SunTrust 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

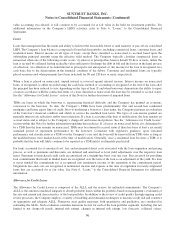

Notes to Consolidated Financial Statements (Continued)

Foreign Currency Transactions

Foreign denominated assets and liabilities resulting from foreign currency transactions are valued using period end foreign

exchange rates and the associated interest income or expense is determined using approximate weighted average exchange

rates for the period. The Company may elect to enter into foreign currency derivatives to mitigate its exposure to changes in

foreign exchange rates. The derivative contracts are accounted for at fair value. Gains and losses resulting from such

valuations are included as noninterest income in the Consolidated Statements of Income/(Loss).

Fair Value

Certain assets and liabilities are measured at fair value on a recurring basis. Examples of these include derivative

instruments, AFS and trading securities, certain LHFI and LHFS, certain issuances of long-term debt, brokered deposits, and

MSR assets. Fair value is used on a non-recurring basis as a measurement basis either when assets are evaluated for

impairment, the basis of accounting is LOCOM or for disclosure purposes. Examples of these non-recurring uses of fair

value include certain LHFS and LHFI, OREO, goodwill, intangible assets, nonmarketable equity securities, certain

partnership investments and long-lived assets. Fair value is defined as the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants at the measurement date. Depending on the nature

of the asset or liability, the Company uses various valuation techniques and assumptions when estimating fair value.

The Company applied the following fair value hierarchy:

Level 1 – Assets or liabilities for which the identical item is traded on an active exchange, such as publicly-traded

instruments or futures contracts.

Level 2 – Assets and liabilities valued based on observable market data for similar instruments.

Level 3 – Assets or liabilities for which significant valuation assumptions are not readily observable in the market;

instruments valued based on the best available data, some of which is internally developed, and considers risk

premiums that a market participant would require.

When determining the fair value measurement for assets and liabilities required or permitted to be recorded at fair value, the

Company considers the principal or most advantageous market in which it would transact and considers assumptions that

market participants would use when pricing the asset or liability. When possible, the Company looks to active and observable

markets to price identical assets or liabilities. When identical assets and liabilities are not traded in active markets, the

Company looks to market observable data for similar assets and liabilities. Nevertheless, the Company uses alternative

valuation techniques to derive a fair value measurement for those assets and liabilities that are either not actively traded in

observable markets or for which market observable inputs are not available. For additional information on the Company’s

valuation of its assets and liabilities held at fair value, refer to Note 20, “Fair Value Election and Measurement,” to the

Consolidated Financial Statements.

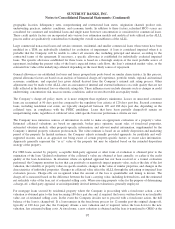

Accounting Policies Recently Adopted and Pending Accounting Pronouncements

In June 2009, the FASB issued ASU 2009-16, an update to ASC 860-10, “Transfers and Servicing,” and ASU 2009-17, an

update to ASC 810-10, “Consolidation”. These updates were effective for the first interim reporting period of 2010. The

update to ASC 860-10 amends the guidance to eliminate the concept of a QSPE and changes some of the requirements for

derecognizing financial assets. The amendments to ASC 810-10: (a) eliminate the exemption from consolidation for existing

QSPEs, (b) shift the determination of which enterprise should consolidate a VIE to a current control approach, such that an

entity that has both the power to make decisions and the right to receive benefits or absorb losses that could potentially be

significant to the VIE will consolidate a VIE, and (c) change when it is necessary to reassess who should consolidate a VIE.

The guidance requires an entity to reassess whether it is the primary beneficiary at least quarterly.

The Company has analyzed the impacts of these amendments on all QSPEs and VIE structures with which it is involved.

Based on this analysis, the Company consolidated its multi-seller conduit, Three Pillars, a CLO entity, and a student loan

securitization vehicle. The Company consolidated these entities because certain subsidiaries of the Company have significant

102