SunTrust 2010 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

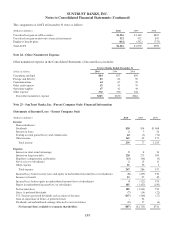

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

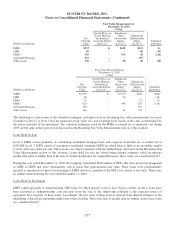

District Court for the Northern District of Georgia, Atlanta Division, and on November 30, 2009, a consolidated amended

complaint was filed. On January 29, 2010, Defendants filed a motion to dismiss the consolidated amended complaint. This

motion was granted, with leave to amend, on September 10, 2010. On October 8, 2010, the lead plaintiff filed an amended

complaint in an attempt to address the pleading deficiencies identified in the Court’s dismissal decision.

Riverside National Bank of Florida v. The McGraw-Hill Companies, Inc. et al.

On August 6, 2009, Riverside National Bank of Florida filed a complaint in the Supreme Court of the State of New York,

County of Kings, against STRH, along with several other broker-dealers, portfolio managers, rating agencies and others. On

November 13, 2009, the Plaintiffs filed a second amended complaint entitled Riverside National Bank of Florida v.

TheMcGraw-Hill Companies, Inc. et al. The complaint alleges claims for common law fraud, negligent misrepresentation,

breach of contract and other state law claims relating to the sale of CDOs, backed by trust preferred securities. The complaint

alleges that the offering materials for the CDOs were misleading, the trust preferred securities underlying the CDOs were not

sufficiently diversified, and the CDOs had inflated and erroneous ratings. As to STRH, the complaint seeks damages in

connection with a $7 million senior CDO security that was acquired by Riverside. The complaint alleges that the security has

lost over $5 million in value and seeks aggregate damages from all defendants of over $132 million. Defendants filed a

motion to dismiss on December 11, 2009. On April 16, 2010, Riverside National Bank of Florida was closed by the Office of

the Comptroller of the Currency and the FDIC was named its receiver. On June 3, 2010, the case was removed to the U.S.

District Court for the Southern District of New York.

Colonial BancGroup Securities Litigation

Beginning in July 2009, STRH, certain other underwriters, The Colonial BancGroup, Inc. and certain officers and directors

of Colonial BancGroup were named as defendants in a putative class action filed in the U.S. District Court for the Middle

District of Alabama, Northern District entitled In re Colonial BancGroup, Inc. Securities Litigation. The complaint was

brought by purchasers of certain debt and equity securities of Colonial BancGroup and seeks unspecified damages. Plaintiffs

allege violations of Sections 11 and 12 of the Securities Act of 1933 due to allegedly false and misleading disclosures in the

relevant registration statement and prospectus relating to Colonial’s goodwill impairment, mortgage underwriting standards

and credit quality. On August 28, 2009, The Colonial BancGroup, Inc. filed for bankruptcy. The Defendants’ motion to

dismiss was denied in May 2010, but the Court subsequently has ordered Plaintiffs to file an amended complaint.

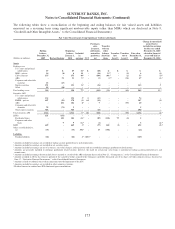

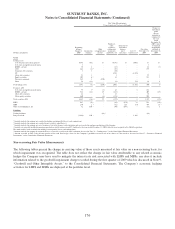

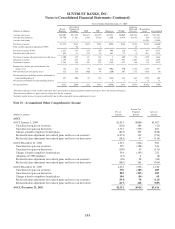

Note 22 - Business Segment Reporting

The Company has six business segments used to measure business activities: Retail Banking, Diversified Commercial

Banking, CRE, CIB, Mortgage, and W&IM with the remainder in Corporate Other and Treasury.

Earlier this year, SunTrust announced a reorganization, which realigned the franchise to support client-focused execution.

The management of the Consumer Banking line of business, which includes the Retail Banking and Mortgage business

segments, was consolidated in order to ensure a holistic view of the consumer client experience. Also the management of the

Commercial and Wholesale businesses was realigned to better focus on the various client segments. Effective in the second

quarter of 2010, the segment reporting structure was adjusted as follows:

1. The management structure of the Retail and Commercial segment was changed resulting in three segments:

Retail Banking, Diversified Commercial Banking, and CRE.

2. Consumer Lending, which includes student lending, indirect auto, and other specialty consumer lending units,

was combined with Retail Banking. Previously, Consumer Lending was combined with Mortgage to form

Household Lending. As a result, Mortgage has been identified as its own segment.

3. Portions of the CIB segment, such as Middle Market, Asset-Based Lending, and Equipment Leasing, were

moved to the Diversified Commercial Banking segment.

Retail Banking serves consumers and business clients with less than $5 million in annual revenue (up to $10 million in

revenues in larger metropolitan markets). Retail Banking provides services to clients through an extensive network of

traditional and in-store branches, ATMs, the internet (www.suntrust.com), and the telephone (1-800-SUNTRUST). Financial

products and services offered to consumers include consumer deposits, home equity lines, consumer lines, indirect auto,

student lending, bank card, and other consumer loan and fee-based products. Retail Banking also serves as an entry point and

184