, CRM, Legal and Compliance, Branch Operations,

Corporate Strategies, Communications, Procurement, Consumer Banking Administration, and Executive Management.

Finally, Corporate Other and Treasury also includes Trustee Management, which provides treasury management and deposit

services to bankruptcy trustees.

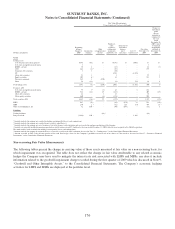

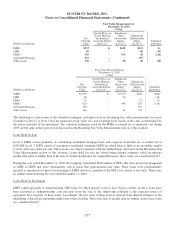

Because the business segment results are presented based on management accounting practices, the transition to the

consolidated results, which are prepared under U.S. GAAP, creates certain differences which are reflected in Reconciling

Items.

For business segment reporting purposes, the basis of presentation in the accompanying discussion includes the following:

•Net interest income – All net interest income is presented on a FTE basis. The revenue gross-up has been applied

to tax-exempt loans and investments to make them comparable to other taxable products. The segments have also

been matched maturity funds transfer priced, generating credits or charges based on the economic value or cost

created by the assets and liabilities of each segment. The mismatch between funds credits and funds charges at the

segment level resides in Reconciling Items. The change in the matched maturity funds mismatch is generally

attributable to the corporate balance sheet management strategies.

•Provision for credit losses – Represents net charge-offs by segment. The difference between the segment net

charge- offs and the consolidated provision for credit losses is reported in Reconciling Items.

•Provision/(benefit) for income taxes – Calculated using a nominal income tax rate for each segment. This

calculation includes the impact of various income adjustments, such as the reversal of the FTE gross up on tax-

exempt assets, tax adjustments, and credits that are unique to each business segment. The difference between the

calculated provision/(benefit) for income taxes at the segment level and the consolidated provision/(benefit) for

income taxes is reported in Reconciling Items.

The segment’s financial performance is comprised of direct financial results as well as various allocations that for internal

management reporting purposes provide an enhanced view of analyzing the segment’s financial performance. The internal

allocations include the following:

•Operational Costs – Expenses are charged to the segments based on various statistical volumes multiplied by

activity based cost rates. As a result of the activity based costing process, planned residual expenses are also allocated to the

segments. The recoveries for the majority of these costs are in the Corporate Other and Treasury segment.

•Support and Overhead Costs – Expenses not directly attributable to a specific segment are allocated based on

various drivers (e.g., number of full-time equivalent employees and volume of loans and deposits). The recoveries

for these allocations are in Corporate Other and Treasury.

•Sales and Referral Credits – Segments may compensate another segment for referring or selling certain products.

The majority of the revenue resides in the segment where the product is ultimately managed.

186