SunTrust 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

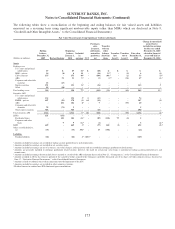

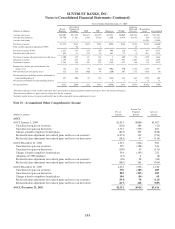

Fair Value of Financial Instruments

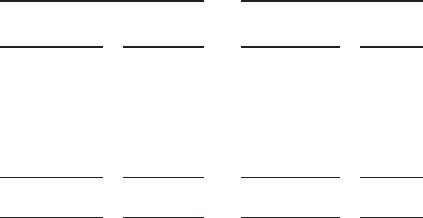

The carrying amounts and fair values of the Company’s financial instruments at December 31 were as follows:

December 31, 2010 December 31, 2009

(Dollars in millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Financial assets

Cash and cash equivalents $5,378 $5,378 (a) $6,997 $6,997 (a)

Trading assets 6,175 6,175 (b) 4,980 4,980 (b)

Securities AFS 26,895 26,895 (b) 28,477 28,477 (b)

LHFS 3,501 3,501 (c) 4,670 4,682 (c)

LHFI 115,975 115,975 113,675 113,675

Interest/credit adjustment on LHFI (2,974) (3,823) (3,120) (4,122)

LHFI, as adjusted for interest/credit risk 113,001 112,152 (d) 110,555 109,553 (d)

Market risk/liquidity adjustment on LHFI - (3,962) - (7,816)

LHFI, fully adjusted $113,001 $108,190 (d) $110,555 $101,737 (d)

Financial liabilities

Consumer and commercial deposits $120,025 $120,368 (e) $116,303 $116,608 (e)

Brokered deposits 2,365 2,381 (f) 4,231 4,161 (f)

Foreign deposits 654 654 (f) 1,329 1,329 (f)

Short-term borrowings 5,821 5,815 (f) 5,366 5,356 (f)

Long-term debt 13,648 13,191 (f) 17,490 16,702 (f)

Trading liabilities 2,678 2,678 (b) 2,189 2,189 (b)

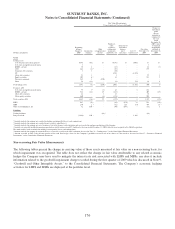

The following methods and assumptions were used by the Company in estimating the fair value of financial instruments:

(a) Cash and cash equivalents are valued at their carrying amounts reported in the balance sheet, which are reasonable

estimates of fair value due to the relatively short period to maturity of the instruments.

(b) Securities AFS, trading assets, and trading liabilities that are classified as level 1 are valued based on quoted market

prices. For those instruments classified as level 2 or level 3, refer to the respective valuation discussions within this

footnote.

(c) LHFS are generally valued based on observable current market prices or, if quoted market prices are not available,

on quoted market prices of similar instruments. In instances when significant valuation assumptions are not readily

observable in the market, instruments are valued based on the best available data in order to approximate fair value.

This data may be internally-developed and considers risk premiums that a market participant would require under

then-current market conditions. Refer to the LHFS section within this footnote for further discussion of the LHFS

carried at fair value.

(d) LHFI fair values are based on a hypothetical exit price, which does not represent the estimated intrinsic value of the

loan if held for investment. The assumptions used are expected to approximate those that a market participant

purchasing the loans would use to value the loans, including a market risk premium and liquidity discount.

Estimating the fair value of the loan portfolio when loan sales and trading markets are illiquid, or for certain loan

types, nonexistent, requires significant judgment. Therefore, the estimated fair value can vary significantly

depending on a market participant’s ultimate considerations and assumptions. The final value yields a market

participant’s expected return on investment that is indicative of the current market conditions, but it does not take

into consideration the Company’s estimated value from continuing to hold these loans or its lack of willingness to

transact at these estimated values.

The Company estimated fair value based on estimated future cash flows discounted, initially, at current origination

rates for loans with similar terms and credit quality, which derived an estimated value of 99% on the loan portfolio’s

net carrying value at both December 31, 2010 and 2009. The value derived from origination rates likely does not

represent an exit price; therefore, an incremental market risk and liquidity discount was subtracted from the initial

value as of December 31, 2010 and 2009, respectively. The discounted value is a function of a market participant’s

required yield in the current environment and is not a reflection of the expected cumulative losses on the loans.

Loan prepayments are used to adjust future cash flows based on historical experience and prepayment model

179